The growth in institutional investment in exchange-traded funds (ETFs) can be attributed to a single factor: versatility. Over the past five years, Greenwich Associates has documented the growth and maturation of ETFs as investment tools used by institutional investors. That pattern continued in 2015, with total ETF allocations increasing as some institutions adopted ETFs in their portfolios for the first time, and existing users found new applications for the funds.

All signs point to continued growth. Institutions participating in the Greenwich Associates 2015 U.S. Exchange-Traded Funds Study plan to take advantage of the inherent versatility of the ETF structure by broadening usage of the funds to include new portfolio applications and asset classes.

In this year’s report, we take a close look at the underlying trends and developments driving this growth. An analysis of the latest study results reveals five primary drivers:

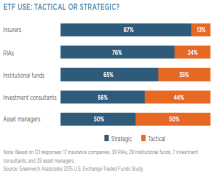

1. Existing institutional users are finding new applications for ETFs in their portfolios, and growing numbers are using ETFs as a primary vehicle to implement long-term strategies.

Sixty-eight percent of institutional ETF assets are now categorized as "strategic" in nature—a share that has climbed from just 58% in 2013 and 63% in 2014. The most popular application for ETFs within institutional portfolios is obtaining core exposures—undoubtedly a strategic function.

2. ETFs are taking on a larger and more important role in institutional fixed-income portfolios.

Sixty-five percent of institutional ETF users employ the funds in fixed income. Liquidity levels in traditional fixed-income markets have declined over the past several years, creating serious portfolio challenges for investors. Liquidity issues have led many institutions to adopt fixed-income ETFs, as ETF liquidity has increased dramatically over the same period. In 2015, institutions name liquidity as an important reason for investing in bond ETFs.

3. Institutions are using ETFs alongside derivatives.

ETFs are increasingly being evaluated along with derivatives to determine the best tool to hedge or gain market exposure. Almost 40% of the institutions in this year’s study replaced derivative products, such as equity futures contracts, with ETFs in the last year, and 78% of futures users plan to replace an existing futures position with an ETF in the next 12 months.

4. Innovative ETF strategies and approaches are gaining traction among institutions.

Approximately 30% of institutions are employing smart-beta (non-market-cap weighted) ETFs, and an equal percentage are using currency-hedged ETFs. At the same time, asset managers offering increasingly popular multi-asset-class funds are using ETFs to fully implement strategies or scale their products. ETFs now make up 48% of assets in multi-asset portfolios, according to asset managers running these funds.

5. Insurance companies are adopting ETFs as a means of investing both surplus and reserve assets.

As recently as 2013 only 30% of insurance companies used ETFs to invest surplus assets, and only 6% used ETFs to invest reserve assets. This year, 59% of insurers in the study are using ETFs for surplus assets and 71% are using ETFs to invest reserve assets, higher than expectations.

As these five developments demonstrate, ETFs are taking on a much more important and strategic role in institutional portfolios. As a result, institutions are now adopting a more careful and discerning approach to selecting ETFs to achieve strategic investment exposures.

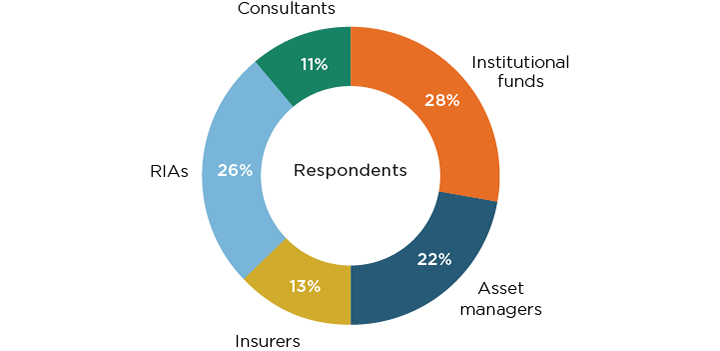

MethodologyGreenwich Associates interviewed a total of 183 US-based institutional investors, 122 of which were exchange-traded fund users and 61 were non-users, in an effort to track and uncover usage trends. The respondent base included 51 institutional funds (corporate pensions, public pensions, foundations and endowments). 41 asset managers (firms managing assets to specific investment strategies/guidelines), 24 insurance companies, 47 RIAs and 20 investment consultants.