Table of Contents

For German institutions participating in the Greenwich Associates 2015 Continental Europe – German Institutional Investors Study, the pre-eminent challenge facing these institutions is clear:

- “The low interest rate environment makes it impossible to meet return targets. We have not yet found a solution.” — German Public Pension Fund.

- “Low interest rates are a problem. As a reaction, we have globalized our investments and invested in higher risk asset classes.” — German Foundation

- “Primary challenge is the low interest rates. The only chance to avoid this is to do things you didn’t do before.” — German Insurer.

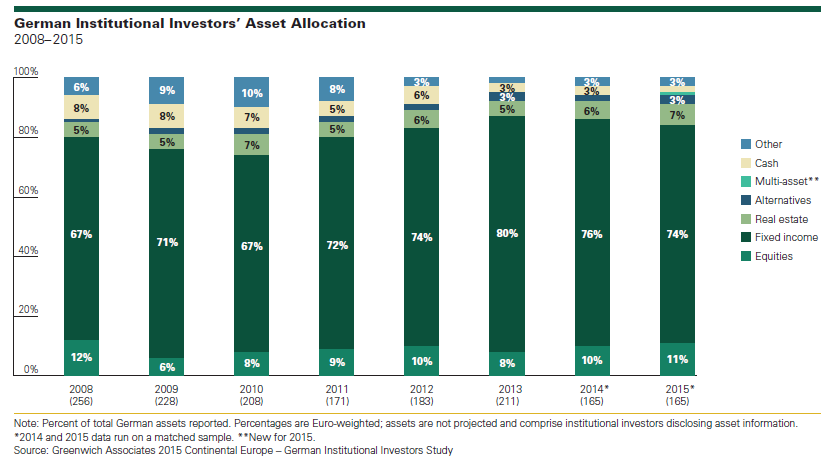

For many institutions in Germany, “doing things they didn’t do before” means investing significant amounts of assets in something other than domestic and government bonds. Many institutions have already taken their first steps in that direction. Allocations to fixed income have been on a steady path of decline since peaking at 80% of total assets in 2013. Average fixed-income allocations fell to 76% in 2014 and to 74% in 2015. Over that period, most of the assets moved out of fixed income have flowed to real estate, which increased to 5% of total assets in 2013 to 7% in 2015, and to equities, which climbed from 8% in 2013 to 10% in 2014 and to 11% currently. A small portion of assets was also directed to multi-asset class strategies, which now account for about 1% of total assets.

Given the dominance of fixed income in German portfolios, institutions’ first moves in attempting to generate additional yield were to extend duration and to diversify fixed-income portfolios away from government and domestic bonds, diversifying geographically and moving along the credit curve. But institutions are now facing the hard truth that even portfolios with bigger exposures to corporate, high-yield and emerging-market bonds and broader credit are not generating the returns needed to fund liabilities or meet spending requirements.

“Institutions are continuing to closely manage their risk allocations but are revisiting their fundamental perceptions of the risk-return profile in fixed income. If a ‘high yield’ is now less than 5%, they are asking themselves, ‘Should we be investing someplace else where the risk won’t actually be any greater but the returns may well be better?’” says Greenwich Associates consultant Lydia Vitalis.

One of the main impediments to broader portfolio diversification is the strict regulations under which many German institutional investors operate. Institutions participating in the study spoke at length about the tensions between their need to experiment with new approaches and to alter risk profiles on the one hand, and strict regulatory prescriptions on the other. “The regulation for insurance leaves us with very limited room. We are forced to invest a significant portion of our portfolio in fixed income and only in asset classes with the proper credit rating, which makes the market even narrower for us than for most other industries,” said one German Insurer.

In large part as a result of multiple regulatory frameworks, allocations vary dramatically among different types of institutions in Germany. The biggest difference, of course, is in allocations to fixed income, which range from roughly 80% of total assets among banks and insurance companies to just 56% of assets among corporate pensions and 44% among churches and foundations. Nevertheless, the German market might be approaching something of an inflection point, as institutions search for a solution that will allow them to achieve necessary return targets.

Although most institutions do not expect to implement major changes to portfolio allocations in the next three years, meaningful shares of investors are planning significant increases to asset classes they think have the potential to deliver better returns. Thirteen percent of German institutions plan to significantly increase allocations in that timeframe to European equities, and an equal share are planning sizable increases in private equity. Seventeen percent expect a significant boost in allocations to multi-asset class strategies—the strongest demand reported for any strategy.

“It important to note that these questions have been in the background for some time, and it’s unlikely that we will see dramatic shifts very quickly,” says Lydia Vitalis. “The difference today is that more institutions are having conversations about how such changes could be implemented, and more institutions are reaching out to asset management firms and asking: If we were to do this, how would we go about it?”

Greenwich Quality Leaders

Institutions’ desire for this type of assistance will present a real opportunity for investment management companies capable of demonstrating a clear understanding of clients’ overall situations, portfolios and needs. Firms like Allianz Global Investors and Union Investment—the 2015 Greenwich Quality Leaders in German Institutional Investment Management—are already taking advantage of this growing need by engaging with institutions about portfolio strategy at the broadest level.

In 2015 nearly 280 institutions were asked to name the external asset managers they employ and to rate them according to a series of investment and service criteria. Firms that receive quality ratings that top those of competitors by a statistically significant margin are named Greenwich Quality Leaders.

Consultants Marc Haynes and Lydia Vitalis advise on the investment management market in Continental Europe.

MethodologyBetween January and April 2015, Greenwich Associates conducted interviews with professionals at 274 of the largest institutional investors in Germany. Institutions included corporate pension funds, public pension funds, banks, Sparkassen, foundations, churches, and insurance companies. Interview participants were asked about their investment service providers, their business practices and their future expectations.

The findings reported in this document reflect solely the views reported to Greenwich Associates by the research participants. They do not represent opinions or endorsements by Greenwich Associates or its staff. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results.

© 2015 Greenwich Associates, LLC. Javelin Research & Strategy is a division of Greenwich Associates. All rights reserved. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promo- tional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.