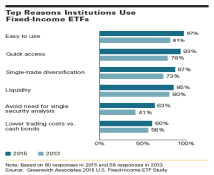

The structural issues in fixed-income markets are contributing to the proliferation of ETFs within institutional portfolios and with trading volumes in bond ETFs increasing rapidly while bond market liquidity recedes, demand for ETFs as a liquidity enhancement tool will likely remain strong.

Institutional demand for bond ETFs will also continue getting a lift from ongoing efforts to restructure portfolios in response to tough conditions in global fixed-income markets.

Over the past several years, institutions implementing such changes have found ETFs to be effective and versatile tools for both achieving strategic exposures and making quick tactical adjustments to their portfolios.

Methodology

RESEARCH GOALS AND METHODOLOGY

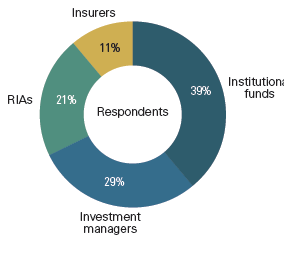

Between January and March 2015, Greenwich Associates interviewed 128 U.S.-based institutional investors about their use and perceptions of fixed-income exchange-traded funds. The respondent base included 37 investment managers (firms managing assets to specific investment strategies/guidelines), 27 registered investment advisers, 50 institutional funds (pensions, endowments and foundations), and 14 insurance companies. The sample population comprised 60 current active users of fixedincome ETFs and 68 non-users in order to determine current and future use of fixed-income ETFs by active users, as well as the current reasons non-users don't actively use fixed-income ETFs and their expected future interest.