Table of Contents

Assets managed by Asian institutions shrunk last year for the first time in a decade.

In 2012, institutions across the Asia-Pacific region managed slightly more than $8 trillion. That AUM grew every year for the next decade, almost doubling. The growth trend reversed course last year, with total AUM dropping to approximately $17 trillion in 2023 from $17.4 trillion in 2022.

Those declines were the result of something close to a perfect storm in financial markets around the world. Surging inflation and rising interest rates drove negative returns in equities and fixed income in 2022. Geopolitical events including Russia’s attack on Ukraine and tensions between the United States and China added to the pressure on global markets. Combined with a slowing Chinese economy, these factors resulted in a historically bad year for global investors and the subsequent decline in Asian institutional AUM.

Despite Slowdown in Hiring, Positive Signs for Asset Managers

The drop in institutional AUM is obviously bad news for asset managers competing for mandates in Asia. As shown in the following graphic, demand for new managers is expected to decline as many institutions adopt a cautious stance and pull back on hiring amid the volatility.

Despite the slowdown in hiring external managers, several important trends are still pointing in a positive direction for the Asian investment management industry. For starters, the softening demand for new managers is being driven mainly by equities. In both fixed income and alternatives, the share of institutions expecting to hire a new manager in the next 12 months actually increased from 2022 to 2023.

Next—and perhaps even more importantly—the total amount of assets available to external managers actually increased modestly last year, from about $3.8 trillion to $4.0 trillion, keeping the 10-year run of growth in outsourced assets intact. Those outsourced assets are coming from a broader group of institutions. As recently as 2016, Asia’s 15 biggest institutions accounted for 84% of externally managed assets in the region. By 2023, that share has dropped to just 62%. The result is a more open and diverse marketplace for asset managers competing for mandates and assets.

Surging Demand for Private Debt

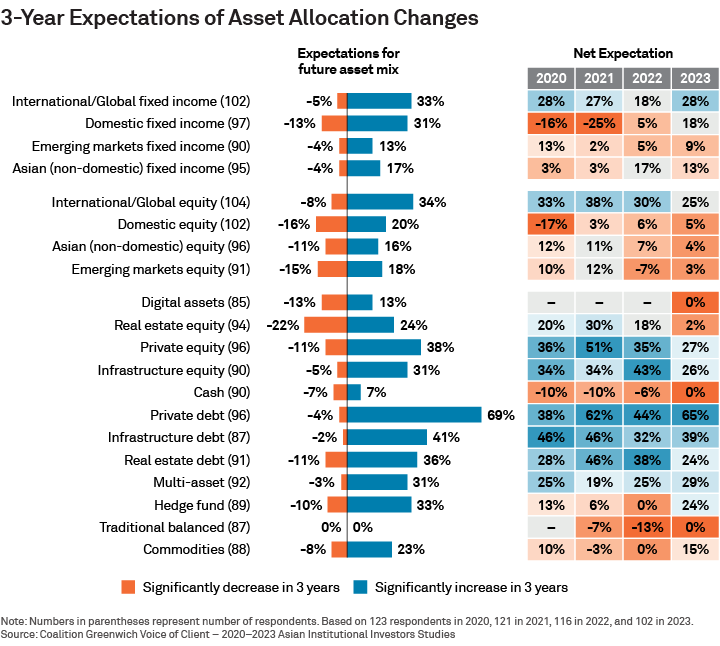

Demand for private debt is surging among institutions in Asia. Every year, Coalition Greenwich asks institutions around the world if and how they plan to change their strategic asset allocations over the next three years. This year, 69% of Asian institutions that are planning changes say they expect to increase allocations to private debt. With only 4% of those institutions planning to cut private debt allocations, the net 65% increase ranks as one of the strongest indicators of demand we’ve seen in our research.

As shown in the graphic above, Asian institutions’ enthusiasm for private debt reflects a broader appetite for fixed income and private assets. Over the next three years, study participants expect demand to be strongest for international/global fixed income on the public side, along with alternatives, including infrastructure debt and equity, private equity, and hedge funds. Institutions also expect to boost allocations to multi-asset funds.

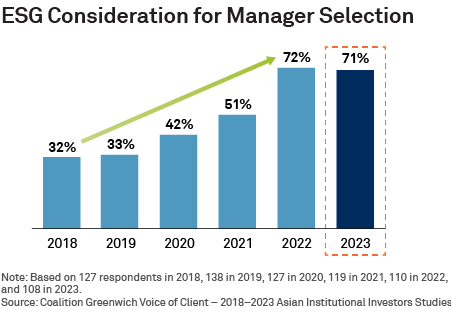

ESG Adoption Plateaus in Volatility, but Sustainability Remains Critical

Although the challenge of managing through market volatility appears to have slowed the uptake of environmental, social and governance (ESG) investing standards last year among Asian institutions, ESG remains a powerful influence in the competition for investment mandates. As shown in the chart below, roughly 7 in 10 Asian institutions consider ESG criteria when selecting new investment managers, roughly unchanged from 2022. That share varies considerably across the region. For example, the majority of institutions in Thailand review ESG metrics, while in South Korea, the number is a bit more subdued. Despite that variance, the overall trend remains in place: 70% of Asian institutions say ESG is playing a growing role in their selection of managers.

To Localize or Not to Localize?

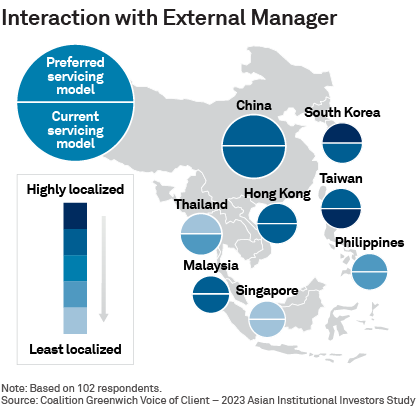

For the first time, Coalition Greenwich asked study participants this year to rate the importance they place on localized service models. The following graphic depicts some of the results. As the image shows, institutions in North Asia express a strong preference for highly localized service models. Asset owners in China and Hong Kong are looking for managers with a domestic presence and local language speakers. Institutions in Singapore are much more open to non-localized service models in which foreign language speakers operate out of regional hubs. South Korea stands out as a marketplace in which asset owners would prefer more localized service than they are currently receiving.

Of course, client preference represents only one input into the equation by which asset managers determine their optimal models. Providing localized service is expensive, and client satisfaction must be balanced against the costs and commitment required to maintain local presences across such a broad and diverse region.

Head of Asia-Pacific Parijat Banerjee and Senior Manager Arifur Rahman advise on the investment management market in Asia.

MethodologyBetween February and August 2023, Coalition Greenwich conducted 122 interviews with senior decision-makers at the largest institutional investors in Asia ex-Japan. Senior fund professionals were asked to provide detailed information on their investment strategies, quantitative and qualitative evaluations of their investment managers, and qualitative assessments of managers soliciting their business. Countries and regions where interviews were conducted include Bangladesh, Brunei, Cambodia, China, India, Indonesia, Hong Kong/Macau, Malaysia, Pakistan, the Philippines, Singapore, South Korea, Taiwan, and Thailand.