Table of Contents

Investors are asking their asset managers to customize service offerings, and in many cases, managers are happy to oblige. Requests for customization create valuable opportunities for managers to differentiate themselves from rivals and deepen client relationships by providing service arrangements tailored to investors’ specific needs.

However, managers moving to take advantage of these opportunities are quickly discovering that customization has some major drawbacks. Namely: Providing customized service propositions to clients is expensive and creates a level of operational complexity that can sap organizations of efficiency.

Today, customization creep represents a real risk to asset management bottom lines. This report can help asset managers navigate this challenge by presenting a detailed breakdown of customization from the perspective of asset management clients. We examine how demand for customized service is evolving among investors around the world and pinpoint exactly what customized features and services they value most. Next, we analyze current satisfaction rates among investors to determine how well asset managers are doing at meeting client demands and where managers can find the best opportunities to differentiate themselves through customization.

Our goal is to help asset managers meet client needs at the lowest possible cost and maximize ROI on customization investments.

Quantifying demand for customization

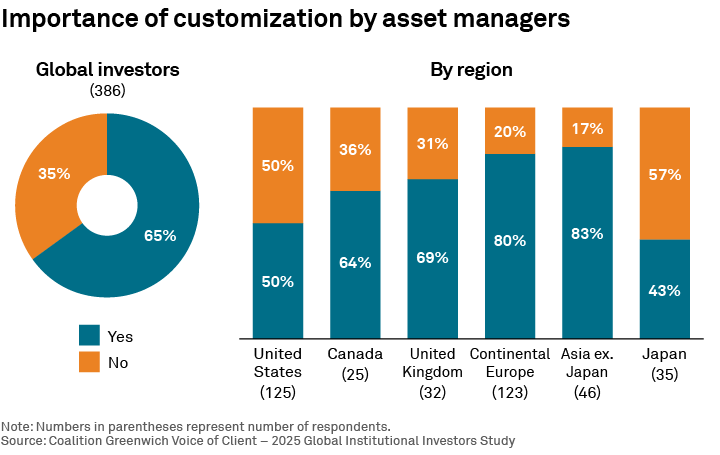

Roughly two-thirds of institutional investors around the world say customization is an important aspect of their relationships with asset managers. That share is highest in continental Europe and Asia, where the proportion of institutions rating customization as important tops 80%. It is lowest in the United States, at 50%, and in Japan, at 43%.

The importance of customization varies considerably among different types of institutions. For example, 9 out of 10 insurance companies view customization as an important element of their relationships with asset managers—a share that likely reflects their complex balance sheets and liability structures. At the other end of the spectrum, only slightly more than half of corporate pension funds say customization is important. As one might expect, larger funds are much more likely than smaller funds to prioritize customization.

Assessing the payoff for customization

Asset managers who take on the cost and complexity of customization can reap significant benefits. Globally, half of institutional investors say they award additional mandates to asset managers who provide customized products and service, including two-thirds of Asia-based institutions and three-quarters of institutional investors in Canada. Banks are especially likely to award extra mandates to managers who customize.

Approximately 40% of institutions—and more than half in continental Europe and Canada—say asset managers who provide bespoke or customized offerings are included in all RFPs. Managers who deliver on customization also have a better chance of getting access to senior decision-makers. Finally, some institutions are willing to pay additional fees for bespoke service, including a third of Canadian institutions and closer to 40% of institutions in the U.K. Around the world, the biggest institutions with the most purchasing power are the least likely to express a willingness to pay for customization.

Defining customization

When institutions talk about customization, what exactly do they mean? While there is no shortage of conversation about customization in the industry today, we believe there is far too little talk about precisely which services and products institutions want customized, and what that customization looks like in practical terms. To better define these terms, we asked institutions around the world to name the specific aspects of manager service and product offerings they want customized.

A service model featuring a single point of contact via a dedicated account manager is rated as an important or very important element of manager relationships by nearly 70% of respondents. Next are customized obligations in the investment agreement, such as notification of a change in fund manager. In third place are customized fees and rebates, followed by bespoke types of investment reporting and customized service level agreements (SLAs).

Institutional investors place an extremely high value on customization across the spectrum of obligations, servicing and self-service. Institutions in Asia and continental Europe place special emphasis on customization in investment agreements and SLAs. Globally, insurance companies and public pension funds assign the most value to customized investment agreements, SLAs and operational setup.

In the area of due diligence questionnaires (DDQs) and fees, institutions in continental Europe are especially interested in customized fees and rebates, and institutions in the U.K. assign the highest level of importance to DDQs that incorporate bespoke questions. Around the world, public pension funds place the most emphasis on customized fees and rebates.

Demand for customized reporting and portfolio analytics among U.S. institutions lags demand for bespoke features among institutions in other parts of the world. Insurance companies place the highest value on customization features across reporting and portfolio analytics.

Measuring institutional satisfaction with manager customization

Now that we’ve defined what it is that institutions want in terms of customization from managers, the next logical question is: Are they getting it? On an industry-wide basis, the answer appears to be yes. In a large majority of the service and product categories discussed in this report, upwards of three-quarters of institutions say they are satisfied or very satisfied with the level of customization they receive from managers.

However, there are nuances to those results that can help asset managers make important decisions about where to direct their investment dollars when it comes to building out customization capabilities.

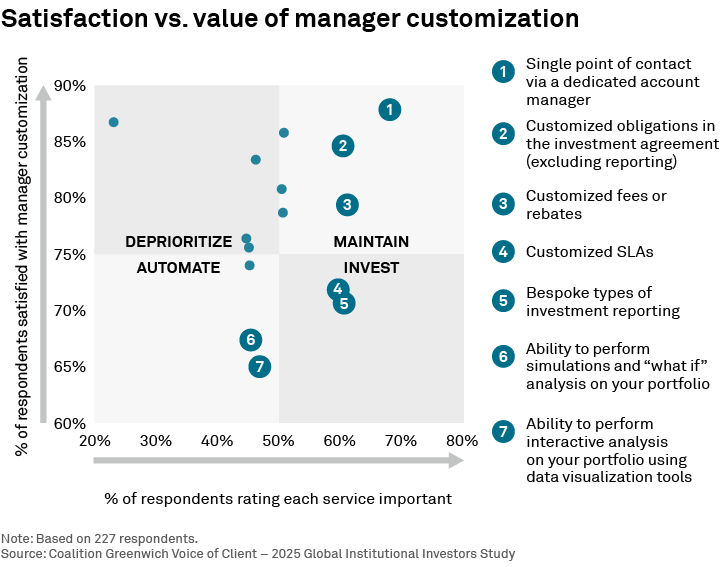

As illustrated in the preceding graphic, we asked study participants about 15 specific services areas to gauge their relative importance and institutions’ satisfaction with the level of customization they are currently receiving from their managers.

From the perspective of institutions, “Maintain” is the optimal range is in the upper right-hand quadrant. Items like a single point of contact and customized obligations in investment agreements rank high in both importance and satisfaction, meaning the customization feature is highly valued by the institution and well delivered by the institution’s managers.

Asset managers might be more interested in items that appear in and near the bottom-right “Invest” quadrant, which depicts customization features for which institutional demand is high, but a sizable share of institutions think managers are falling short in meeting their expectations. Based on the results presented in the chart, asset managers looking to pinpoint the areas in which they could generate the highest levels of ROI on customization-related investments should focus on bespoke investment reporting, interactive portfolio analytics, and customized SLAs.

At the other end of the spectrum, some offerings that might seem worthwhile probably won’t deliver much bang for the buck. For example, managers are doing a good job providing 24/7 support facilities, but institutions do not assign much value to that level of access and support.

A workable framework for customization

Managers face two main challenges when it comes to customization. First, the features most prized by institutions are often also the hardest and most expensive to deliver at scale. Second, the number and scope of customization requests from clients in aggregate have the potential to bog down manager operations, adding complexity, increasing costs and draining efficiency.

For those reasons, managers today must be prepared to push back and draw a hard line against customization initiatives that don’t make sense. Managers must acknowledge that clients will accept almost any additional service as part of their investment mandate, even if it doesn’t provide any real value. In the end, both managers and clients lose if resources are being misallocated to unnecessary services. To avoid that situation, managers need to take a wider perspective, get closer to clients to better understand specific needs, and—most importantly—dare to tell clients, “No.”

To assist managers in developing this type of workable strategy, we present the following customization framework designed to help managers make practical decisions about the costs and benefits of potential customization projects and start building an operational foundation capable of delivering cost-effective customization to clients at scale:

- Establish tiering standards. Clients should be tiered by specific needs, potential wallet or other metrics that matter to the manager, and the scope of services offered to each tier should reflect their relative importance. Critical to this element is the internal enforcement of standards, or in simpler terms, keeping salespeople honest.

- Offer a menu. Managers should develop a set of specific services in which they offer a distinct advantage over other competitors. These services, which must be reflective of the client’s tier, should be offered to new clients as part of the onboarding process.

- Set a cadence. Knowing that clients will likely oversubscribe to their tier-specific services, the manager should establish regular coaching touchpoints with the client to ensure that they are getting the most out of the overall services agreement.

- Trim the offering. The manager’s ultimate goal should be to improve the clients’ overall level of satisfaction while reducing the number of specific services required, giving clients exactly what they need and saving the manager unnecessary costs.

- Invest in technology. Despite the upfront investment, client service technologies such as client portals, APIs and, most pressingly, artificial intelligence, enable managers to deliver and customize service at scale. Leveraging a flexible, user-friendly data platform driven by AI will empower clients to self-serve, permit more transparent, secure transfer of information between clients and managers, and facilitate the provision of customized service, reporting and analytics to clients around the world.

Christopher Dunn, Head of Investment Management—Europe, and Marlie Vredenburgh, Senior Relationship Manager, advise our investment management clients in Europe and North America.