Table of Contents

2015 brought little respite to investors, as most markets were flat or declined sharply, roiled by fears over global growth, volatile commodity prices, international political discord, and domestic crises. However, those with the fortitude to stay the course were rewarded with more promising conditions in the first half of 2016, as a succession of markets rebounded.

“In a similar vein, investors have looked for consistency and sound advice from their brokers, rewarding those able to help them navigate both macro issues of economics and asset allocation, and those with depth of coverage across countries and industries,” notes Greenwich Associates Managing Director Jay Bennett.

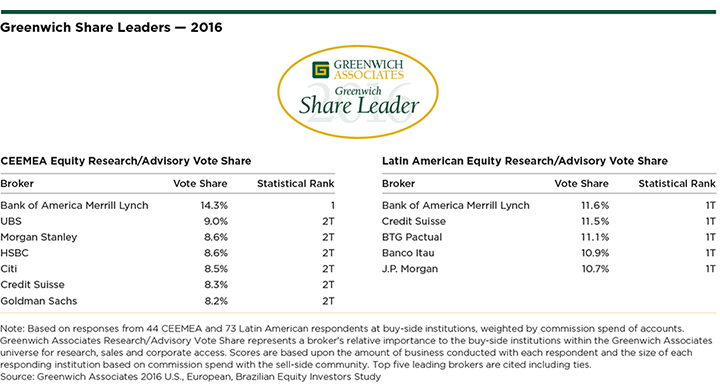

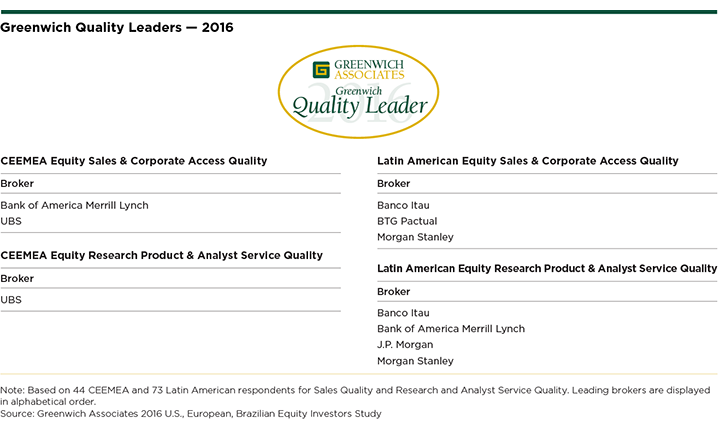

The 2016 Greenwich Share and Quality Leader designations are awarded to brokers based on the results of interviews conducted by Greenwich Associates with 44 North American and European investors in CEEMEA equities and 73 North American, European, and Brazilian investors in Latin American equities. Greenwich Quality Leaders℠ are firms that receive quality ratings from their institutional clients in sales and in research/analyst service that top those awarded to competitors by a statistically significant margin.

Greenwich Leaders: CEEMEA

Expansive in geographic scope, CEEMEA assets nonetheless concentrate in Russian (36%) and South African (24%) equities. Eastern Europe represents 19% of assets on average, followed by Turkey at 12% and Middle East/North Africa at 10%. Few brokers are consistently strong in all of these markets and regions, resulting in a broad first tier of brokers for the provision of research and advisory services. Bank of America Merrill Lynch earns first place with 14.3% of the vote share, followed by UBS, Morgan Stanley, HSBC, Citi, Credit Suisse, and Goldman Sachs in a broad statistical tie for second. These firms are the 2016 Greenwich Share Leaders℠ in CEEMEA Equity Research/Advisory.

Bank of America Merrill Lynch and UBS are the 2016 Greenwich Quality Leaders in CEEMEA Equity Sales & Corporate Access, while UBS has distanced itself from other competitors as the 2016 Greenwich Quality Leader in CEEMEA Equity Research Product & Analyst Service.

Greenwich Leaders: Latin America

Despite international economic headwinds and domestic political discord, Brazil continues to occupy a central role in Latin American portfolios, representing 56% of European investors’ assets under management and 39% of U.S. investors’ portfolios. Mexico, however, has grown in importance among U.S. investors, equaling if not modestly surpassing Brazilian equities in importance. Brazilian institutions, meanwhile, remain largely domestic with 91% of assets in Brazilian equities.

With this as a springboard, it is perhaps not surprising that BTG Pactual and Banco Itau are among the 2016 Greenwich Share Leaders in Latin American Equity Research/Advisory. With scores of 10.7%–11.6%, they are joined by Bank of America Merrill Lynch, Credit Suisse, and J.P. Morgan in what is statistically a five-way tie for first.

The 2016 Greenwich Quality Leaders in Latin American Equity Sales & Corporate Access are Banco Itau, BTG Pactual and Morgan Stanley. Banco Itau, Bank of America Merrill Lynch, J.P. Morgan, and Morgan Stanley are the 2016 Greenwich Quality Leaders in Latin American Research Product & Analyst Service.

Consultants Jay Bennett, John Colon, John Feng, Thomas Jacques, and Satnam Sohal advise on the institutional equity markets globally.

MethodologyFrom March to May 2016, Greenwich Associates interviewed 117 institutional investors in CEEMEA and Latin American equities at U.S., European and Brazilian institutions about the research and sales services they receive from their brokers. These portfolio managers and traders were also asked about current market practices, trends and compensation.