Asset management companies continue to enter the Asian market to fight for a share of the region’s fast-growing pool of institutional investment assets. Most of these new entrants are following the example set by European and North American firms with an established presence. They are focusing their efforts almost exclusively on the handful of massive Asian institutions that control the vast bulk of these assets.

A small number of asset managers are taking a different path by building much broader franchises that extend well beyond the major financial centers and the sovereign wealth and public pension funds that dominate Asia’s institutional asset base. Generally, these are large U.S. or European organizations with extensive capabilities that allow them to build relationships among a wide base of Asian institutions by providing advice on how to structure and manage their portfolios.

Asian institutions currently control about $11–12 trillion in assets. While most of that money is managed in-house, about $1.9 trillion is open to external asset managers an increase of over 20% from 2014. Greenwich Associates expects the pool of externally managed assets to continue growing at a steady pace, as institutions in Asia diversify investment portfolios.

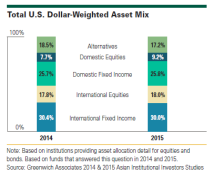

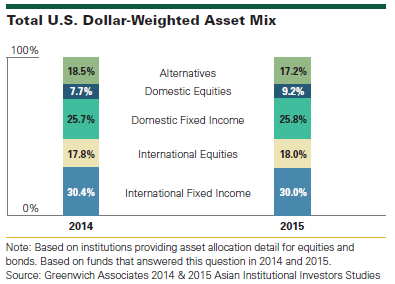

However, about 90% of these assets are held by about 25 institutions. As a result, most asset managers target a group of 30–40 institutions from offices in Hong Kong and Singapore. The arrival of new asset management companies in this concentrated market has created intense competition for assets. As recently as five years ago, the firms that succeeded in this tough environment were generally large organizations with high levels of brand recognition. More recently, however, Asian institutions have been diversifying, adding strategies like credit, high yield and regional equities to portfolios previously dominated by domestic fixed income and global equities and fixed income. As they do so, they are becoming more open to managers with strong track records and the ability to explain how they create value even if their investment committees aren’t familiar with the brand name.

Most of the firms on the list of 2015 Greenwich Quality Leaders in Asian Investment Management Service are trying to build a strong presence in Asia by forging relationships with the region’s giant institutions as well as smaller institutions outside the major financial centers. “Firms like Allianz Global Investors, BlackRock, Franklin Templeton, and J.P. Morgan Asset Management are demonstrating their commitment to local Asian markets by putting people on the ground to service local institutions,” says Greenwich Associates consultant Abhi Shroff. “This commitment is reflected in high scores for these managers on the Greenwich Quality Index.”

These firms are capitalizing on the fact that institutional use of investment consultants remains low in Asia. Only 22% of Asian institutions use consultants for portfolio decisions and manager selection, as opposed to the 80–90% usage levels seen in the United States, United Kingdom and Australia. A handful of asset managers have the resources and capabilities to provide thought leadership and advice at both the portfolio/asset allocation level and within particular strategies.

About two-thirds of Asian institutions say they value and would like to see improvement in managers’ ability to provide advice on their broad portfolios. “That demand didn’t exist just a few years ago, but now Asian institutions are asking their asset managers for help giving those managers capable of providing good advice a chance to win new clients and deepen existing relationships,” says Greenwich Associates consultant Jivan Sidhu.

Consultants Abhi Shroff and Jivan Sidhu advise on the investment management market in Asia.

MethodologyBetween January and March 2015, Greenwich Associates conducted 112 interviews with the largest institutional investors in Asia. Senior fund professionals were asked to provide detailed information on their investment strategies, quantitative and qualitative evaluations of their investment managers, and qualitative assessments of those managers soliciting their business. Countries and regions where interviews were conducted include Brunei, China, Hong Kong/Macau, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam.

The findings reported in this document reflect solely the views reported to Greenwich Associates by the research participants. They do not represent opinions or endorsements by Greenwich Associates or its staff. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results.

© 2015 Greenwich Associates, LLC. Javelin Strategy & Research is a division of Greenwich Associates. All rights reserved. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, Greenwich ACCESS™, Greenwich AIM™ and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.