Table of Contents

Background

MiFID II is an updated version of the Markets in Financial Instruments Directive (MiFID), a set of rules and regulations that govern the financial markets in the European Union (EU). It came into effect in January 2018 and aims to improve the functioning of financial markets, protect investors and increase transparency. Among other things, MiFID II requires that asset managers separate the cost of research from the cost of executing trades, which has led to a decline in research budgets and a shift toward paying for research in cash (hard dollars) consistent with the MiFID II requirements, using adviser funds, rather than client trading commissions (soft dollars). However, this conflicts with U.S. law, which would cause U.S. broker-dealers receiving these separate, hard dollar payments for research to be considered investment advisers under the Investment Advisers Act of 1940 (Advisers Act).

In response to this conflict, the U.S. Securities and Exchange Commission (SEC) issued a “no-action” letter in 2017 to the Securities Industry and Financial Markets Association (SIFMA), allowing U.S. broker-dealers to receive these hard dollar payments for research required by MiFID II from EU asset managers without violating U.S. law. The letter was initially set to expire on July 3, 2020 but was extended for an additional three years, until July 3, 2023, to provide more time for market participants to adjust to the new MiFID II requirements.

Brokers who provide research as broadly defined under MiFID II to asset managers subject to MiFID II have raised concerns that the expiration of the letter could ultimately result in a reduction in the quality and quantity of investment research available to investors. Absent registration as investment advisers, they will be unable to accept these hard dollar payments for research after the expiration of the no-action letter. They note that these payments have become an important source of revenue for them, and they fear that without the letter, they will not be able to fully serve these asset managers’ clients if these managers continue to pay for research out of their own pockets as mandated by MiFID II.

On the other hand, some buy-side asset managers have expressed concerns that they will lose access to valuable research services from brokers they are no longer able to pay after the expiration of the no-action letter.

Overall, the expiration of the SEC MiFID II no-action letter is expected to have significant implications for the research and asset management industries. Stakeholders on both sides have been closely monitoring developments and advocating for their respective positions. This study addresses the concerns and potential impacts of the letter’s expiration among the buy-side asset managers and sell-side broker-dealers providing research.

Sell-Side Confusion and Concern Around Impact

Seventy-one percent of sell-side respondents are not planning on providing any research services as an investment adviser. In addition, 96% of sell-side respondents have not been able to determine whether they will need to terminate or restrict access to research when the letter expires.

All of those 71% of sell-side respondents said that providing research through an investment adviser would be incompatible with their business models (i.e., it would not be feasible for sales and trading functions to operate within an investment adviser). In addition, over 39% also cite return on investment (ROI) considerations, and over 25% say there would not be enough time to register at this point even if it was feasible. Several also mentioned concerns around regulatory uncertainty.

The remaining 29% of sell-side research providers are already registered, or are in the process of registering, as advisers. Conversations with market participants suggest that it is easier for firms engaged in agency-only trading activity to register as advisers, as they do not have to grapple with the principal trading restrictions in the Advisers Act. For firms engaged in principal trading that have registered, a number have said the principal trading restrictions are incompatible with placing sales and trading functions within an adviser.

In short, these results suggest that a large majority of sell-side firms believe that registering as an investment adviser is not a viable solution to the conflicts-of-law problem U.S. broker-dealers face under the Advisers Act in connection with the MiFID II unbundling requirement. Moreover, it points to the confusion such firms face upon the expiration of the no-action relief, given the lack of a workable path forward.

Ninety-three percent of sell-side respondents are concerned that the expiration will put them at a competitive disadvantage relative to their non-U.S. peers, who are not faced with a similar conflicts of law problem. In addition, despite analyzing this topic for some time, 80% of sell-side respondents are specifically concerned about how prepared they might be for the impact of the expiration.

While 71% of buy-side respondents are not necessarily concerned about their own firm’s preparedness for the impact of the expiration (since the expiration does not affect how they are regulated substantively), almost half of them (44%) are still concerned that the expiration will put U.S. brokers at a competitive disadvantage to their non-U.S. peers.

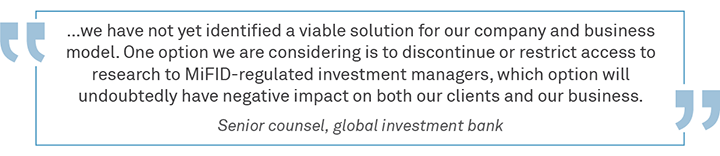

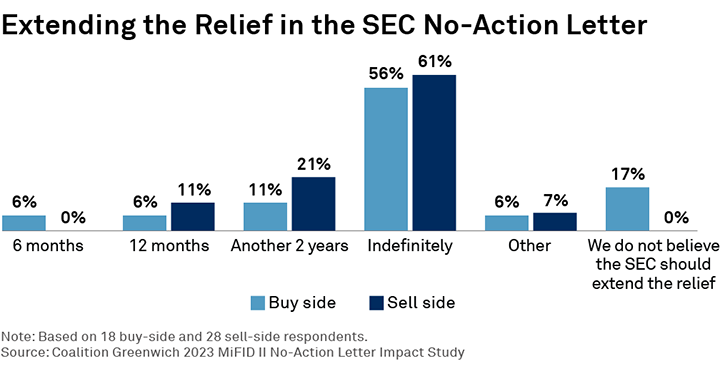

By a large margin, industry participants that participated in the study and others with whom we have spoken prefer that the SEC extend the no-action relief. All of the of sell-side and 75% of buy-side respondents agree. Over half of each group want the relief extended indefinitely, with only few wanting the SEC to do so for 12 months or less.

Sell-Side Plans for Servicing MiFID II-Covered Accounts

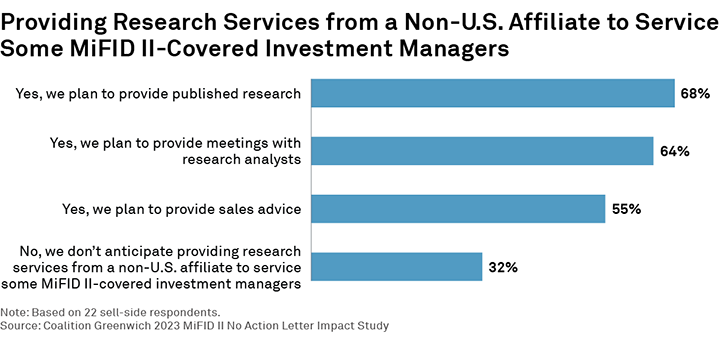

Global broker-dealers with non-U.S. research businesses can offer advice through their non-U.S. affiliates to non-U.S. investment managers on a hard dollar basis. However, questions about the extraterritorial application of U.S. law might prompt such providers to limit availability of U.S. advice or preclude the sharing of global advice by non-U.S. investment managers with U.S. affiliates.

In this regard, among sell-side respondents providing or planning to provide research through offshore affiliates, 60% are concerned that the extraterritorial application of U.S. law might prompt their firm to restrict MiFID II-covered investment managers from sharing certain research services (e.g., sales advice) with their U.S. personnel or affiliates, or from using those services to manage U.S. person accounts.

In addition to these complexities, some global broker-dealers indicate that a “European solution”—mentioned by the SEC in a meeting with the industry and involving a non-U.S. affiliate providing research—may not work for them. The research shows that a full third of global brokers are not planning to provide research out of a European affiliate, though the data does not indicate whether such firms may provide research through an adviser in the U.S. For those firms that are planning to rely on a European affiliate, fewer (55%) are planning to provide sales advice to MiFID II managers than are planning to provide traditional published research (68%) and meetings with research analysts (64%).

U.S. broker-dealers without a European presence cannot leverage this “European solution” available to certain global broker-dealers. These U.S. firms may lose MiFID II-manager clients upon the expiration of the no-action relief, unless they are registered investment advisers or establish a European affiliate. However, both options require significant investments and organizational transformation, and the data suggests neither option is likely to be pursued.

Buy-Side Impact/Concerns Over Losing Access to Research

While the buy side may not be overly concerned about their own preparedness for the impact of the expiration, they still may face challenges upon the expiration of the no-action relief. While some firms say they are engaging on this issue through SIFMA’s advocacy efforts, other managers may not be fully aware that they need to make further adjustments. These managers will no longer be able to pay hard dollars for research from U.S. brokers-dealers that do not register as investment advisers, unless those payments are made outside of the U.S. to non-U.S. affiliates of the brokers. In other words, buy-side firms will have no choice but to pay soft dollars to such U.S. brokers to continue obtaining research directly from them.

Importantly, 22% of U.S. and U.K. buy-side respondents do not anticipate procuring research services on a hard dollar basis from their offices outside the U.S., or through one of their non-U.S. affiliates, when the letter expires. In addition, 75% of the buy-side respondents are not planning to switch from paying hard to soft dollars for MiFID II-covered accounts to access research directly from U.S. brokers that are not registered as advisers, and using fee offsets or other steps to reach a substantially equivalent outcome. At 29%, almost a third of buy-side firms say they will not be able to pay for any U.S. broker research in soft dollars for any clients. This data suggests that some buy-side respondents may need to make further adjustments to continue to access research provided by certain members of the sell side, or they will be faced with the prospect of losing access to that research.

Buy-side firms may also face their own challenges in continuing to manage U.S. accounts upon the expiration of the letter. More than half of buy-side respondents (57%) noted that they currently share research services paid for with hard dollars with U.S. personnel and/or affiliates, and almost two-thirds of them (63%) noted that they use research services paid for with hard dollars to manage U.S. person accounts. While the data does not show whether these hard dollars are currently paid to U.S. or non-U.S. brokers, it is likely that some portion is now paid to U.S. brokers, given the current MiFID II no-action relief.

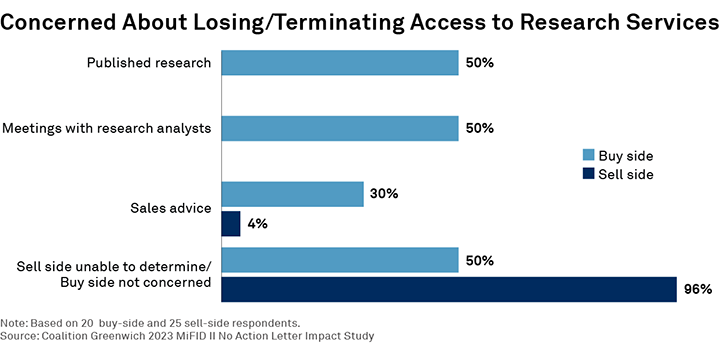

MiFID-covered asset managers as a whole are concerned about losing access to U.S. broker research as a result of the expiration. Half of these respondents are concerned about losing access to published research and meetings with research analysts from U.S. broker-dealers. Of this group, 80% are concerned about losing access to research on U.S. small-cap companies and 100% on large caps, with 40% being concerned about losing access to research on fixed-income securities.

Thirty percent of buy-side firms are concerned about losing access to sales advice provided by U.S. broker-dealers. Of this group of buy-side firms, 67% are concerned about losing access to alpha capture, 50% to trade commentary and all (100%) to bespoke analysis.

Overall, over a third of buy-side respondents (37%) expect that the expiration of the MiFID II letter will either negatively or very negatively affect their ability to access research with respect to less well-known and/or smaller-cap companies.

Conclusion

As others have previously stated, there is no easy solution to the complex conflicts between U.S. law and MiFID II. This presents a fundamental dilemma for U.S. market participants. MiFID II requires unbundled payments for research, while the Advisers Act regulates brokers as investment advisers if they receive unbundled payments for research that constitutes investment advice.

The data highlights the intractable conflicts created by MiFID II and the Advisers Act, making it challenging for market participants to restructure their businesses and squarely comply with both regulatory regimes.

Some buy- and sell-side participants feel the expiration of the MiFID II no-action letter will make the provision of research more cumbersome, and the related documentation and procedures more complex, and will also raise regulatory uncertainty. In addition, some sell-side participants fear that they will be faced with having to choose between discontinuing research services provided or inconveniencing their clients by instituting cumbersome practices that put them at a disadvantage to their peers. They worry that the increased operational burdens could lead to a revenue impact, as well as loss of valuable research to their customers. Overall, they are concerned there could be fewer firms providing research as a result of these impacts.

Given the significant risk that impacted buy-side managers will lose access to important research services, and the negative impact on the competitiveness of U.S. markets and research providers, participants feel the least disruptive option at this point is an extension of the relief in the MiFID II no-action letter by the SEC staff.

An extension could be especially appropriate now, given that the EU and the U.K. are reevaluating the MiFID II unbundling requirements, with the EU considering rolling back those requirements further or even making them optional in conflicts-of-law situations like the one faced by firms in the U.S. At a minimum, an extension until the legislative/regulatory processes in the EU and U.K. play out could help participants plan for potential changes to the MiFID II unbundling requirements without simultaneously having to deal with potentially disruptive changes to their research practices and businesses as a result of the Advisers Act requirements. Such an approach would also have the benefit of allowing U.S. and European regulators to more fully coordinate regarding this critical area of the marketplace.

Notably, the perceived risks are so great that the SEC’s Small Business Capital Formation Advisory Committee, comprised of independent persons selected by the SEC, unanimously recommended the extension of the letter because of concerns about disruptions to the research market.

Ultimately, our research suggests that an extension of the relief in the no-action letter is the simplest, narrowest path to preventing market disruptions and to allow market participants to continue providing valuable research services to their clients. Participants are hopeful that the SEC will recognize the importance of this issue and take the necessary steps to extend the relief in the no-action letter, ensuring the continued success and competitiveness of U.S. markets.

Jesse Forster advises on market structure and technology globally.

MethodologyCoalition Greenwich conducted in-depth research in March and April of 2023 to identify views on, readiness for and expected impact of the July 3, 2023 expiration of the SEC’s MiFID II no-action letter.

We gathered responses from 20 asset managers in the U.S. and U.K., and 33 U.S.- based broker-dealers, including top-tier, regional and boutique research providers. Respondents include heads of trading, commission management heads, CIOs and other senior personnel from these firms.