European institutional investors are adjusting their portfolios to a set of fast-changing conditions that include the return of volatility to global capital markets, the impending end of European Central Bank bond buying and the looming shift to a rising-rate environment. As they do so, institutions are integrating exchange-traded funds (ETFs) more deeply into their investment processes and strategies.

Average ETF allocations among the institutions participating in Greenwich Associates annual European Exchange-Traded Funds Study increased to 10.3 % of total assets in 2017 from just 7.7% in 2016. This growth reflects the continuing adoption of ETFs into institutional portfolios as a standard means of obtaining beta exposures and the introduction of ETFs to a long list of portfolio functions, both strategic and tactical. ETFs are spreading into asset classes outside equities and fixed income. For example, one-third of study participants in 2017 are investing in commodity ETFs, up from 20% the prior year.

Two additional trends are boosting institutional demand for ETFs in Europe:

- Investments in non-market-cap weighted/smart beta ETFs are growing steadily in institutional portfolios. The share of study participants investing in these funds has increased 10 percentage points in just two years, to 31%. Half the asset managers participating in the 2017 study are using these products. Given the increasing popularity of factor investing worldwide, demand for smart beta ETFs is expected to continue growing in both retail and institutional portfolios.

- Multi-asset investment funds have emerged as one of the most consistent and fast-growing sources of ETF demand in the institutional channel. As investor appetite for these strategies grows, the share of European asset managers buying ETFs for use in multiasset funds increased to approximately 80% in 2017 from 63% in 2016. Even with this strong momentum there is room for growth, since European asset managers running multi-asset funds allocate far fewer portfolio assets to ETFs than do their counterparts in the United States.

Given these powerful trends, ETFs will likely remain on a growth trajectory through the coming year. Approximately 40% of study participants currently investing in equity ETFs plan to increase ETF allocations in that asset class in the next 12 months, as do a quarter of current fixed-income ETF investors. More broadly, Greenwich Associates projects that total global institutional investment in ETFs will see U.S.$300 billion in flows annually by 2020.

Amid this steady growth, iShares/BlackRock has maintained its position as European institutions’ ETF provider of choice. iShares/BlackRock is used as an ETF provider by 9 out of 10 study participants and is considered by these institutions as the “best-in-class” provider in all nine of the product and service categories assessed in the study.

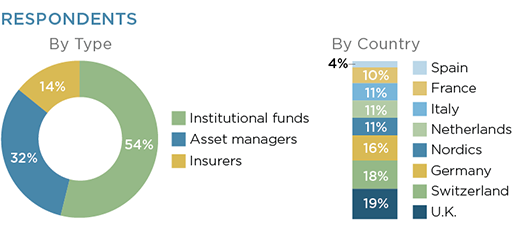

MethodologyBetween October and December 2017, Greenwich Associates interviewed 125 institutional investors for its fourth annual edition of the European Exchange-Traded Funds (ETF) Study. The research universe included 68 institutional funds, 40 asset managers and 17 insurance companies/insurance company asset managers. Corporate pension funds and asset management firms are the most widely represented, followed by insurance companies and public pension funds.

Most of the participants are large institutions. Sixty-four percent of the institutions in the study have assets under management (AUM) of more than $5 billion, up from 55% in 2016 and 50% in 2015. Among the participants in this year’s study, 39% manage more than $20 billion, and 26% have AUM in excess of $50 billion. Institutions in the study manage approximately half of assets internally, on average. Respondents also represent a wide range of countries, including France, Germany, Italy, the Netherlands, Nordics, Spain, Switzerland, and the United Kingdom.