Exchange-traded funds are becoming standard investment tools for insurance companies, but for the moment, life insurers and property and casualty (P&C) companies are employing ETFs in different ways and for different purposes. Approximately 70% of U.S. insurance companies now invest in ETFs in their general accounts. Multiline and P&C companies are the biggest users, with 90% and 80% of study participants investing respectively, compared with 47% of life companies.

Life insurance companies are adopting ETFs first and foremost as a means to address short-term liquidity and cash management in fixed-income portfolios. Meanwhile, P&C companies are using ETFs mainly to obtain longer-term strategic investment exposures in equity portfolios. These varied applications show that ETFs are proliferating in insurance company general accounts due in large part to their versatility as investment vehicles.

This growth should continue in 2019 and beyond. About 40% of current insurance company ETF investors expect to increase ETF allocations in the next three years, with not a single study participant reporting plans to cut allocations over that period. Three-quarters of ETF non-users in the study say they expect their organizations to consider using ETFs at some point in the future. Those decisions will be influenced by insurance companies’ building demand for new approaches like factor-based strategies, which institutional investors access mainly through ETFs.

Regulations and accounting rules are the biggest impediments to insurance company ETF investment and will play a big role in determining the pace of growth in the future. Already, a decision by the NAIC to allow insurers to use a “systematic value” accounting methodology has created new demand for fixed-income ETFs. As state and federal regulators become more familiar with the ETF structure and track record, Greenwich Associates expects an increasingly friendly regulatory environment to attract new insurance companies to ETFs and to open the door for larger allocations among current investors.

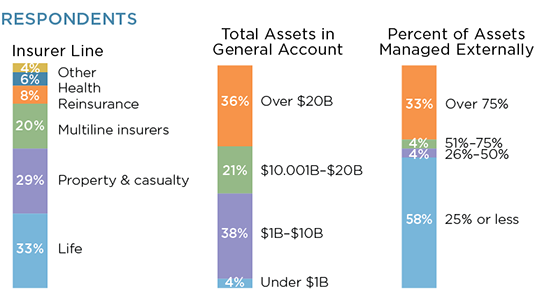

MethodologyBetween January and March 2019, Greenwich Associates interviewed 51 professionals from across a variety of insurer lines and sizes for a study on ETF investment in the insurance industry, sponsored by Invesco. Thirty-three percent of study participants represented life insurance companies, 29% represented P&C insurers, 20% of were from multiline insurers, and the sample included representation from reinsurance, health insurance and other insurer lines.

Most companies in the study are large insurers, with 57% having more than $10 billion in general account assets, including 36% with more than $20 billion. More than three-quarters of the life companies have more than $10 billion in general account assets.

Most study participants manage a majority of their assets in-house. However, a sizable minority of one-third allocate more than three-quarters of general account assets to external investment managers.