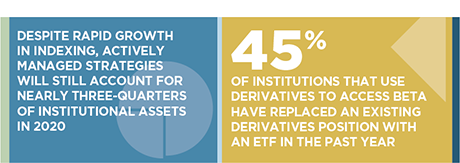

The results of Greenwich Associates 2016 Global Exchange-Traded Funds Study reveal that institutional investment in exchange-traded funds is growing, as new users introduce ETFs into their portfolios and existing investors expand allocations to the funds. Driving this growth is institutional investors’ wholesale reconsideration of the long-held distinction between active and indexed investment approaches. Passively managed ETFs are increasingly used to achieve active outcomes, thereby blurring the lines between active and index approaches.

With ETFs slotted into a broadening range of portfolio functions by institutions in North America, Europe, Asia, and Latin America, the category is on a solid trajectory to reach the Greenwich Associates projection that total institutional investment in ETFs will see an additional $300 billion in flows annually by 2020.

MethodologyThis paper presents the results of the industry’s most comprehensive study to date of the global institutional market for exchange-traded fund

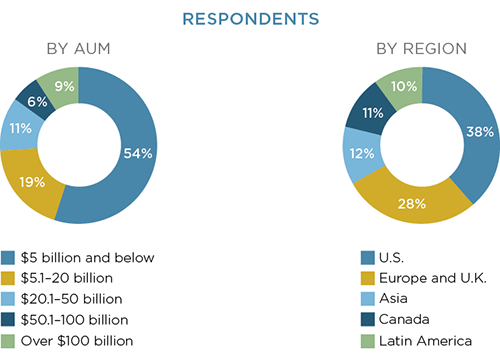

For its 2016 Global ETF Study, Greenwich Associates interviewed 481 institutions in 21 countries around the world. That total includes 187 institutions in the United States, 132 in the United Kingdom and Continental Europe, 59 in Asia, and 53 Canadian institutions. This year Greenwich Associates extended the study to Latin America for the first time, interviewing 50 institutions there.

Although Institutional funds and asset managers make up a majority of study participants, the research sample includes representation from a wide variety of institution types. Greenwich Associates interviewed 174

institutional funds (including public and corporate pensions, endowments and foundations), 161 asset managers, 86 insurance companies, 55 registered investment advisors (RIAs), and five investment consultants.

Many of the participants in this year’s study are large institutions. Approximately 45% of study participants have assets under management (AUM) of more than $5 billion, about 25% manage more than $20 billion,and nearly 10% have AUM in excess of $100 billion.

Around the world, these institutions manage a majority of portfolio assets—about 56%—internally. That share is down slightly from the 58% reported in 2015. The decrease has been driven by a shift toward external management on the part of institutions in Europe. Among European study participants, the share of total assets managed externally increased to 52% in 2016 from 41% in 2015. By channel, the move toward external management was most pronounced among RIAs, whose share of internally managed assets declined to approximately 61% in 2016 from 74% in 2015, and institutional funds, where internally managed share of assets declined to 33% from 39%.