Table of Contents

In a year of surging capital market inflows and soaring equity market valuations, the biggest challenge for many asset managers was getting their funds to stand out in a crowded field of products on retail distribution platforms. In both Europe and Asia, fund distributors say Allianz Global Investors rose to that challenge best, earning the firm the title of 2021 Greenwich Quality Leader in Intermediary Distribution.

One of the main ways asset managers attempt to set themselves and their funds apart from rivals is by delivering high-quality service to fund distribution platforms and their retail clients. However, the COVID-19 crisis has disrupted asset management client service models. Almost overnight, in-person meetings have been replaced by Zoom sales presentations and virtual due diligence. Digital reporting and communications shifted from nice-to-have features to strategic imperatives.

In this environment, it’s hardly a surprise that some asset managers saw client service ratings dip during the crisis. A sizable number of asset managers in Europe and Asia saw ratings from fund distributors slip in core elements of service, such as timeliness of written reports, availability and responsiveness, and relationship manager quality. In these challenging conditions, only a handful of fund providers managed to improve their overall quality scores, with Allianz Global Investors topping the list.

The firm increased its quality scores over the past year by going above and beyond to support fund distributors and their retail clients in an environment that remained operationally challenging. In Asia, Allianz was seen as one of the best to transition to effective digital delivery, reporting and communications. In Europe, fund distributors elevated the firm’s quality scores in all investments, service and relationship management key success factors tracked by Coalition Greenwich.

Capturing Retail Interest with Thematic Funds

In both Asia and Europe, asset managers last year succeeded in capturing the attention and assets of retail investors on fund platforms in part by offering specialty products outside traditional fund categories like global equities or European or Asian fixed income. The fund-platform gatekeepers participating in the Coalition Greenwich 2021 Global Intermediary Distribution Study say demand on their platforms for “thematic” investment funds increased sharply from 2020 to 2021.

“With equity markets outperforming, retail risk appetite has been growing, which translated into increased demand for anything seen as having the potential to outperform standard products,” says Coalition Greenwich consultant Parijat Banerjee. “That includes everything from healthcare or tech-focused funds to green bonds in China.”

Fund distributors in Asia and Europe say growing demand for thematic funds is making platform offerings more diverse. As a result, gatekeepers are paying much more attention to managers’ ability and willingness to provide funds that actually meet these emerging needs of the investors on their platforms. “Distributors want managers who take the time to understand the platform’s client base,” says Coalition Greenwich consultant Mark Buckley. “That includes both delivering appropriate products and providing communications and marketing materials that effectively explain their products to the end investors.”

Getting the Basics of Digital Right

Distributors are also showing a strong preference for asset managers who have invested the time and resources required to provide strong digital services and support. Some of that concern for digital, of course, has been accelerated by the COVID-19 crisis and restrictions on in-person interactions. But long-term trends are also at play. Distributors are working to take advantage of cost savings from the digitization of back-office functions, and to meet the demands of increasingly tech-savvy end investors with quicker turnaround times.

In Europe and Asia, the asset managers benefiting most are firms whose digital strategies emphasize the basics. Distributors in both regions rank basic capabilities like providing market updates/analysis and delivering standard fund updates and reporting as top digital priorities. “While managers may continue to work on rollouts of mobile interfaces and AI-driven robo-advisory tools, they should prioritize simple portals and interfaces that make it easy for distributors and investors to connect and get the information they need,” says Mark Buckley.

ESG: Prerequisite for Platform Placement

Asset managers who are still debating the pros and cons of environmental, social and governance investing should be aware that a commitment to ESG might soon be required to maintain a position on fund distribution platforms.

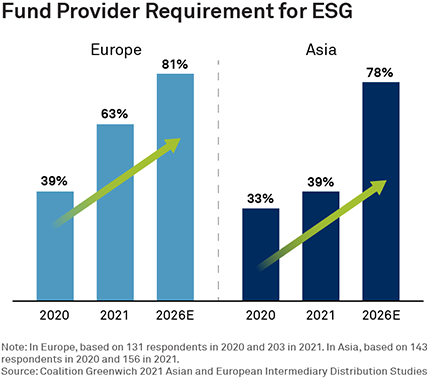

Sixty-three percent of fund distributors in Europe and 39% in Asia say they require all managers on their platforms to have a clearly articulated ESG policy and offer ESG-compliant funds. In both regions, approximately 80% of fund distributors expect to have such a requirement in place in 5 years’ time.

“Distributors are leaving no room for ambiguity: Asset managers who fail to integrate ESG will not be allowed on their platforms,” says Parijat Banerjee.

Europe: Amid Surging Flows, Distributors Seek Visibility into Fund Providers

Gatekeepers for European fund platforms are tightening their focus on manager transparency and stability. Every year, Coalition Greenwich asks platform gatekeepers to rank the criteria they use in assessing funds and managers. From 2020 to 2021, two factors rose significantly in terms of importance: information transparency and stability of the investment team. “After the volatility of the COVID-19 crisis, fund distributors are working to ensure they have full visibility into the investment and operational processes of their fund providers’ managers, and that those asset managers have the continuity of staffing required to deliver consistent results,” says Mark Buckley.

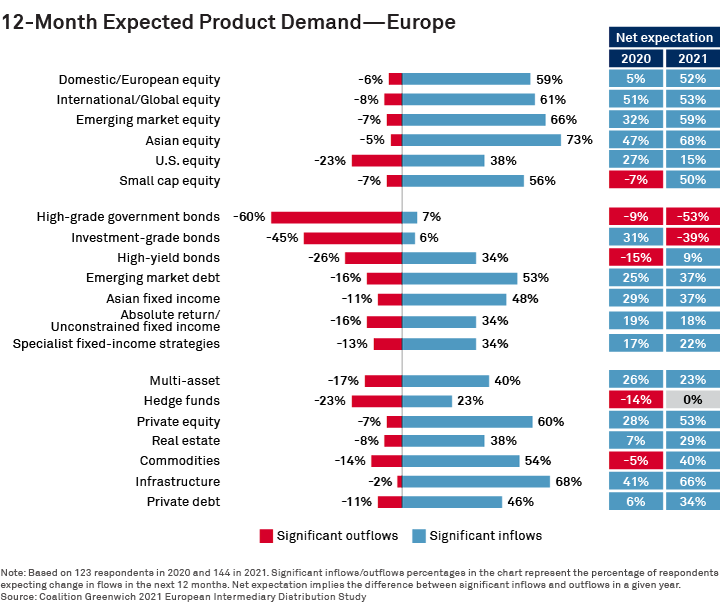

Looking ahead to 2022, European fund distributors expect to see significant retail inflows across virtually all asset classes. In equities, distributors expect inflows to remain strong in almost every category. Expectations are similar for alternatives and private assets, where demand is expected to be strongest for infrastructure and private equity.

The story is much the same in fixed income—or at least in certain fixed-income categories. For example, distributors are expecting strong inflows for emerging markets and Asian debt, and positive inflows in other products with the potential to deliver relatively attractive yields. At the opposite end of the spectrum, distributors expect retail investors to continue reducing exposure to government bonds and investment-grade debt.

Asia: Distributors Expect More “Risk On” from Retail

Asian fund distributors expect investors on their platforms to remain bullish in the year ahead. “Distributors think retail will remain in risk-on mode,” says Parijat Banerjee.

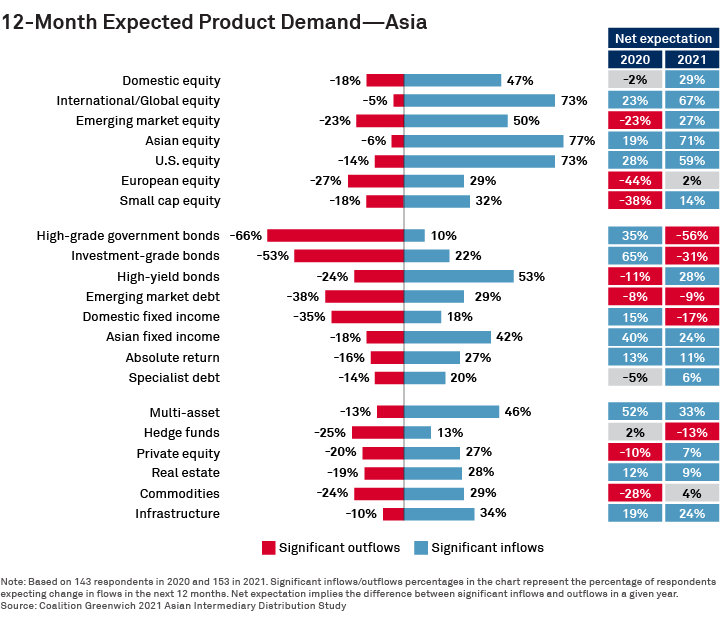

Distributors are projecting strong retail inflows into every equity category, save European equities, with the strongest demand expected for Asian, international/global and U.S. equities. Distributors expect to see increased inflows into alternative categories like infrastructure, and to a lesser extent private equity and real estate. Flows into multi-asset funds are projected to remain robust.

Given the global economic and interest-rate environment in the second half of 2021, it’s no surprise that fixed income is more of a mixed bag. While things could be different if central banks start increasing interest rates, distributors are projecting significant outflows from both government bonds and investment-grade credit—a reversal from last year’s expectations. Meanwhile, distributors think retail demand will remain strong for high-yield bonds and Asian fixed income.

Consultants Mark Buckley, Sophie Emler, Parijat Banerjee, and Arifur Rahman advise investment management clients in Europe and Asia.

MethodologyBetween March and May 2021, Coalition Greenwich conducted 161 interviews with some of the largest fund distributors in Asia and with 217 fund distributors in Europe between February and June 2021. Senior gatekeepers were asked to provide detailed information on their business priorities, quantitative and qualitative evaluations of their investment managers, and qualitative assessments of those managers soliciting their business. Countries and regions where interviews were conducted in Asia include Hong Kong, Macau, Singapore, South Korea, Taiwan, Malaysia, and Thailand. In Europe, interviews were conducted in Austria, Benelux, France, Germany, Greece, Iberia, Ireland, Italy, Monaco, Nordics, Switzerland, and the United Kingdom.