Table of Contents

The results of the Greenwich Associates 2018 Continental European Institutional Investors Study reveal three prominent trends that are changing European portfolios and creating new opportunities for asset managers competing in the region:

- After nearly a decade of historically low interest rates and yields, institutional investors are adding specialty investment products to their portfolios in an effort to source the alpha needed to hit their return targets. Demand is strongest for real assets and specialty fixed-income and equity strategies.

- The pace of post-crisis regulation across Europe and the world has yet to slow down. Compliance with Solvency II and other European and country-specific regulations are at the very top of institutions’ priority lists in 2018, and these efforts are having a real impact on investment processes and portfolios as well as investors’ own personnel and IT resources.

- Institutional investors are responding to regulatory edicts and public pressure to integrate socially responsible investing (SRI) factors into their investment decisions and portfolios.

Greenwich Quality Leader

Together, these trends are fueling an unusually high rate of change in portfolios traditionally known for stability. They are also are creating opportunities for asset managers capable of helping plan sponsors in this period of transition. The 2018 Greenwich Quality Leaders℠ in Overall Continental European Institutional Investment Management Quality, Allianz Global Investors and PIMCO, are seizing these opportunities by helping institutions create and implement solutions to the many dynamic issues impacting their investment strategies and operations.

AllianzGI offers institutional investors one of the market’s broadest and most comprehensive platforms, which the firm employs to help institutional investors with everything from the creation of portfolio-wide strategies and responses to regulations, to the implementation of specific products and strategies at the asset-class level. PIMCO, meanwhile, distinguishes itself among European institutions mainly due to its strength in the specialty fixed-income products that investors across the region are turning to in their search for yield.

Asset Allocation Adjustments

The primary issue facing European institutional investors in 2018 is the same one they have been wrestling with for nearly the past decade: historically low interest rates. While generating necessary yields in this environment remains the biggest challenge facing these investors, this year also brings a new twist: What steps should institutions be taking to prepare their portfolios for a shift into a period of rising rates?

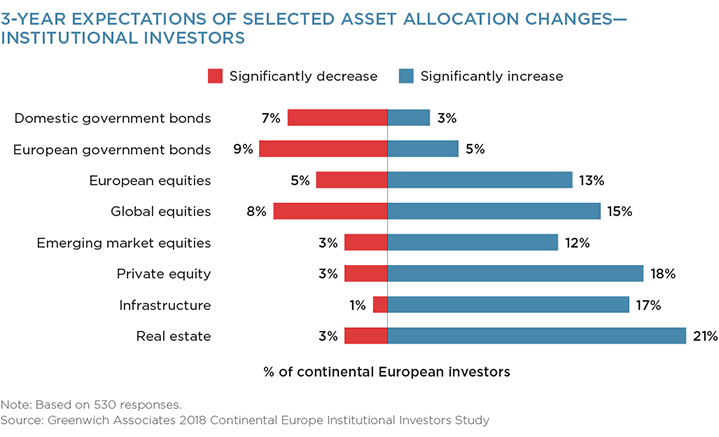

A small but not insignificant number of institutions in the study are moving to shorten portfolio duration to protect against near-term rate increases. However, most remain focused on the task of finding yield. To that end, over the past several years European institutional investors have been trimming back holdings of low-yielding domestic government bonds and European government bonds and shifting into asset classes with the potential to deliver higher levels of alpha and better returns. Expect that trend to continue and, potentially, even accelerate in the next three years.

Many of the assets freed up from core fixed-income allocations are flowing into real estate, private equity and infrastructure—asset classes investors are hoping will deliver the robust levels of alpha they’ll need to hit long-term return targets. For the same reason, demand is building for private debt—a relatively new asset class for many investors. Institutions also expect to increase allocations to other, more traditional asset classes seen as having greater potential to deliver relatively high levels of alpha. That list includes securitized bonds, emerging market debt, and—for insurance companies and other European institutions with portfolios weighted heavily to fixed income—global equities.

Quantitative Strategies Supplement Active Strategies

Institutions are also hoping to enhance overall portfolio returns with quantitative strategies based on “factors” like momentum and value which are proven to provide systematically available risk premia over long periods of time. These strategies are emerging as an attractive supplement and even replacement for traditional, fundamental active management strategies in asset classes like large cap European equities, which are generally perceived as too efficient to provide much opportunity for outperformance. “In these asset classes, institutions that had been replacing fundamental managers with passive strategies are now also incorporating smart beta,” says Greenwich Associates Managing Director Markus Ohlig.

Approximately one-quarter of the institutions in the study are using quantitative strategies in European equities, about 1 in 5 are using them in global equities, and smaller shares of investors are using quant strategies in other equity categories.

Investors’ expectations for alpha generation from their portfolios are increasing in step with these portfolio moves. In 2015, 37% of the institutions participating in the study were expecting their portfolios to deliver alpha of 50 basis points or more, while 17% reported alpha expectations of more than 100 bps. This year, 44% of institutions are looking for more than 50 bps of alpha and 23% expect 100 basis points or more.

“Of course, institutions will also have to contend with the significantly higher fee levels associated with specialty investment products,” says Markus Ohlig.

Regulations

Although much of the heavy lifting associated with Solvency II implementation is now in the past, institutional investors are still adjusting policies, practices and platforms to conform with the sweeping rules. They are also devoting significant time and resources to compliance demands from a raft of local, country-based regulations that are having a major impact on investments and operations. For example, French institutions participating in the 2018 study are working to implement new local regulations on asset liability matching, German institutions are focused on changes to fund taxation laws, and both Irish and Norwegian plan sponsors are adjusting to new requirements on funding ratios and return targets.

Even after initial implementation, these new regulations are having a profound effect on institutions’ investment functions and, increasingly, on their relationships with their asset managers. In particular, issues like reporting and compliance have moved from secondary considerations to primary criteria in manager searches. As the representative of a French pension fund explains, “Even if a particular manager or product has excellent performance, we have problems using it if the regulatory information is not provided in a timely manner.”

Socially Responsible Investing

Socially responsible investing is emerging as an important driver of institutional investing—in certain European countries. Ninety-seven percent of Dutch institutions say SRI is an important consideration when selecting an asset manager—up 12 percentage points in the past two years alone. That trend is also consistent in Norway. The pace of SRI adoption is even faster in France, where the share of institutions including SRI as an important criterion in manager selection jumped to 53% in 2018 from just 31% in 2016, and in Iberia, where it grew to 69% from 47%.

“Being able to find asset managers that meet our high standards related to [SRI] is a challenge, but the issue has a growing awareness within the asset management community, making it easier to find funds with the right profile,” says a representative of a Norwegian pension fund.

However, SRI is not gaining traction at a consistent rate across Europe. On the contrary, only about 30% of German institutions and a quarter of Swiss institutions say SRI plays an important role in their manager selection process—but most likely these markets will follow the lead from Northern Europe in the coming years.

Consultants Mark Buckley and Markus Ohlig advise on the investment management market in Continental Europe.

MethodologyDuring the first quarter of 2018, Greenwich Associates conducted in-depth interviews with 734 key decision-makers at the largest Continental European institutional investors. Institutions included Continental European corporate, public, and industry-wide defined-benefit, defined-contribution and hybrid pension funds, banks (including Sparkassen in Germany), foundations and churches, insurance and reinsurance companies, sovereign pension reserve funds, and other non-pension institutional investors including official institutions, central banks, monetary authorities, sovereign wealth funds, and supranationals.