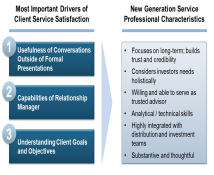

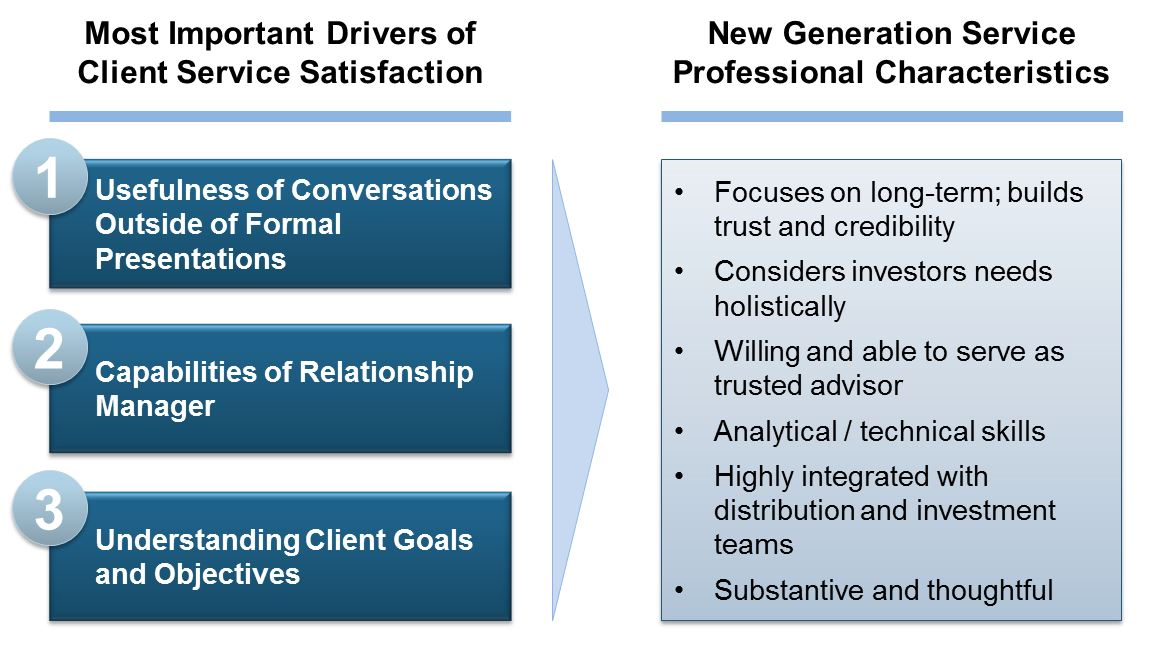

Institutional Investors expect more from asset managers and those who are most successful in distribution have adapted to meet these needs. Solving problems, rather than offering products requires a greater level of advice and counseling.

The Bottom Line:

- Investor needs are typically holistic, but the industry has focused on delivering relative performance across a limited set of traditional products

- In recent years, investors have struggled to meet their needs

- Over-reliance upon equity risk premium

- Focused on relative performance

- Low growth/low yield environment

- Over-reliance upon traditional single-strategy building-blocks leading to ineffective diversification

- Investors want superior outcomes

- They want to follow a strategic plan and better align policy to outcomes

- They want to see positive results in continued challenging market conditions

- They want to achieve better diversification across risk exposures

- They are willing to change how and where the invest

- Investors are looking to asset managers for assistance