Electronic equity trading is as pervasive today as trading itself. It is the fastest-paced part of capital markets and remains one of the most innovative and dynamic environments. The creative destruction of the last decade has seen dozens of new business models launch—some fail, but a few thrive. Dark pools have shut down, only to be replaced by new ones. Fresh-faced young startups get bought out by established firms, while at the same time, some new companies take out old ones. And trading flow shifts from venue to venue, as new products debut and advanced decision-making tools are employed.

As markets continue to evolve in this way, like perpetual motion, it can be difficult to keep on top of the latest innovations and newest developments in the space. In this study, we take a look at the recent trends in global electronic execution, including shifting attitudes brought about by MiFID II, the uptake of algo wheels and the use of artificial intelligence (AI) technology.

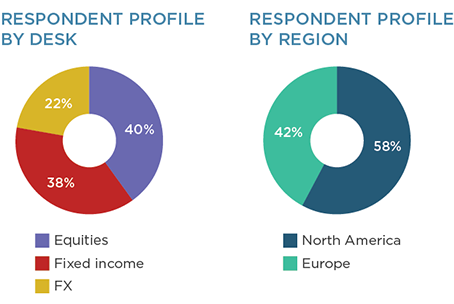

MethodologyBetween May and October 2018, Greenwich Associates interviewed 256 buy-side traders in Europe and North America, working on equity, fixed-income and foreign-exchange trading desks. Topics included trading desk budget allocations, trader staffing levels, OMS/EMS/TCA platform usage, and the impact of market structure changes on the sector.