Table of Contents

Executive Summary

Envisioning technology that doesn’t exist today and its application within financial markets is nearly as hard as predicting the market itself.

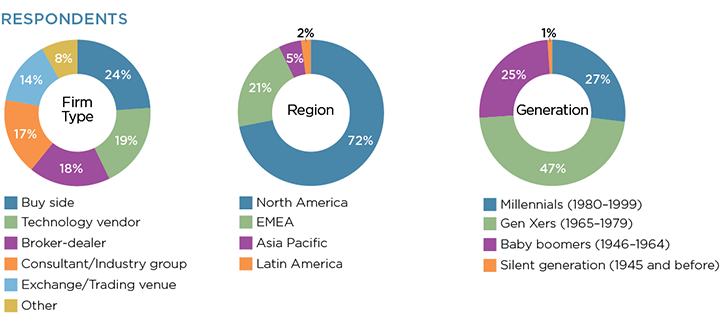

In this Greenwich Report, the first of a three part series made possible by Refinitiv, we’ll examine the forces and technology driving the trading desk of the future from the vantage point of 107 capital markets professionals that participated in this research.

Topics include what tools and technologies will have the biggest impact on financial markets, the use of AI, big data deployment, and the impact (or lack thereof) of cryptocurrencies.

We’ll also examine the different mindsets of those working within the capital markets, both by firm type and generation. While technology was broadly seen as a positive for financial markets, views on specific technologies and personal job prospects differed in interesting ways based on the respondent’s age and employer.

Ultimately, our research findings confirmed that the fintech revolution of the past decade is set to pick up even more steam in the coming years. With investors, banks, exchanges, and technology firms finally out of defensive mode following the great recession of 10 years ago, real investment in the next generation of fintech is now having a broader impact than ever before.

Introduction

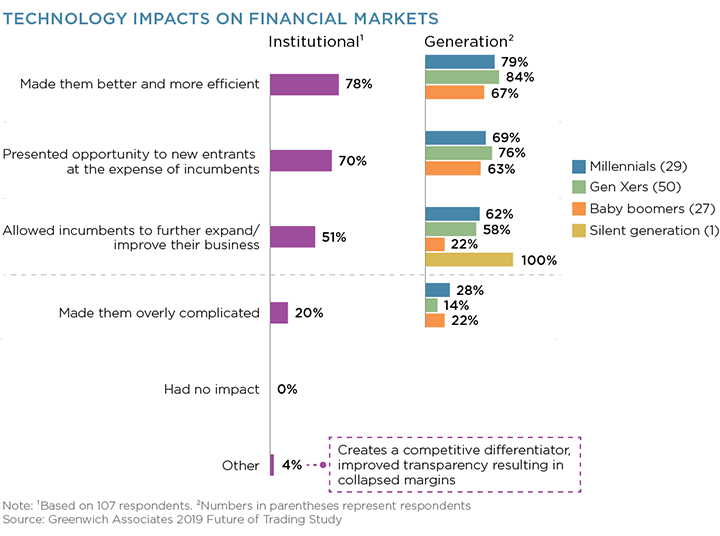

The technological advancements of the past 20 years have proven to be a godsend for financial markets. Seventy-eight percent of capital markets professionals Greenwich Associates spoke with believe that technology as a whole has made markets better and more efficient.

Sure, jobs have been lost due to automation during this time, with some industry veterans seeing their roles replaced or diminished due to technology innovation and automation. This is likely why the baby boomers participating in our study were less enthusiastic about technology’s impact on the markets than were the Gen Xers and millennials. And markets continue to experience periodic bouts of volatility catalyzed by computers trading with computers, leaving investors on edge and regulators struggling to determine a root cause.

Nevertheless, our data shows that capital markets professionals see these issues as nothing more than speed bumps, with the pros of technological progress continuing to far outweigh the cons.

To further that idea, technology has helped both the big get bigger and the market’s Davids compete with its Goliaths. While over half of study participants believe that the technology explosion has helped incumbents to expand and cement their place as critical elements of the capital markets ecosystem, even more—70%—believe it has helped startups to gain traction on market leaders, despite the complexities of displacing those deeply entrenched platforms.

Both of these thoughts are, in fact, true. Startups are either successful and grow into a new incumbent, have such a good idea that one of the incumbents buys them, or, in the process of failing, cause their bigger competitors to step up their game to provide better and more cost-efficient products for their clients. The result is a better market for everyone, from the largest institutional asset manager all the way down to the smallest retail investor. More than ever before, access to more information and cheaper access to markets is available to all.

The buy side’s ability to execute equity trades via algo wheels and the sell side’s ability to automatically respond to a request for quote in the bond market, among many other similar innovations, have allowed trading desks to operate more efficiently while improving execution quality. Furthermore, access to large data sets and complex analytics has allowed asset managers to ensure they’re receiving the best price on a trade and working with the best counterparties, ultimately saving end investors millions. And banks are now using machine learning to better service clients based on their past behavior and preferences. These advancements, while hugely impactful, only scratch the surface of where we’ve come and where we’re likely to go.

The Technology that Matters

The market’s current state should be seen as a new benchmark, one that the industry will strive to beat every year going forward. Automated trading, alternative data and real-time analytics are now a given, and we should focus not on their impact thus far but the emerging technology tools that will have the biggest impact in the coming three to five years.

Trading desks must think about both strategic and tactical innovation. The former, which includes sweeping technological developments like artificial intelligence and cloud computing, are critical to long-term success and profitability—although their impact on the desk’s P&L today or next month remains small.

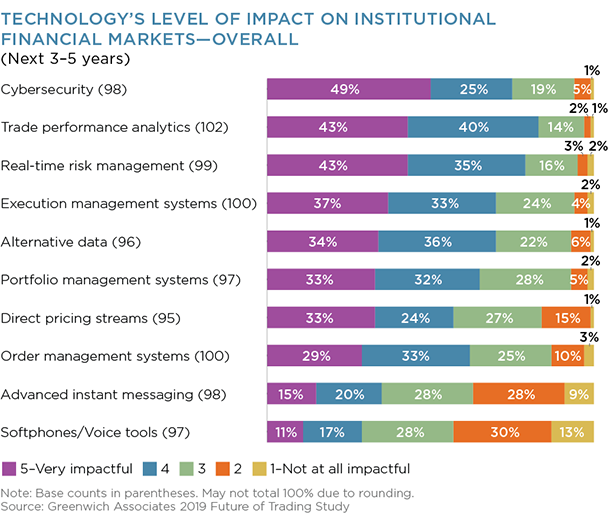

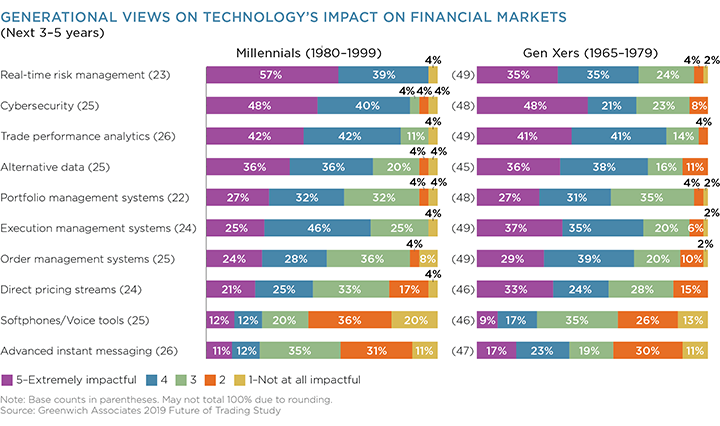

It should come as no surprise, then, that among all study participants, including strategists and technology professionals, broad, long-term, defensive solutions top the list of impactful tools for the trading desk. Solutions focused on cybersecurity, real-time risk management and trade performance analytics will all be critical to the success of trading desks in the coming years.

The last decade has taught financial firms that proactive management of potential risks and constant self-examination are the best tools for fighting potential future blow-ups. Let’s not forget the London Whale, Libor fixing and, of course, CDO Squared. This is, in part, why Greenwich Associates data shows that the buy side spent $1.1 billion on risk management technology in 2018. Furthermore, given the risk that hackers attack a trading algorithm or exchange-matching engine—as they have credit card numbers or Hillary Clinton’s email—an investment in a good defense is a no-brainer. Interestingly, millennials point to real-time risk and cybersecurity as key tools going forward much more often than do Gen Xers—perhaps a result of the former having lived their whole lives online.

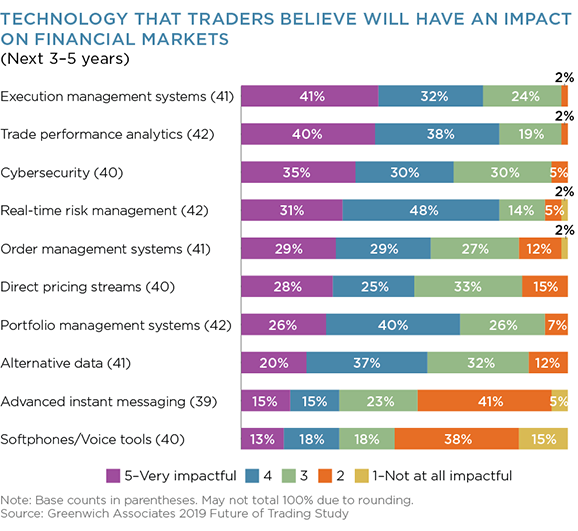

Tactical innovations, including trading systems, analytics and data products, will not dramatically alter the course of a trading business, but can have an immediate impact on the desk’s execution quality and/or customer service. Upgrading your execution management system to gain access to advanced analytics and the latest algorithmic trading tools, for example, could show a return on investment in only a few weeks.

To that end, the traders in our study were more often playing offense, seeing the execution management system (EMS) as the most impactful piece of technology for the next three to five years. The EMS is the trader’s window to the world and the single most critical tool needed to succeed in that seat. The wave of M&A in the order and execution management world over the past several years and the $1.4 billion the buy side spent on those technologies in 2018 help to quantify the importance of these systems going forward. And even if it is, in fact, AI, data mining or cloud computing that is actually providing a trader with the tools needed to win (more on this shortly), it is the EMS that makes these underlying technologies functional and available.

Performance analytics, which topped the list of both “extremely impactful” and “impactful” responses, straddles the line of tactical and strategic. From a tactical perspective, analyzing customer relationships and individual trades can result in an immediate positive impact to the bottom line. Improving service levels for a small but very profitable customer provides immediate impact for the sell side, whereas the buy-side trader could improve their execution quality by examining more deeply the pricing received from individual dealers over time. We will examine this human relationship element more closely in an upcoming report in this series.

Thinking longer term, however, performance analytics sits at the intersection of several bigger technology trends, including AI, cloud computing, alternative data, and big data. Monthly trading performance reviews on the buy side are fading as real-time pre-trade analytics allow traders to make more informed execution and counterparty decisions in the moment. The results of these decisions are then fed back into the analytics platform, making not only the traders but the pre-trade analytics smarter with every trade. These tactical benefits will only be heightened in the coming years as innovation in these more strategic technologies progresses.

AI Inside?

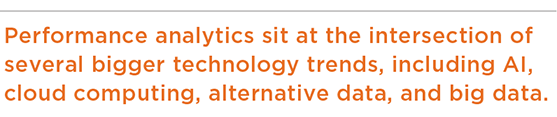

To that point, true disruption in capital markets will come from the biggest advancements in technology rather than incremental improvements to specific tools. Of the many amazing technologies that have impacted our work and daily lives over the past decade, such as cloud computing, high-speed internet and even blockchain, capital markets professionals overwhelmingly see AI as the most potentially disruptive in the coming three to five years. This stands in stark contrast to cryptocurrencies, where institutional traders of all ages remain largely unexcited despite the efforts of many to make these markets more accessible.

Belief in the opportunity for AI on trading desks is particularly true with millennials, two-thirds of whom see AI as being very disruptive in the coming years, as opposed to only half of Gen Xers. Millennials have seen the impacts of AI throughout their entire adult life, whether it be via Netflix suggesting what’d you’d like to watch or Google completing your sentences for you, and as such, have no doubt about the impact it can have on capital markets.

Exactly how and where artificial intelligence will be the most disruptive is a source of intense debate. Machine learning (ML)—a type of artificial intelligence—gets the most attention. As we explained in a Greenwich Report released in 2017¹, machine learning refers to the ability of computers to learn things without being explicitly programmed. There are different techniques within ML, including supervised learning, unsupervised learning and deep learning. Machine learning is how Google figures out what you’re going to type before you type it and how Apple tells you who’s in the picture you just took.

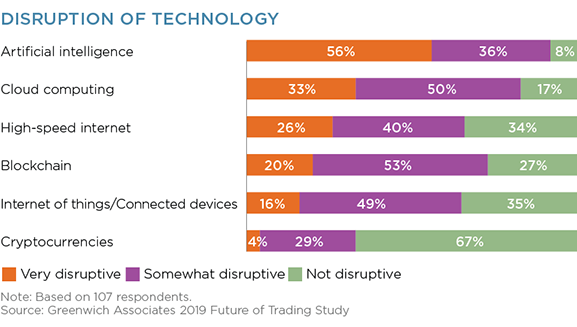

But while 61% of study respondents said they are either using AI today or plan to in the next 12–24 months, a very small percentage of those applications get anywhere close to the amazingly complex products from Google, Apple and their peers. A big part of that is data availability. Those global technology giants have access to the habits and data of billions of people around the world. Most financial services firms, on the other hand, are still working hard at normalizing the data they do have, are struggling to work within privacy rules surrounding customer data, and often work with such limited data sets that the output is still more art than science. This is exactly why capital markets firms are hiring PhDs in physics and particle science—the data challenge is incredibly more complex than it first appears. These complexities make those firms that effectively and consistently aggregate and normalize huge quantities of data tremendously valuable.

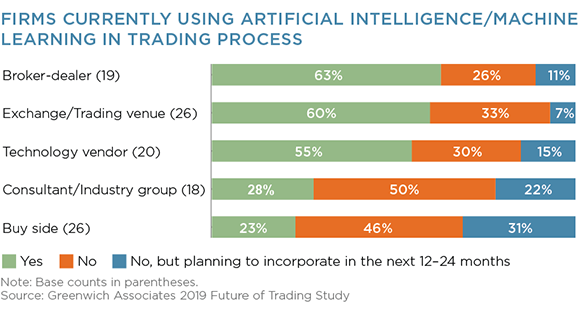

The banks and exchanges have made the most progress developing AI-driven solutions, with fintech vendors also pouring money into AI. Their AI investment is expected to be the most impactful for execution algorithms and the analysis of structured and unstructured data, both of which can ultimately help broker-dealers provide better services to their customers at a lower cost. AI-driven execution algorithms, for example, are actively being used by a small few early adopters in equity markets. The more they are used, the smarter they get at predicting and reacting to market conditions. They are also designed to “learn” traders’ preferences, similar to how Google Maps suggests where you might want to go when you get in the car.

Asset managers and hedge funds have taken a back seat with regard to AI development, with only 1 in 5 using some AI today. Given the fee pressures and tough market conditions the buy side is facing, however, letting their vendors and trading counterparties make the investment is a smart move. There is significant upfront cost and technology risk inherent in building cutting-edge solutions; cost and risk the buy side would have to pass on to their clients, which is less than ideal. The ability to easily tap into new, fully vetted tools through a third-party provider alleviates this problem considerably, reducing the risk while still allowing the asset manager or hedge fund to put cutting-edge technology to work on the trading desk.

The Party Has Just Started

On one hand, the lack of AI sophistication on trading desks is a bit disappointing, given the level of talent in financial services and the billions of dollars capital markets participants and service providers spend on developing technology. On the other hand, the world of trading has only scratched the surface of the true power of AI.

Four out of five study participants expect AI and/or ML to be fully integrated into the trading process and that their firm will have internal AI expertise in the next three to five years. Slightly fewer—62%—expect AI-focused budgets to increase. That’s not to say the other 38% aren’t spending on AI at all but, instead, they do not expect to increase their current levels of spending in the next three to five years. This is because they simply cannot earmark any more of the IT budget for such long-term development projects, as they doubt it can help their business to a sufficient degree or they feel, as the buy side more often does, that leaving it to technology providers is the best way forward.

Nevertheless, the dichotomy here is an important one. AI development clearly isn’t cheap, given the cost of developers and the time commitment needed for R&D. But the payback is expected to be worth it, with costs following the initial implementation coming down. This is critically important now, as broker-dealers continue to struggle with pressures to increase return on equity for already low-margin trading businesses. The buy side’s need for cost efficiency is only slightly better, given continued pressure on management fees that show no signs of abating.

Conclusion

Better leveraging pre-trade analytics, enhancing EMSs with the latest visualization tools and tapping into new risk models are all critically important to ensuring the desk performs better than it did the day before. But, as identified by our study participants, an ongoing examination of how cloud computing, big data, cybersecurity, and artificial intelligence can and should be utilized by the trading desk is the only way to remain relevant in the future.

Technological progress in financial markets requires the right data and the right people, both of which we will dive into more deeply later in this Future of Trading series. Information has always been the fuel for capital markets, but it now comes in many forms and exists in a quantity that no one could have fathomed only 10 years ago, let alone 100 years ago. And the changing nature of work for those in financial services must also be well understood, as the traders are expected to know Python as well as be able to price a bond or negotiate a trade.

The future of trading is indelibly intertwined with trading technology innovation. While trading desks on the buy and sell side will certainly work to improve their processes in search of efficiency, the real edge will be gained, maintained or lost based on how technology is deployed and put to work—and the people put in place to take the desk into the future.

1https://www.greenwich.com/equities/artificial-intelligence-coming-disruption-wall-street

MethodologyIn April 2019, Greenwich Associates conducted an online study with 107 capital markets professionals globally. The study examined the technology trends, the data explosion and the skills required to be successful in capital markets in the future.