Table of Contents

Executive Summary

Interest rates at a 15-year high and the mini bank crisis of March 2023 have been a double whammy for small and midsize corporate borrowers, making it expensive and sometimes impossible for them to get the funding they need to expand or survive. Even the largest borrowers, corporates and private equity firms looking to finance buyouts, are now working harder to secure the credit they need, as top-tier banks are facing increasingly stringent capital requirements.

Enter private credit. Nonbanks providing financing outside of the traditional banking system are certainly nothing new, but the aforementioned headwinds to the public credit markets, coupled with increased investor appetite for yields that often top 10%, have seen the private credit market grow to $1.3 trillion at the end of 2022,1 with estimates suggesting the market could more than double to $2.7 trillion by 2026.2

Large asset managers such as Apollo, KKR and Blackstone account for the majority of private credit assets under management (AUM), but it is the long tail of investors—boutique asset managers, wealth managers and family offices—that are increasingly entering the market and acting as the source of funds for small and medium-sized businesses around the world.

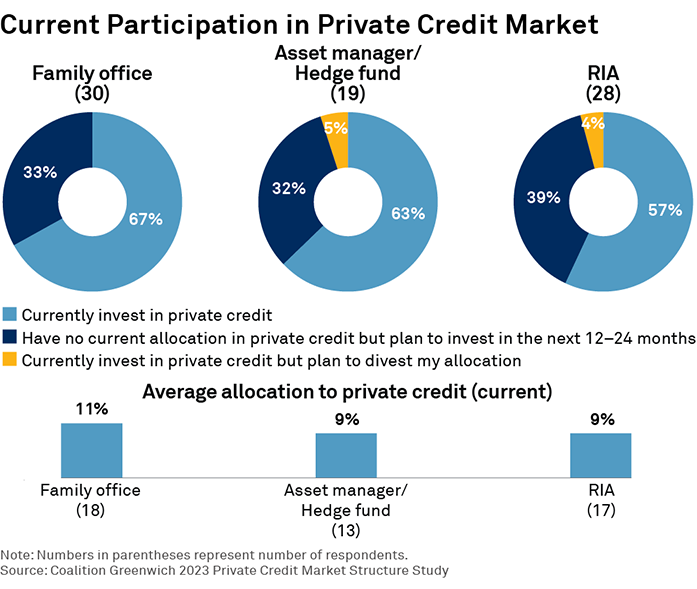

To better understand the investment approaches and views of this investor base, we gathered thoughts and data from 77 investors in the U.S. familiar with private credit markets in the summer of 2023, the majority managing $250 million or less with an average allocation to private credit of 10%—well above the 3% average allocation of U.S. pension funds according to Coalition Greenwich data.3

Uncorrelated (High) Returns Drive Demand

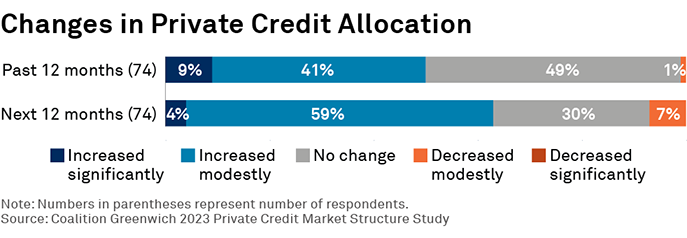

Despite the higher than average allocations, the focus on private credit among this group of asset managers and wealth managers (which includes RIAs and family offices) is set to grow. Sixty-three percent expect to increase their allocations to private credit in the year ahead, compared to the 7% who expect their allocations to decline and the 50% who increased allocations in the past year.

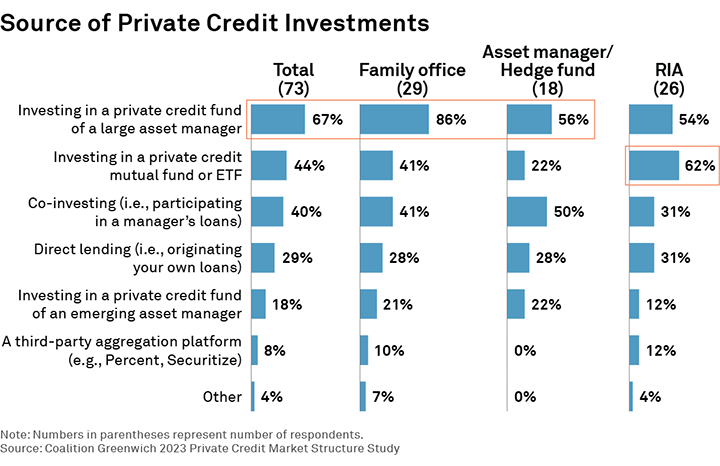

The majority acquire their private credit exposure through funds offered by large asset managers, who from an AUM perspective still dominate the space. Public liquid alternatives (i.e., ETFs, mutual funds) are also common, particularly with wealth managers whose clients often prefer investments through traditional investment vehicles, expecting a certain level of transparency and liquidity given the regulations that oversee those products. Co-investing, or direct participation in loans originated and subsequently syndicated by a manager, is also popular, particularly with asset managers who generally have unique and sophisticated expertise and due diligence capabilities that allow them to handle more complex investment structures.

Why Private Credit

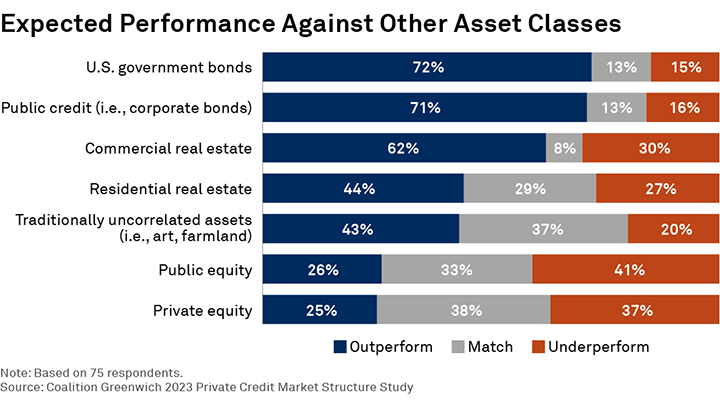

The interest in private credit makes sense. Over 70% of study participants expect private credit to outperform U.S. government bonds and U.S. corporate bonds (public credit) in the coming year. There was also notable conviction about private credit’s outperformance against real estate, particularly commercial real estate that continues to suffer despite many workers returning to the office over the past several months.

Private credit is expected to return 11% annually over the next five years according to KKR,4 easily beating the 5% risk-free rate. Private credit instruments based on loans to lower middle market companies offer even higher returns, topping 18% in September 2023 according to data from Percent.5 This sheds light on the two-thirds of respondents who demand returns over 11% to make private credit attractive over other alternatives.

Double-digit yields do not come without some additional counterparty risk, of course, and investors must do their homework to understand these risks. Even so, these returns explain why income generation is a key driver for private credit investments, although the risk-reward profile is only part of the story.

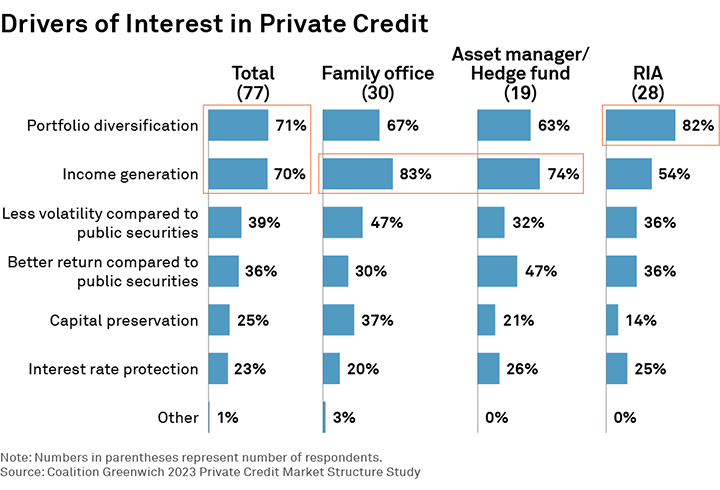

The primary driver for study participants to invest in private credit is portfolio diversification, particularly for financial advisors whose clients are often looking to add returns to their portfolio that are uncorrelated to public equity and fixed-income markets. Wealth managers also need to forecast cash flows for clients’ retirement or other monthly financial obligations, and private credit provides a more predictable path to that goal than would private equity or another alternative investment. Which raises the next question—should private credit be likened to traditional fixed-income investments, given the current income properties and debt structure, or as an alternative investment?

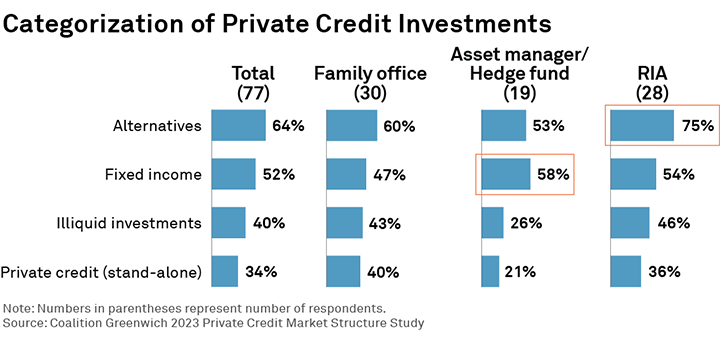

The research found that views differ based on investor type. For wealth managers overseeing a client’s portfolio, which in this case includes both RIAs and family offices, private credit is seen as an alternative investment alongside core holdings of stocks and bonds. The majority of these portfolios primarily hold these traditional asset types with an allocation to alternatives; anything from private credit to farmland. So, if the investment is not a stock or bond, into the alternatives bucket it goes.

For asset managers and hedge funds that invest institutional (rather than retail) capital, their access to more sophisticated products creates a broader definition of fixed-income assets; from private credit to collateralized loan obligations (CLOs) to credit derivatives. While the exact categorization of private credit investments may seem trivial, how investors bucket these investments can have a huge impact on the size of the allocation and the perceived performance of the investment, as the benchmark could differ greatly.

Barriers to Private Credit’s Growth

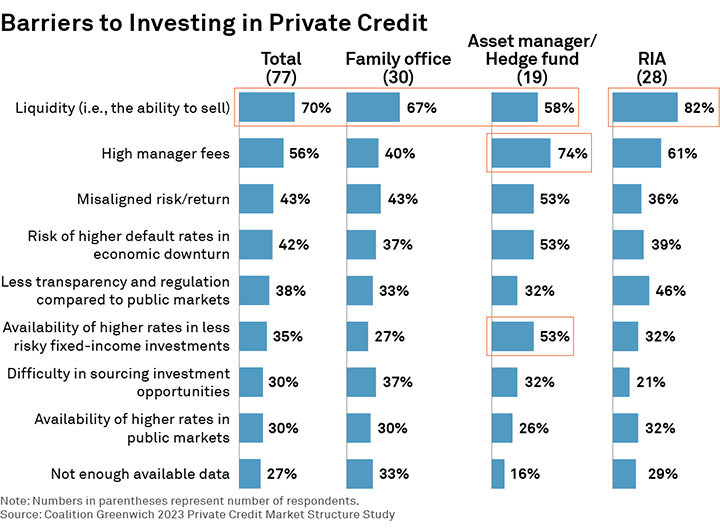

While private credit is clearly in an evolutionary period, transitioning from a purely institutional market to one that provides investment opportunities for a broader swath of investors (and borrowers) is not without challenges. A lack of liquidity, particularly when investors are looking to sell, and high fees are seen as the biggest impediments to further investment in the asset class.

For wealth managers, the liquidity challenges are the biggest road bump. While the majority of assets held by high net worth investors are viewed as long-term investments, the ability to access that money when the time arises is top of mind. Even with no plans to sell, understanding the current true value of an investment is also key, which is hard when liquidity is low.

For asset managers, high fees present a bigger roadblock. Private credit/alternative fund managers typically charge “2 and 20,” which is a 2% management fee on AUM and a 20% carried interest fee on profits. Operating expenses (legal, accounting, etc.) are also typically passed along to investors in these funds. Asset managers are in a long-running war against lower fees forged by passive index funds that charge only a few basis points for the service they provide. That means that all costs must be monitored closely, as they ultimately cut into the manager’s profit, the client’s return or both. High fees can also leave an otherwise high-yielding private credit investment generating an absolute return closer to risk-free U.S. Treasuries or more liquid corporate bonds, negating the benefits of the more opaque and less liquid investment.

Improving Access

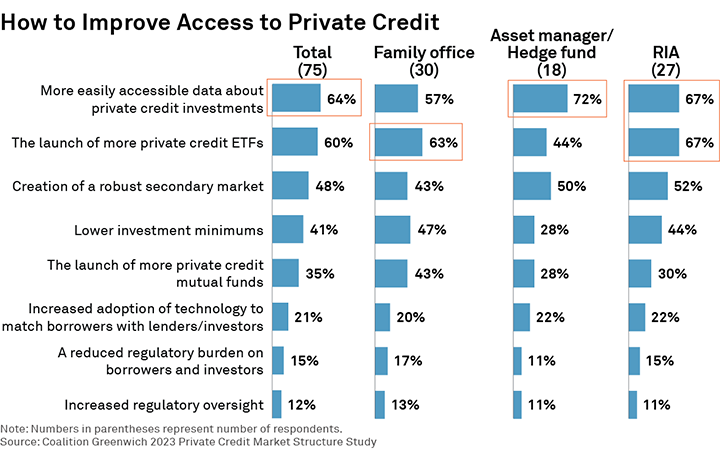

These concerns are reflected in the suggestions provided for improving access to the private credit market going forward. The wealth management cohort was bullish on the creation of more private credit liquid alternatives, with the assumption that investing in private credit through that vehicle would provide both better liquidity (given liquid alternatives are generally easier to trade) and lower fees.

While neither liquidity nor lower fees are guaranteed simply by being a public 40-Act fund, liquid alternatives have proven to be the method for achieving both in other market segments over time and do democratize access to investment types that are otherwise out of reach for many investors. Nevertheless, liquid alternatives are in many ways a band-aid to the challenges investors currently face in private credit.

We’d suggest that a more impactful long-term approach to improved market access would be to focus on increasing access to standardized company information to foster the creation of a robust and standardized secondary market for individual loans. While these elements create a chicken-or-the-egg dilemma—one often leads to the other—potential solutions for both already exist and will improve over time through increased adoption and awareness.

Show Me the Data

While it remains a mystery whether the chicken or the egg was first, the history of capital markets is littered with examples of robust and accurate data leading to increased liquidity and secondary market trading. Corporate bond markets, for instance, saw public reporting of trading data mandated in 2002. At the time, electronic trading was non-existent and bid-ask spreads were wide. Over time, data paved the way for more investors to enter the market, for electronic trading to grow and, ultimately, for market liquidity to improve, despite the pullback of dealer capital used to make markets following the global financial crisis.

![]()

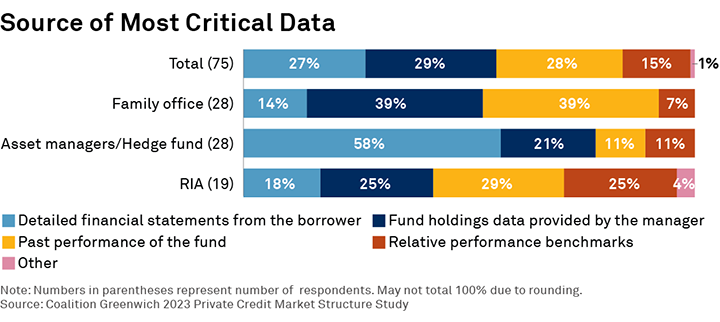

While private and public debt markets come with obvious differences, the importance of data in the creation of a robust secondary market is key. U.S. corporate bond investors today have access to continuously updated prices on nearly every tradeable bond—private credit investors do not. In some cases, that’s ok. Part of the allure of private credit is the reduced volatility that comes with instruments that trade less frequently. However, the most common sources of data cited by investors in our study are the managers of their private credit investments—a large single point of failure.

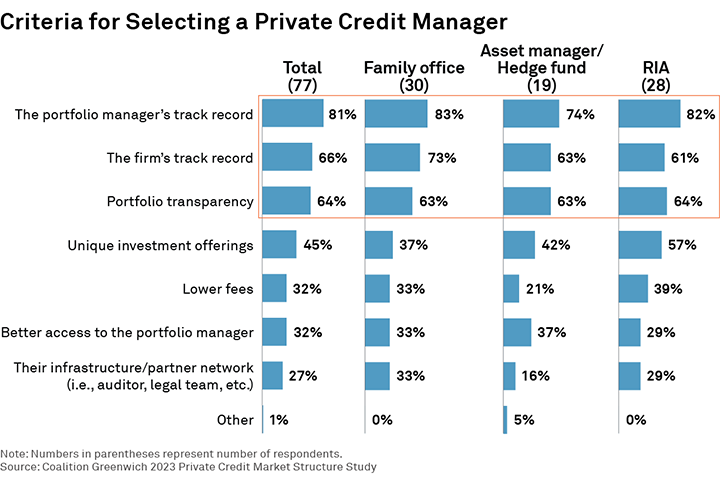

After track record, portfolio transparency is the top selection criterion used by private credit investors, so managers have huge incentives to open the hood and provide potential investors with what they need. Even so, while our intention here is not to suggest that private credit investors should doubt the data their managers provide, prudent risk management would suggest multiple inputs are crucial to investment strategy and tracking over time.

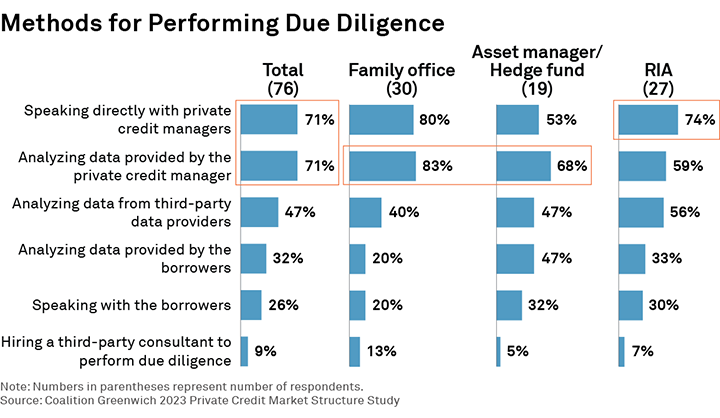

Due diligence on private credit investments is similarly conducted primarily via manager-provided data and insights, including detailed financial statements from the borrower, fund holdings data, past performance of the fund, and relative performance benchmarks. There are many reasons why this could remain the only approach even as technology offers increased market transparency. Private loans are generally too small to be rated, and the borrowers too small to have publicly available data on the health of their business or even audited financials. As such, the only way to gauge the riskiness of the loan is to speak with the manager (the lender) and the borrower directly. Standards for such information would go a long way toward increased transparency in the market, but ultimately, the direct lending business is one of trust, even in today’s highly connected and electronic markets.

The large market data providers such as Bloomberg, Refinitiv (LSEG) and FactSet are increasingly providing private credit data to their customers. Third-party private market aggregation platforms, some who offer not only market data but also access to private credit investments, are also an increasingly important part of the ecosystem. These platforms help borrowers and investors find one another but also act as data aggregators, pulling together information on investments from borrowers, managers and investors alike.

The Path Forward

The private credit market offers borrowers access to capital that, in many cases, would not have been available through traditional bank lending. It also, in turn, offers investors opportunities to generate income higher than can be had in the public market, often with a similar risk profile.

For decades, the private credit market has been available only to institutional borrowers and lenders, keeping the benefits of this funding method exclusively for the largest institutions. Technology and natural market forces have now brought private credit to a much broader swath of investors that includes smaller institutions, wealth managers and high net worth retail investors. But there is still more work to do.

The sourcing of private credit investment opportunities is still primarily in the hands of the largest asset managers, and the data to understand these investors is almost always provided by the managers themselves. More robust “exchanges,” operational efficiency in the form of interconnected trading and investment platforms, and standardized, easy-to-consume data will go a long way toward opening up the private credit market even further. ETFs are certainly one part of the path forward, but the underlying market structure must evolve first to ensure robust supply and sufficient transparency.

Kevin McPartland is the Head of Research for Market Structure & Technology at Coalition Greenwich.

3Coalition Greenwich 2022 U.S. Institutional Investor Study

5https://app.percent.com/markets/rates

MethodologyCoalition Greenwich conducted 77 interviews in the summer of 2023 with asset managers, hedge funds and wealth managers (both family offices and RIAs) in the United States to better understand their participation in the private credit market and expectations for the future. The majority of respondents managed $250 million or less in assets for their clients.