Table of Contents

Factory shutdowns, shipping chaos, labor shortages, and other disruptions continue to put the supply chains of Asia’s large companies to the test. But more than two years since the start of the COVID-19 crisis, corporate treasury departments have been implementing adjustments to their supply chains that will have long-term ramifications for businesses, economies and the trade finance industry that supports commerce across the region.

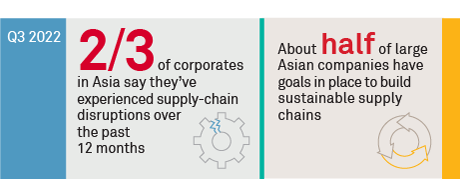

Two-thirds of corporates in Asia say they’ve experienced supply-chain disruptions over the past 12 months. However, given that the supply chains of large companies are sprawling systems encompassing a wide range of functions and players, it can be difficult for even experts to understand exactly what issues represent the biggest challenges across a region as vast as Asia. To pinpoint the most important problems, Coalition Greenwich asked the companies participating in our annual Asian Large Corporate Trade Finance Study to identify the specific supply-chain issues they have been experiencing and explain how these disruptions are impacting their businesses.

By far the most common type of disruption Asian corporates reported were shortages of raw materials and other inputs needed for production. These shortages led to increases in production costs as well as changes in quality, as companies and suppliers switched to alternative suppliers. The global shortage of chips and semiconductors was one disruption specifically cited as having a pronounced negative impact last year.

Asian companies also experienced disruptions related to logistics. Study participants cited shipping delays, surging freight costs, congested ports, and a lack of shipping containers as logistical challenges experienced in the past 12 months.

Disruptions to global supply chains and other impacts of the global pandemic also had more generalized effects on Asian companies. Study participants cited decreases and fluctuations in demand and labor shortages as continuing challenges.

How Are Asian Companies Responding to Disruptions in Supply Chains?

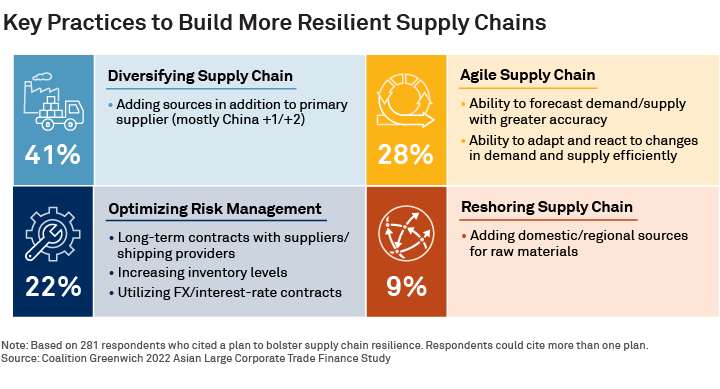

In response to these persistent disruptions, corporates in Asia are taking steps to bolster supply-chain resilience. The most prevalent plan among these corporates was to diversify the supply chain by adding new domestic and regional raw material sources and alleviating the company’s reliance on individual suppliers—a strategy often referred to as China+1 and China+2.

Companies are also exploring more sophisticated strategies designed to insulate their companies against supply-chain risk. Nearly 30% of study participants say they are working to make supply chains more agile. These companies are investing more time and capital to enhance their ability to accurately forecast demand and supply, and to react and adapt effectively to changes. Nearly a quarter of companies are working to optimize their risk-management functions through a combination of initiatives, including shifting to longer-term contracts with suppliers and shipping companies, increasing inventory levels, and hedging FX and interest-rate risk with financial contracts.

COVID-19 Disruptions Push Corporates Toward Digital Trade Finance

For corporates in Asia, changes to supply-chain management practices will represent long-term impacts of the COVID-19 crisis. Another lasting consequence of the pandemic and its disruptions will be the creeping digitization of trade finance.

Throughout the global pandemic, companies and their banks were forced to find ways to adapt to work-from-home requirements in order to keep businesses running. For many companies, that meant making a sudden switch from manual, paper-based trade finance practices to digital systems. Roughly 56% of large Asian companies now execute at least a portion of their trade finance function through a bank proprietary digital platform. Conversely, nearly 1 in 5 companies uses an open third-party digital platform, up from 15% in 2021.

After adopting these channels, companies are now getting more comfortable with digital tools and executing growing shares of their trade finance business through these platforms. The average share of trade finance business executed digitally increased to roughly 40% in 2022 from just 34% in the prior year.

Companies are ramping up their use of digital platforms because they have discovered important benefits like the efficiency and convenience of online documentation and processing. “It is important for us to be able to not only submit/deliver documents online, we need to be able to track the progress as well,” explains one corporate treasury professional. Companies are especially impressed with platforms that encompass the entire value chain. “If part of the process is offline, we would not be using the platform,” said another study respondent.

Companies cite additional benefits, including analytics that aid in decision-making, full integration with bank systems and easy-to-use interfaces. “Having a user-friendly interface is of the utmost importance to us to ensure that our senior management team is able to use the platform,” says one corporate treasury professional.

Despite companies’ enthusiasm for these benefits, there remains a natural limit on the growth of digital trade finance in the region. Asia’s collection of disparate national regulatory regimes currently prevents any full digitization of the trade finance value chain. While Coalition Greenwich expects to see more harmonization at a bilateral level or in regional blocks, the level of synchronization required for comprehensive digitization of these activities across Asia is unlikely to happen anytime soon.

Sustainable Supply Chains

About half of corporates in Asia have goals in place to build sustainable supply chains, a finding that challenges the widespread notion that Asian corporates are trailing their counterparts in the West when it comes to embracing important environmental, social and governance (ESG) standards.

Environmental concerns are a top priority in these initiatives. Companies participating in the study have set “green standards” throughout their supply chains, implemented sustainability standards for suppliers and other partners, and included ESG language into contracts to ensure that raw materials are sustainably sourced. While many Asian companies are taking commendable steps to ensure that their supply chains are environmentally sound, companies should also be working to extend their focus—especially to key social issues prominent across Asian economies.

Most large companies that have not established sustainability goals for their supply chains are looking to do so but, thus far, have been held back by some internal or external factors. Only 28% of study participants say they don’t see a need for sustainable supply chain targets. Of the rest, about two-thirds say they lack the funding, finances or general resources to go down this path. The remaining third say their limited knowledge of ESG issues is preventing them from taking action.

We see this is as a prime opportunity for banks looking to deepen their relationships with large Asian corporates to step up with financing support and expertise and help companies ensure sustainability in their supply chains.

Coalition Greenwich Head of Asia Gaurav Arora, Ruchirangad Agarwal and Wesley Han specialize in Asian corporate/ transaction banking and treasury services.

MethodologyBetween April and July 2022, Coalition Greenwich conducted 709 interviews with corporates with annual revenues of $500 million or more across China, Hong Kong, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. Trade finance interview topics included product demand, quality of coverage and capabilities in specific product areas.