Implementation of the MiFID II directives in the U.K. and Europe is now less than a year away. European, U.K. and U.S. asset managers no longer have the luxury of time to address the changes necessary to be MiFID II compliant. Greenwich Associates recently conducted a study canvassing U.S. and European buy-side investment managers to gain insights into how they are preparing for the MiFID II directives. This will be a momentous time for global equity markets, and clarity about the ramifications following the January 3, 2018 implementation date is gradually emerging.

Global Changes to Internal Processes

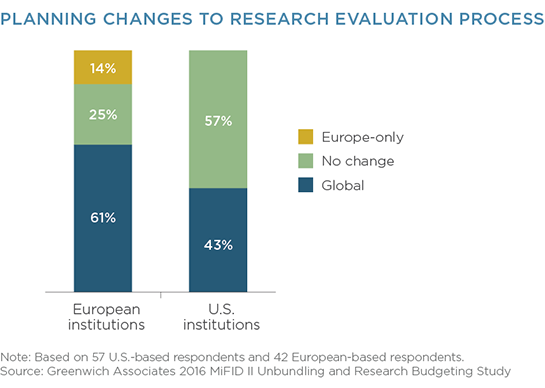

While determining the full extent of MiFID II on U.S. asset managers remains a murky endeavor, many are working to ensure the ripple effect from across the pond doesn’t turn into a tidal wave. Numerous U.S. asset managers with substantial business in the U.K. and Europe are choosing to adopt global practices to lessen the burden of maintaining distinct research management processes in different regions. In theory, as large global investment managers adopt global processes, smaller firms will follow suit.

Although brokers prefer accepting bundled payments, pricing research and accepting payments in a myriad of different formats is a hassle. Furthermore, when institutional investors begin to see increased transparency in their European investment research spend, they may mandate that their other investment managers do the same. As such, if the global goliaths unbundle, U.S. investors will likely do so as well—despite the lack of a regulatory directive.

MethodologyFrom October through November 2016, Greenwich Associates interviewed 99 buy-side U.S. and European equity broker liaisons, heads of commission management, and head traders. Respondents answered a series of qualitative and quantitative questions about the structure of their research budgeting, evaluation and payment process, and expected impacts from the changing regulatory landscape as a result of the MiFID II directives coming out of Europe.