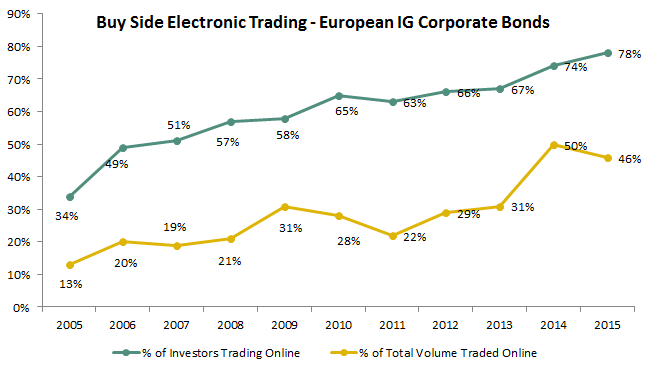

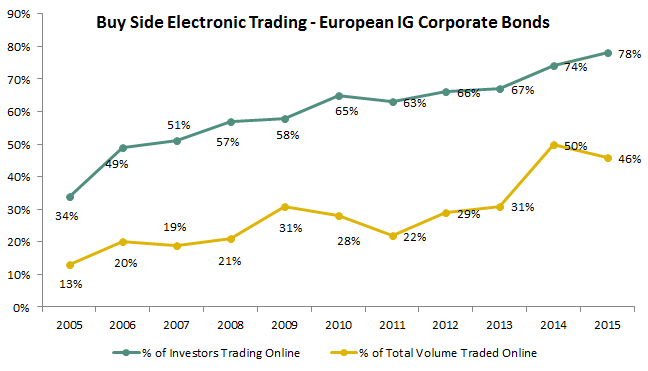

Only a small few markets have been able to migrate more than half of trading volume to the screen. FX trades roughly three-quarters of its volume electronically for instance. Index CDS in the US trades over 90% of its volume electronically - a product of regulation rather than organic market demand. European investment grade corporate bonds, however, appear to have hit the electronic trading glass ceiling. Based on over 300 interviews each year with European corporate bond investors, the electronic trading growth trend (volume weighted) that started in 2011 took a downward turn based on our 2015 interviews.

Now as with all such trends these days, the reasons for the 2015 reversal could be many. A confluence of economic factors such as negative interest rates, currency volatility and the on going European recesssion impacted bond flows in such a way that trading on the screen made less sense then it did a year ago. To that end, we've pointed out in recent research that the value of the sell side sales desk is alive and well, and with the markets in a continued state of uncertainty trading with a human provides a level of comfort that an RFQ can't match.

The market's changing liquidity profile also must be factored into e-trading's evolution. On one hand, the reduction in principle liquidity provision by some banks has driven investors to the screen as they seek new counterparties with which to trade. Coversely, this new harder to trade environment drives some back to the phone as the advice provided by the sales desk - market color, trading patterns, potenial sources for a natural match - leads to an easier and hopefully better execution than what the screen could provide.

The as of yet unimplemented MiFID II is also a factor. While we fully expect that once implemented MiFID II will drive e-trading up beyond current levels, the regulatory uncertainty that exists today creates the opposite effect. Most market participants are hesitant to invest in e-trading technology, people and strategies when the rules of the game are as of yet undecided.

This new European corporate bond e-trading data point does not bring with it all bad news however. Firstly, electronic trading in IG corporate bonds in Europe still dwarfs the US. Greenwich Associates data shows that in 2015 20% of client volume in the US was traded on the screen compared to Europe's 46%. We also continue to see e-trading further penetrate the buy side, with 78% of our over 300 investor study participants trading at least some volume electronically - up from 74% last year and from an astounding 34% in 2005. And lastly, 2016 data will tell us whether or not this drop is a new trend or simply a market gyration leading to continued growth the following year.

My guess? Corporate bond e-trading still has plenty of room for growth, particularly in light of MiFID II and the level of innovation happening at the venues today, so this downward move is not the end of the story. But given the market structure of the corporate bond market and trends in other markets, Europe is closer to the perverbial ceiling than is the US market that still has a long way to go.