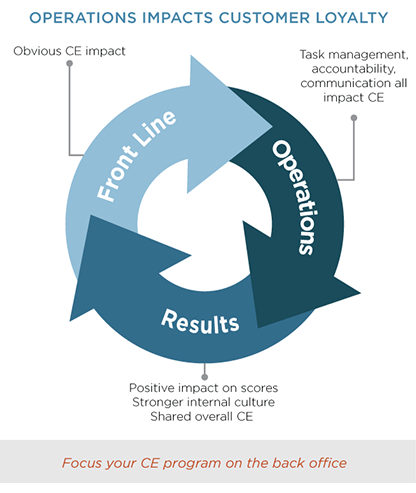

Too often, when banks try to manage or improve the customer experience, they focus solely on customer-facing, or front-office staff. However, many customer experience issues are the result of bank operations, or back-office employees - which are beyond the control of call center or bank branch employees who interact directly with the customer.

This disconnect has real consequences for customer loyalty scores. Since back-office functions impact a customer's experience in opening a new account, processing loan applications and other everyday transactions, it is important for banks to include the operations staff in their Customer Experience (CE) Management programs.

Bottom Line

Banks have an opportunity to improve customer satisfaction and loyalty results by extending the CE processes to the operational areas of the business. The first step: Educate the back-office staff about their role in customer experience. Then banks can set expectations for operational staff and use similar score cards to evaluate performance and eventually create a compensation-based incentive program to improve performance.

To learn more, read Bank Operations and the Customer Experience.