Since 2009, U.S. equities have been on a tear, with the S&P 500 increasing by 3.5 times. Against this backdrop, one might expect U.S. brokers to have benefited handsomely from the equity bull market.

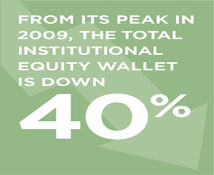

For the 12 months through Q1 2017, however, total U.S. equity commissions dropped 13%. This latest drop leaves the total institutional equity wallet down 40% from its peak in 2009.

It is not a pretty picture. A combination of factors has led to this decline:

- The steady appreciation of stock prices has meant that many asset managers see less need to turn over their portfolios—buy and hold has been an effective strategy.

- In turn, the lower volatility regime we have been witnessing has also contributed to lower turnover.

- Equity assets in the U.S. have been shifting into passive funds—which generally turn over less frequently and execute at a lower commission rate.

- Commission rates have also been trending down over this period.

The Greenwich Associates 2017 North American Equity Investors Study is based primarily on 1Q interviews with 300 buy-side trading desks within the Greenwich Assocaites universe. Desks were asked for their overall equity commissions, as well as the allocations for research/advisory services, capital commitment, and sales trading and agency execution.