We opened our 2019 Trends in Global Equity Electronic Execution report saying, “Electronic equity trading is as pervasive today as trading itself … and remains one of the most innovative and dynamic environments.” That statement is even more true today. Unfortunately for the sell side, that innovation and dynamism comes at a high cost. To say the institutional equities business is cutthroat would be an understatement at best, particularly for brokers competing in the electronic or algorithmic arena.

Competing brokers face numerous challenges: rising market data, venue and connectivity fees (both inbound and outbound), falling commission rates, and narrowing broker lists that concentrate fow to the buy side’s most valued counterparties. To complicate matters further, upstart brokers are entering European equity markets with claims of next-generation algorithmic platforms. These developments have pushed established incumbents, most with deep pockets, to continuously refresh their legacy offerings in a valiant effort to keep pace.

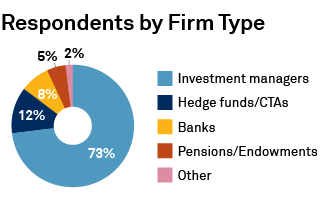

MethodologyFrom April through August 2022, Coalition Greenwich interviewed 116 buy-side equity traders in Europe. The study was conducted over the phone, online and in-person. Respondents answered a series of qualitative and quantitative questions about the brokers they use and their business practices in the European cash equity space.