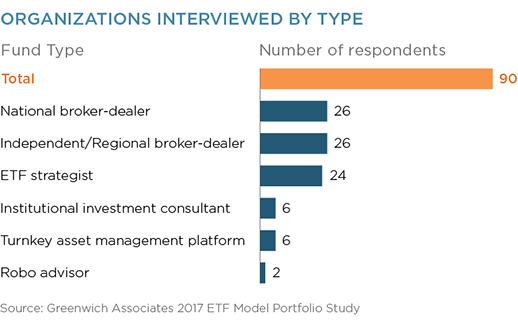

As the number of exchange-traded funds (ETF) model portfolios grows, broker-dealers, fund platforms and other distributors of these vehicles face an increasingly complex task in selecting the right portfolios and providers. To gain a better understanding of what the investment community is looking for from their ETF model portfolios and providers, Greenwich Associates conducted a study of 90 users of these vehicles, including more than 50 national and independent and regional brokerdealers and 24 ETF strategists, as well as representatives from the ranks of investment consultants, turnkey asset management platforms and robo advisors. The results of this study are incorporated into a comprehensive framework for users of ETF model portfolios to follow when conducting due diligence on the expanding array of these products.

By the end of 2016, investors poured at least $84 billion into ETF model portfolios, according to Morningstar.* Assets under management in ETF model portfolios covered in the Morningstar universe increased 19% in 2016. The rapid proliferation of portfolios and the entrance of new providers into the space is a clear sign that ETF model portfolios will remain on a growth trajectory. The number of options available to investors has expanded rapidly, as the ETF strategists that pioneered these vehicles have been joined by many large asset managers and ETF providers. Investment in ETF model portfolios could increase even more dramatically should long-discussed fiduciary standards be implemented— changing the economics of the brokerage industry.

Finding and selecting the right ETF model portfolios in an increasingly crowded market is very challenging. Assessing traditional due diligence metrics of investment process, performance and price to weed out underperformers and identify top prospects is not enough. To find the provider best positioned to fill the role of a long-term partner, investors need to conduct more thorough evaluations. A comprehensive due diligence process should incorporate a range of qualitative, value-added factors that enable buyers of ETF model portfolios to truly differentiate one provider from another and select the best partner to help achieve their goals.

*Source: Morningstar ETF Managed Portfolios Landscape Report, Q4 2016

MethodologyBetween November 2016 and March 2017, Greenwich Associates conducted a study examining the ETF model portfolio space. Interviews were held with 90 key industry stakeholders including ETF strategists, investment consultants, national and regional broker-dealers, robo advisors, and turnkey asset management programs (TAMP). Questions explored the dynamics driving growth in the segment and what methods of evaluation both advisors and investors currently leverage when selecting model portfolio strategies and providers.