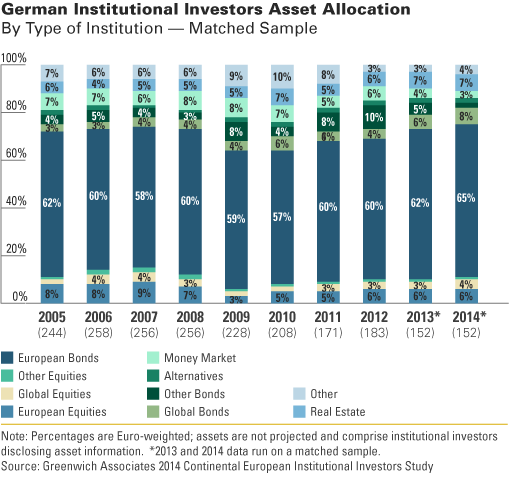

Results from the Continental European Institutional Investors Study revealed that European bonds make up 65% of institutional investor portfolios, as the asset class has been on the incline since 2010 when it was 57%. Likewise, allocation to Global Bonds increased once again this year from 6% to 8%.

Other Findings to Help Support Your Business Strategy:

- Corporate pensions remain dedicated to fixed income by increasing their allocation to European IG Corp. Bonds from 22% to 32%. Foundations/churches also increased their designation to European government bonds from 5% to 26%.

- Public/industry pensions decreased their exposure to European equities (13: 15%, 14: 9%).

- Current allocation for collateralized bonds is 24% among insurers and pensions, with target allocation for 2015 at 28%. Investors target exposure for fixed income is significantly lower for corporates, insurers and pensions.

- Public/industry pensions favor real estate on their search for yield, while the hopes for increased allocation to alternatives from 2013 failed to materialize.

- Institutions expect to significantly increase exposure to infrastructure and real estate, while domestic and government bonds assets are expected to significantly decrease.

- Investors identified asset return expectations and regulatory pressure as the major drivers behind significant allocation changes among German institutions. Market volatility and liability pressure soon follow affecting these strategic decisions.