Table of Contents

The pool of institutional assets available to investment managers competing for business in Asia is expanding—despite the end of a spectacular 10-year run of growth for Asian institutional assets overall. Although that is good news for all asset managers competing in the region, it could be particularly beneficial to PIMCO, which Asian institutions name as the clear-cut leader in manager service quality.

PIMCO is the 2017 Greenwich Quality Leader℠ in Asian Institutional Investment Management Service. This year, Greenwich Associates interviewed 124 large institutions across Asia, including central banks, sovereign wealth funds, pension funds, insurance companies, and others. Study participants were asked to name the asset managers they use and to rate them in a series of categories related to investments and service. Asset managers with ratings topping those of competitors by a statistically significant margin are named Greenwich Quality Leaders.

“Although PIMCO was the sole winner for 2017, Wellington Asset Management and Amundi Asset Management should also be recognized for the distinguished level of service quality they deliver to their institutional clients,” says Greenwich Associates Managing Director Markus Ohlig.

Greenwich Associates assessment of asset management service quality takes into account the following factors, each of which is rated individually by institutions participating in the Firm’s annual research:

- Understanding of institutions’ goals and objectives

- Credibility with investment committee or trustees

- Capability of the relationship managers

- Usefulness of formal investment review meetings

- Quality of reporting documents

- Usefulness of interactions outside of formal review meeting

PIMCO and Wellington both perform strongly in another key area for Asian institutions: thought leadership and intellectual capital transfer, ranking No. 1 and No. 2, respectively, in the category. “When Asian institutions have a question, PIMCO is the first number they dial,” says Markus Ohlig.

Asian Asset Growth Stalls

For the first time in a decade, growth in Asia’s institutional assets stalled last year, with total assets remaining roughly flat from 2016–2017. “China’s heavy spending in support of the Yuan eroded the country’s account surpluses and helped put the brakes on the long-term buildup of institutional assets in the Asian region,” explains Greenwich Associates consultant Parijat Banerjee.

Despite that slowdown, asset managers should remain optimistic about their short-term prospects in Asia. The reason: Institutions are diversifying their portfolios, and they are allocating growing shares of investment assets to external managers. As recently as 2012, Asian institutions were allocating only 16% of total assets to external managers. That share climbed to 18% in the past two years. Furthermore, usage of external managers is shifting toward higher-margin specialty strategies that are more profitable—and in case of illiquid assets, also more sticky.

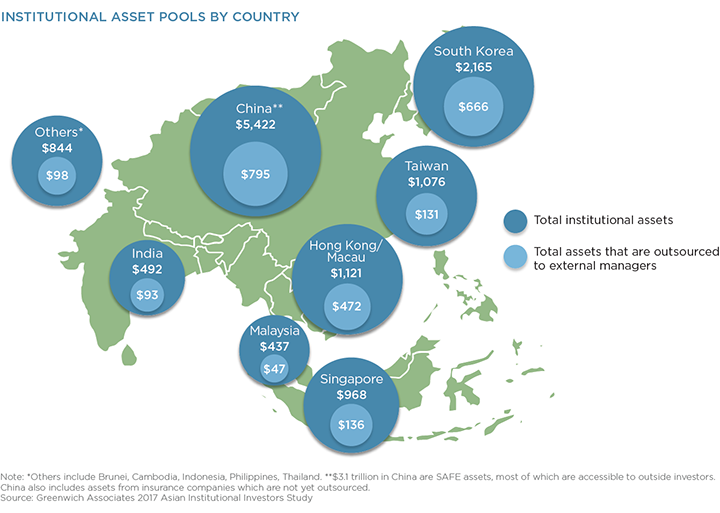

The geographic breakdown of total institutional assets and assets available to external managers is shown here.

Portfolio diversification is contributing to the increased use of external managers. In 2010, domestic fixed income accounted for 36% of Asian institutional assets. By 2017, institutions had reduced that average allocation to just 24%. Institutions are also moving assets out of fixed income in general and into equities and alternative asset classes. All of these shifts are creating new opportunities for asset managers—especially among midsize Asian institutions without the resources to support comprehensive internal investment functions in unfamiliar asset classes.

This shift is creating a bigger and more attractive market for asset managers. Asia remains a highly concentrated market, with 20% of the institutions in the region controlling 75% of the assets. But future outsourcing opportunities are more likely to come to midsize institutional investors. “Five to 10 years ago, results in this business were entirely dependent on a manager’s ability to build relationships and win assets from a tight group of 20–40 institutions,” says Markus Ohlig. “Today, asset managers can tap into a much broader universe of more than 100 institutions which allocate significant amounts of assets to external firms.”

These opportunities will remain in place and could actually proliferate in the future. Over the next three years, Asian institutions participating in Greenwich Associates annual research plan to further reduce allocations to domestic fixed income while increasing allocations to a broad range of other asset classes. These include domestic equities, international fixed income, Asian and emerging market equities and debt, as well as alternatives such as commodities, private equity, real estate, infrastructure, and hedge funds. “Contrary to trends in most other markets in the world, Asia will be a fertile market for hedge fund managers over the next three years,” says Parijat Banerjee.

Manager and Consultant Hiring Still Slow

Not all trends identified in the research represent tailwinds for the industry. For example, although the share of total institutional assets allocated to external managers is on the rise, the average number of managers employed by Asian institutions is not increasing. The likely explanation: Over the past few years, Asian institutions moving into new investment areas for the first time hedged their bets by hiring two or even three asset managers in a single asset class. Now, after a period of monitoring performance and service, they are settling in on their final choices and allocating new assets to one high-performing firm already in that group.

And finally, business prospects for investment consultants in Asia remain less than encouraging. Only 1 in 5 Asian institutions use an investment consultant. That’s by far the lowest rate in the world. Investment consultants are used by a third of institutions in Continental Europe, about half of institutions in Japan, 85% in the United States and 94% in the United Kingdom.

Managing Director Markus Ohlig and consultant Parijat Banerjee advise on the investment management market in Asia.

MethodologyBetween January and March 2017, Greenwich Associates conducted 124 interviews with the largest institutional investors in Asia.

Senior fund professionals were asked to provide detailed information on their investment strategies, quantitative and qualitative evaluations of their investment managers, and qualitative assessments of those managers soliciting their business.

Countries and regions where interviews were conducted include Brunei, Cambodia, China, Hong Kong/Macau, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan, and Thailand.