Overall job satisfaction in the United States is now over 50%. One study even puts the percentage of American’s satisfied with their job at an amazing 92%. If you trust either measure, that means the vast majority of working people in the U.S. like, or at least don't hate, their job. Pretty impressive, given how tough things were after the Great Recession and how much complaining people do about work in general.

From that, most would probably then assume that people on Wall Street love their jobs even more—endless excitement, big bonuses and lots of good steak and wine, perhaps? When asked, “If you were to start your career again, would you still go into trading?” one of our study respondents reflected that sentiment best: “Yes…see Liar’s Poker.”

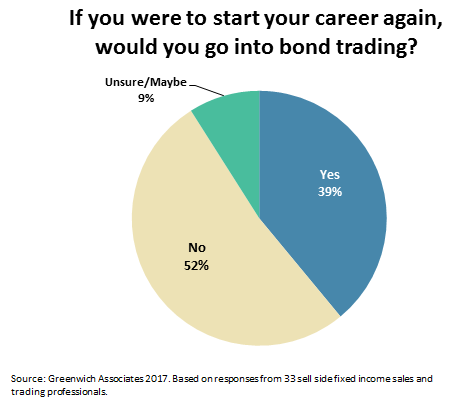

But when taking into account responses from all of the 30+ bond dealers we questioned, that Hollywood excitement about trading is actually in the minority. Only 39% said they would make the same job choice, and over half responded with a definite “No.”

For those in the industry, this negative sentiment toward bond dealing isn’t that surprising. In addition to the Main Street rebellion on Wall Street since the financial crisis, the endless stream of new regulations, changing technology, restrictive internal policies, criminal prosecutions, and the risk of going to jail if there is even the perception that your actions aren’t aboveboard doesn’t exactly inspire people to jump behind the desk. Again, one of our respondents said it perfectly: “No, the overbearing regulatory environment negatively impacts our ability to service the best interest of clients.”

So does that mean all of those Ivy League grads will need to find another career to do “God’s work”? No, not exactly. First, with changes in technology, limited balance sheets and new regulations, bond trading isn’t what it used to be. And as desks on the Street continue to turn over, the new crop of traders and salespeople—who know nothing other than low-interest rates, no capital and electronic trading—will enjoy it for what it is, rather than missing what once was.

Second, most respondents who were negative about the sell-side trading role were positive about other parts of financial services. Moving from the sell side to the buy side was mentioned more than once, as there is more opportunity for growth with less stringent regulations and a debatably steadier stream of recurring revenue based on assets rather than transactions. And taking a positive view of the slew of new regulations hitting the desk, one respondent told us, “As crazy as it sounds, right now I would look into risk and/or compliance, as there is much more growth there.” A trader wishing they worked in compliance? Clearly, times have changed.

Wall Street certainly isn’t what it once was, but for the most part that’s a good thing. If it didn’t adapt to and take advantage of new technologies and ways of doing things, it would have died a slow painful death. Michael Lewis has long since moved on from Liar’s Poker, and increasingly, so too have bond traders.