Canadian institutions are at the forefront of a growing move by institutions around the world to integrate exchange-traded funds (ETFs) into their portfolios. The 52 institutions participating in the Greenwich Associates 2017 Canadian Exchange-Traded Funds Study allocate an average 18.8% of total assets to ETFs—the highest average allocation found in any of the five regional markets covered in our annual global research.

ETFs attracted new institutional users in Canada last year in both equities and fixed income, and growing numbers of institutions are using ETFs in both domestic and international markets.

Versatility is the primary driver of this proliferation. At the strategic level, Canadian institutions are increasingly using ETFs to obtain “core” investment exposures and diversification benefits. Use of ETFs increased last year in each of the 10 primary portfolio functions covered in the study. Study participants are using ETFs because they are easy to use, fast to execute, liquid, simple, relatively cheap to trade, and provide diversification in a single trade. These features make ETFs flexible enough to be applied to a fast-expanding list of portfolio applications.

The steadily expanding use of ETFs reflects institutions’ embrace of the funds as an effective source of beta exposures that they are using alongside—and at times in place of—derivatives. Canadian institutions are also using index ETFs to obtain exposures used to generate alpha at the asset-allocation level in actively managed strategies, in addition to other more permanent exposures.

Increasing demand for smart beta ETFs is providing a major lift to overall investment. Almost half (46%) of study participants invest in non-marketcap- weighted/smart beta ETFs, with demand last year focused largely on minimum-volatility ETFs, designed to protect investors from a spike in volatility like the one seen in February 2018.

Greenwich Associates projects a continuation of this growth trajectory. In equities, the share of current investors planning to increase ETF allocations tops that planning reductions by a ratio of 3:1. In fixed income, planned increases outpace planned cuts by nearly a 2:1 margin. In both cases, sizable shares of institutions expect to increase ETF allocations by more than 10%. In the meantime, new institutional investors will continue entering the ETF market in fixed income, commodities, real estate, and other asset classes.

Amid this steady growth, iShares/BlackRock remains the ETF provider of choice for Canadian institutions. Nine out of 10 institutions in the study use iShares/BlackRock as an ETF provider, and study participants name iShares/ BlackRock as the market’s best-in-class provider in 7 of the 9 product and service categories assessed by Greenwich Associates in this year’s research.

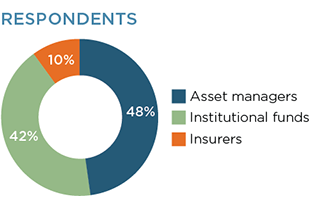

MethodologyBetween October 2017 and January 2018, Greenwich Associates interviewed 52 Canadian institutional investors for its 2017 Canadian Exchange-Traded Funds Study, the fifth edition of our annual research. The 2017 research sample includes a wide variety of institutional respondent types. More than half the participants (48%) are asset managers. The remainder of the research universe includes endowments, foundations, corporate defined-benefit plans, public pension funds, insurance companies and insurance asset managers, along with representation from family offices, investment consultants, and other segments.

Most study participants are large institutions. Approximately 45% of the institutions in the study have assets under management of $5 billion or more, and more than 1 in 5 have AUM topping $50 billion.