Executive Summary

The primary drivers of growth in exchange-traded fund (ETF) investment in Asian institutional portfolios last year reflect the flexibility and versatility of ETFs as investment vehicles. The institutional ETF investors participating in the Greenwich Associates 2017 Asian ETF Study allocate an average 14% of total assets to ETFs. (The median allocation is 5%). These institutions are applying ETFs to an expanding list of portfolio functions, both strategic and tactical. ETFs are also attracting new institutional users, who are joining existing investors in using the funds to obtain a growing variety of investment exposures, including:

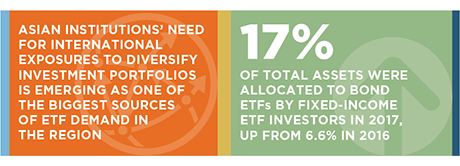

- International Exposures: Among study participants, 54% are usingETFs for international diversification, up sharply from about one-third in 2016.

- Fixed-Income Exposures: Among institutions that invest in the funds, ETFs now make up 17.1% of fixed-income assets, up from just 6.6% in 2016. This growth occurred at the expense of individual bonds, which made up 58.6% of fixed-income assets in 2016 but only about 50% in 2017.

- Multi-Asset Exposures: Over the last three years, study participants have tripled their use of ETFs in multi-asset funds. The median allocation has grown from just 5% in 2015 to 15% in 2017.

Across the board, Asian institutions are integrating ETFs into their portfolios as a standard tool for obtaining beta exposures in their allocations in both active and passive strategies. This steady expansion into new applications is stoking demand. In both equities and fixed income, 45% of study participants currently investing in ETFs expect to increase allocations to the funds in the coming year. Meanwhile, fully one-quarter of all ETF non-users say they are likely to start investing in the funds in the next 12 months.

With market volatility on the upswing and interest rates in key markets around the world expected to climb, Greenwich Associates expects this growth in ETF use and allocation to continue over a longer-term horizon.

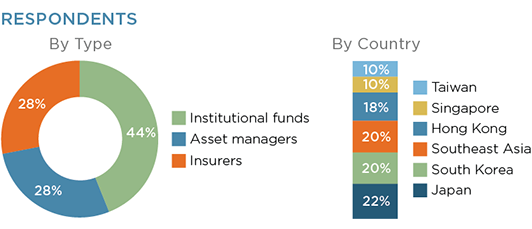

MethodologyBetween October 2017 and January 2018, Greenwich Associates interviewed 50 Asian institutional investors for its 2017 Asian Exchange-Traded Funds Study—the third edition of our benchmark annual research program. At one-third of the research sample, insurance companies make up the largest proportion of study participants, followed by asset managers, public defined-benefit plans, and endowments and foundations.

Most of the participants are large institutions. Roughly half the institutions in the study have AUM of $5 billion or more (up from 42% in 2016), and about a quarter manage more than $20 billion. Relative to institutions in other parts of the world, these investors manage sizable shares of their assets in-house. Across all Asian institutions in the study, nearly 60% of assets are managed internally.