Download the full report using the link above.

Summary

The competitive positioning of Europe’s leading fixed-income dealers is increasingly defined by regulations and banks’ strategic responses to new rules that have altered the economics of the business.

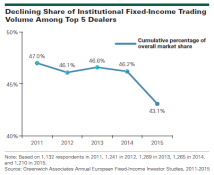

A quick glance at the list of Greenwich Leaders in our 2015 European Fixed-Income Study might suggest that regulators have achieved a key goal by reducing the concentration of fixed-income trading business controlled by the handful of very large banks that have traditionally dominated the business.

Today’s European fixed-income market is much flatter than the market that existed as recently as 2011. In that year, the top five dealers controlled an aggregate 47% of institutional fixed-income trading volume. Today the top five control 43%, with the remainder divided more broadly among a group of European and foreign dealers.

MethodologyBetween May and July 2015, Greenwich Associates conducted 1,210 interviews with senior fixed-income investment professionals at banks, fund managers/advisors, insurance companies, corporations, central banks, hedge funds, and other institutions across Europe.

Countries where interviews were conducted include Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Luxembourg, Malta, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, the United Kingdom and selected interviews conducted in Central & Eastern Europe and the Middle East. Interview topics included service provider assessments, trading practices, market trend analysis, and investor compensation.