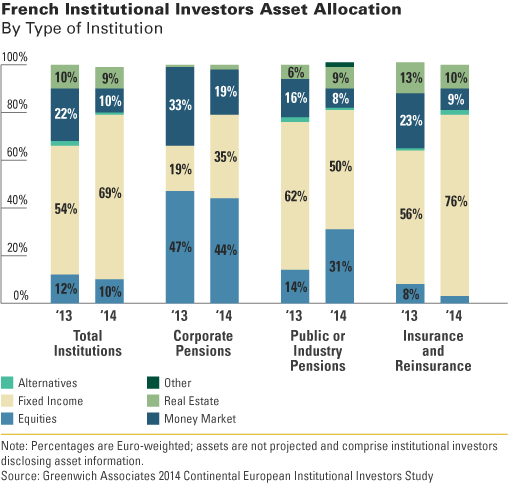

Results from the Continental European Institutional Investors Study revealed that investors increased their allocations to fixed income, while decreasing their money market allocations.

Other Findings to Help Support Your Business Strategy:

- Corporate pensions increased exposure to fixed income (13: 19%, 14: 35%), while insurance and reinsurance funds increased fixed-income allocation to 76%. This strategic decision follows the actions of Continental European corporates as they search for higher returns with riskier investing.

- Public/Industry pensions more than doubled their allocation to equities, while slashing money market and fixed-income investments.

- French investors identified regulatory pressure, funding position and liability profile as the key decision-maker for allocation changes. Key influencers also include liquidity, asset return expectations and market volatility.

- With regard to portfolio risk, one French investor stated, “There has been no change over the last 12 months. We anticipate a slight decrease in risk over the next 12 months. It will be achieved through a portfolio diversification that will incorporate new asset classes, such as private equity and global bonds.”