Powerful market dynamics including quantitative easing by the ECB, increased market volatility and diminished liquidity in fixed income are causing European institutions to increase their use of exchange-traded funds (ETFs). The results of the Greenwich Associates 2016 European Exchange-Traded Funds Study show that institutional investors are turning to ETFs for liquidity, ease of use and fast access to exposures.

Institutions are taking full advantage of that versatility in equities, where ETFs now account for about a quarter of total assets among the 86% of study participants currently investing in the funds. Institutions’ integration of bond ETFs is more of a work in progress. Nearly half the ETF users in the Greenwich Associates study use bond ETFs, but invest only 8% of total assets to the funds. Approximately 1 in 4 of these investors have been using the funds for less than two years, and 17% of users started investing in bond ETFs in the past 12 months.

Across asset classes, institutions are using ETFs for a diverse set of applications, ranging from high-level strategic functions like obtaining core exposures and achieving portfolio diversification, to making tactical portfolio adjustments and executing short-term tasks. ETFs are poised for further growth, with approximately a third of current equity ETF users planning to increase allocations to these funds in the year ahead, and 27% of bond ETFs users planning to do so. Among institutions in the study not currently investing in equity ETFs, nearly a quarter say they are at least somewhat likely to consider investing in the funds in 2017. Meanwhile, slightly more than 1 in 10 non-users of bond ETFs express similar plans.

Four major trends are contributing to this growth trajectory:

- One-third of the institutions in the study say they are using ETFs to complement or replace other investment vehicles—a share that climbed from 29% in 2015. Institutions currently use a variety of derivatives to access beta, such as futures, swaps, and options. Half of ETF users plan to replace an existing equity futures position with ETFs in the coming year, and 40% say they will evaluate futures positions for potential replacement.

- Growing proportions of institutions are using ETFs to manage risk. These increases likely reflect institutions’ need for tools to help manage increased volatility associated with Brexit, as well as other structural changes and market events. ETFs are viewed as effective for managing liquidity, inflation, or concentration risk.

- European institutions experiencing liquidity shortages in fixed income are turning to ETFs for relief. The liquidity, speed and ease of use of bond ETFs could attract additional investors in 2017, as the European banks that institutions rely on for liquidity struggle to meet new capital requirements.

- European institutions seeking new sources of returns and predictability in uncertain markets are triggering demand for innovative ETF products. Approximately a quarter of institutional ETF investors are now using non-market-cap weighted/smart beta ETFs, up from 21% expecting to do so in 2015. Three-quarters of these users plan to increase allocations to these funds in the next year.

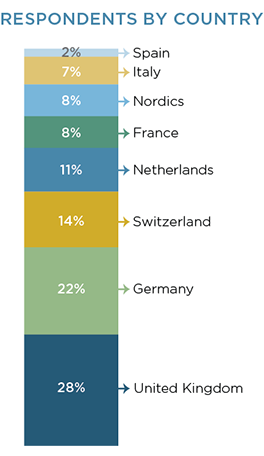

Between October and December 2016, Greenwich Associates interviewed 132 institutional investors for its 2016 European Exchange-Traded Funds (ETF) Study, including 65 institutional funds, 48 asset managers and 19 insurance companies/insurance company asset managers. Corporate pension funds and asset management firms are the most widely represented, followed by insurance companies and public pension funds.

Most of the participants are large institutions. Fifty-five percent of the institutions in the study have assets under management (AUM) of more than $5 billion, one-third manage more than $20 billion, and 1 in 5 have AUM in excess of $50 billion. Respondents also represent a wide range of countries, including France, Germany, Italy, the Netherlands, Nordics, Spain, Switzerland, and the United Kingdom.