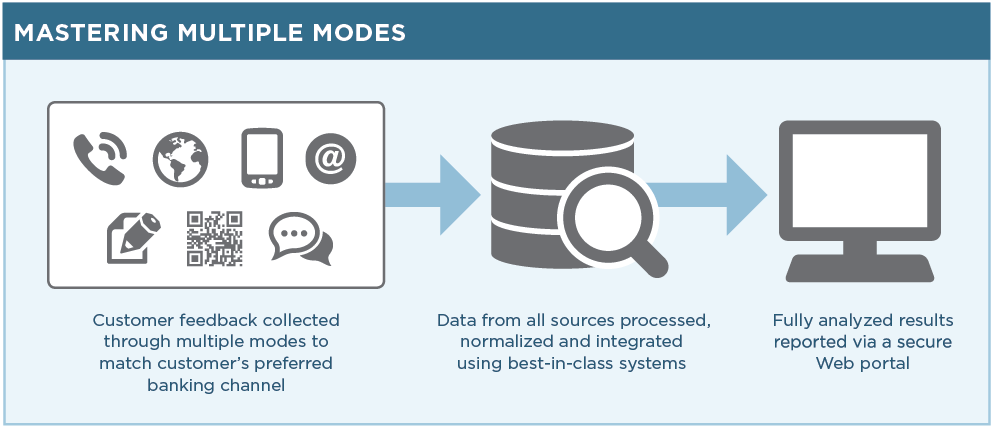

Many financial institutions still need to figure out how to integrate feedback collected through phone, email, online, SMS text, QR codes, and social media channels into their existing customer experience management (CEM) programs. Doing so will help more accurately measure customer loyalty.

Those that fail to offer surveys in their customers' preferred mode, may deliver a negative customer experience, demonstrate a lack of innovation and receive a less than desired response rate.

Bottom Line

It's clear that the multi-mode customer experience environment is here to stay and mixed data collection methods support that customer demand. Only by embracing new data collection methods and properly blending customer feedback can financial institutions ensure their CEM programs produce accurate and reliable results that engage customers and drive return on investment.

Download Full Paper:

Mastering Mixed Data Collection Methods in Customer Experience Management