Canadian institutions made aggressive use of exchange-traded funds in their portfolios last year as they navigated a sharp market downturn, a surge in volatility and a series of unpredictable geopolitical events. As they contend with these risks and implement the adjustments needed to reposition their portfolios, growing numbers of Canadian institutions are using ETFs to strategically replace other investment vehicles.

Building upon an already robust use of ETFs, institutions are adding the funds to their portfolios for three main reasons:

- Flexibility, Ease of Use and Cost-Effectiveness: ETFs have proven to be highly flexible vehicles that institutions find easy to use and cost-effective when taking on both strategic and tactical investment exposures across asset classes and portfolio functions.

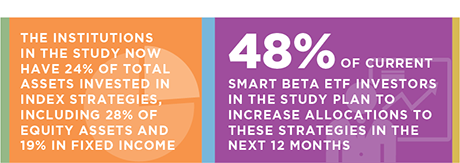

- Index Exposures: Throughout the market volatility of 2018, investors in Canada and around the world continued moving assets from active to index strategies, and ETFs are by far institutions’ vehicles of choice for index exposures.

- Fixed-Income Liquidity: Diminished liquidity in global bond markets is fueling demand for bond ETFs, with 45% of ETF investors in the study using the funds to obtain fixed-income exposures.

Continued strong demand for factor-based strategies will remain one of the key drivers of ETF growth in 2019. Almost half of current smart beta ETF investors in the study plan to increase allocations to these strategies in the next 12 months. Of these, almost 40% are eyeing increases in excess of 10%. Additional growth will come from larger asset classes: 27% of current ETF investors plan to increase allocations to bond ETFs in the coming year, and 20% plan to boost allocations to equity ETFs. Over a longer horizon, Greenwich Associates expects the continued integration of environmental, social and governance (ESG) into institutional investment processes to emerge as an important source of demand for ETFs in Canada.

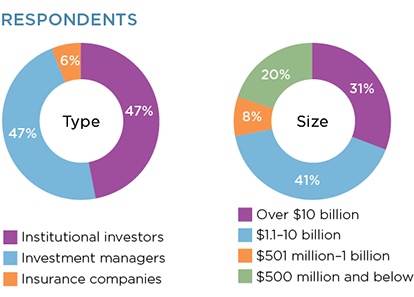

MethodologyBetween October and December 2018, Greenwich Associates interviewed 51 institutional investors for its sixth annual edition of the Canadian Exchange-Traded Funds Study.

The research universe included 24 asset managers, 24 institutional funds and three insurance companies/insurance company asset managers. Thirty-eight of these institutions currently invest in ETFs. Most of the participants are large institutions. More than 30% of the institutions in the study have assets under management (AUM) of more than $10 billion, 40% manage in excess of $5 billion, and nearly three-quarters have AUM of more than $1 billion. The research universe included 35 portfolio managers/chief investment officers, 11 research analysts and representation from buy-side risk management, product development/sales/marketing and trading.