U.S. institutional investors are the global leaders when it comes to exchange-traded fund (ETF) investing.

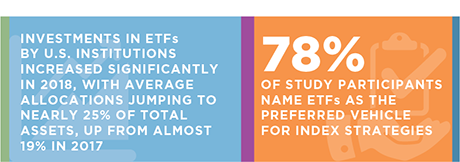

Institutional investments in ETFs increased significantly in the United States in 2018. Average allocations by institutions currently investing in ETFs jumped to 24.8% of total assets, up from 18.5% in 2017, among the 181 institutional investors participating in the Greenwich Associates 2018 U.S. Exchange-Traded Funds Study. This percentage tops allocations among institutions in Canada, Europe and Asia.

Last year’s growth was driven in large part by three powerful trends affecting institutional portfolios and portfolio construction:

- Turbulence Drives Demand: A confluence of events ranging from interest-rate hikes and fears of recession, to trade wars and Brexit had institutions laser-focused on risk management in 2018. As they repositioned their portfolios to address these risks, many U.S. institutions used ETFs to implement specific changes. Study participants say they chose ETFs for an ease of use that allowed them to quickly and seamlessly integrate new exposures into strategies across portfolios and asset classes, and to take advantage of other characteristics such as speed of execution, single-trade diversification and liquidity.

- The Index Revolution Proceeds: U.S. institutions continued shifting assets from active management to index strategies, and 78% of study participants name ETFs as their preferred vehicle for index exposures. As ETFs displace other investment vehicles in institutional portfolios, active mutual funds are by far the most common vehicles being replaced. This transition should fuel additional demand for ETFs as institutions continue shifting assets to index strategies.

- Proliferation Across Portfolios: Institutional investors continue expanding the list of portfolio functions in which they are applying ETFs. The spread of ETFs is being fueled in large part by versatility that allows them to serve a broad range of strategic and tactical purposes, and by their role as institutions’ preferred vehicle for factor-based and other specialized exposures.

Although it’s unclear if ETFs can sustain last year’s rapid pace of expansion, we expect use and investment to continue to grow in 2019, as 40% of current equity ETF investors and 42% of existing bond ETF investors plan to increase ETF allocations in the coming year, according to our study participants.

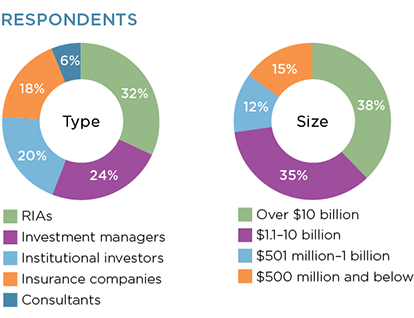

MethodologyBetween October and December 2018, Greenwich Associates interviewed 181 institutional investors for its ninth annual edition of the U.S. Exchange-Traded Funds Study. The research universe included 44 investment managers, 37 institutional funds, 33 insurance companies/insurance company asset managers, 56 registered investment advisors (RIAs), 11 investment consultants, as well as representation from family offices and other types of institutional investors. Most of the participants are large institutions.

Almost 40% of the institutions in the study have assets under management (AUM) totaling more than $10 billion, and nearly half manage in excess of $5 billion. The research universe included 120 portfolio managers/chief investment officers, 49 research analysts, six traders, and representation from buy-side sales, marketing, product development, and compliance departments.