Asian fixed income has been growing in importance in the portfolios of institutional investors and private banking clients around the world. Based on data from our recent study, Greenwich Associates projects meaningful growth in Asian fixed-income investments in the next 12 months and beyond.

The inclusion of domestic Chinese bonds in the Bloomberg Barclays Global Aggregate Bond Index and other regional industry benchmarks will be an important driver of near-term growth. Over a longer horizon, the continued expansion and maturation of Asian bond markets and investors’ ongoing search for attractive yields in a low-rate environment will fuel further growth.

More than half of the APAC, European and U.S. institutional investors and private banks participating in the study have an allocation to Asian fixed income, with Asian assets making up 18% of fixed-income portfolios overall.

The vast majority of existing investors plan to increase or maintain their allocations to Asian fixed income in the next 12 months, and about one-quarter of current non-investors plan to initiate an allocation during that period. While actively managed or direct investments are currently the most popular vehicle for taking on Asian fixed-income exposures, growing numbers of institutional investors and private banks are using or considering exchange-traded funds (ETFs), which many see as having the potential to enhance liquidity and lower costs.

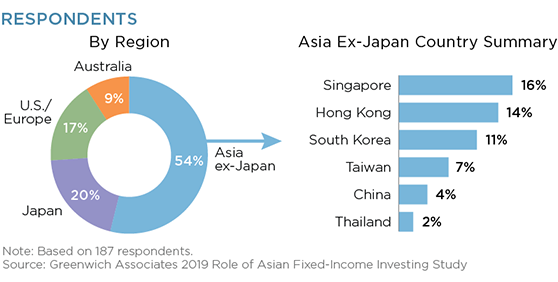

MethodologyBetween October 2018 and March 2019, Greenwich Associates interviewed 187 institutional investors and gatekeepers at private banks in a study commissioned by ABF Pan Asia Bond Index Fund (PAIF, an ETF managed by State Street Global Advisors) on Asian fixed income. The research sample was made up of 151 institutional investors and 36 intermediary fund distributors from Asia-Pacific, Europe and the United States.