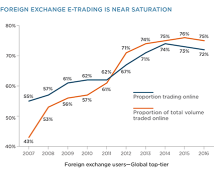

The foreign-exchange market remains the most electronically traded market in the world. Of the total notional volume traded by institutional investors globally, 75% is now traded on the screen, up from just over 43% before the credit crisis. Seventy-two percent of investors trade at least some of their volume electronically.

The impressive adoption of e-trading in FX over the past decade stands out not only versus other asset classes, but also because it has developed via natural market demand and not regulatory mandate.

In the past five years, for instance, electronic trading in interest-rate swaps and credit-default swaps has grown rapidly to roughly two-thirds and 90%, respectively. But that growth was almost completely due to regulatory requirements mandating, in effect, “Trade electronically, or else.”

However, the FX market’s historic move toward electronic trading seems to have hit a plateau. E-trading levels have remained roughly flat since 2013, signaling the market has hit the upper limits of on-screen trading and the next stage in its evolution.