The institutions participating in the Greenwich Associates 2017 U.S. Exchange-Traded Funds Study are preparing their investment portfolios for the return of volatility and the shift to a rising interest-rate environment. As part of those efforts, they are increasing their use of exchange-traded funds (ETFs) in 20 of the 21 equity and fixed-income product categories covered in the study, and they are integrating the funds into more sophisticated portfolio applications.

Driving this expansion is ETF versatility. ETFs are being adopted in portfolios alongside, and in some cases in place of, individual stocks and bonds, mutual funds and derivatives as a source of primary beta exposures for use in a wide variety of active and passive investment strategies.

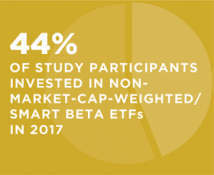

Institutions are making greater use of ETFs in strategic portfolio functions. They are using ETFs to obtain investment exposures in “core” portfolio allocations, and as building blocks in top-down strategies that create alpha through asset allocation, as opposed to security selection. They are also employing ETFs to guard portfolios against volatility—a task growing numbers of institutions are addressing with smart beta ETFs.

Meanwhile, institutions continue relying on ETFs as a liquid, fast and relatively low-cost tool in a wide range of tactical tasks, such as managing cash flows and making tactical changes to their portfolios.

About a third of current ETF users in the study plan to increase allocations to the funds in the coming year, and significant shares of non-users say they are likely to start investing in ETFs in the next 12 months. Institutions are planning the biggest allocation increases in fixed income, where they are using the funds to enhance liquidity and otherwise prepare for a new era of “quantitative tightening.”

These results point to continued growth in institutional ETF investment in the remainder of 2018 and into 2019. That growth could actually accelerate if continued increases in volatility place a premium on ETF features, including enhanced liquidity, operational efficiency and lower costs.

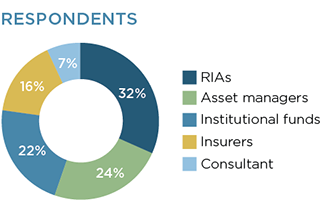

MethodologyBetween October 2017 and February 2018, Greenwich Associates interviewed 180 institutional investors for its 2017 U.S. Exchange- Traded Funds Study. A wide range of institutions participated, including RIAs, asset managers, insurance companies, public and corporate defined-benefit plans, endowments/foundations, and investment consultants—along with representation from insurance asset managers, defined-contribution plans, family offices, and other segments of the institutional channel.

Most of the participants in this year’s study are large institutions. Forty-five percent have assets under management (AUM) of more than $20 billion (up from 33% in 2016) and approximately 1 in 5 have AUM in excess of $100 billion (up from 14%). Together, the study participants represent a sizable slice of the U.S. institutional market, with a combined AUM of $11.16 trillion, up from $6.67 trillion in 2016.