Derivatives markets thrive in times of volatility, and the first half of 2025 has delivered. Numerous volume records have been broken already, including in subsets of options, futures and swaps. And the industry saw it coming.

The frenzied nature of the tariff debate is affecting global financial markets as investors whipsaw between buying and selling across a wide range of asset classes. This event and headline-driven growth is currently top of mind, but there are organic and secular trends that will also drive derivatives growth. For these reasons, 70% of derivatives professionals in our study, conducted in January of 2025, felt that trading volumes would increase this year, while only 3% anticipated a decrease in activity. Record volumes in March were followed by more tariff-induced volumes in April, proving that 70% correct early in the second quarter.

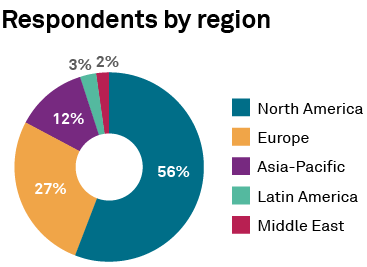

MethodologyThis report is based on interviews conducted between January and February 2025 with 263 derivatives market participants and experts sourced from the Crisil Coalition Greenwich network and the FIA community. The research includes findings from 109 people working at clearing firms, brokers, swap dealers and other intermediaries, 55 working at asset managers, hedge funds and other end-users, and 42 working at exchanges, clearinghouses and other market infrastructure operators. The majority are focused on exchange-traded derivatives, but many are involved with cleared OTC derivatives such as interest-rate swaps. Questions explored the key drivers of change in the derivatives market, the impact of the new administration in the U.S., and how regulation may affect the market.