Table of Contents

In their ongoing search for yield, German institutional investors are trimming allocations across fixed income and shifting funds to real assets and certain equity products. As they increase their exposure to these specialty classes, institutions are boosting the share of portfolio assets they outsource, creating new opportunities for asset managers.

The 2018 Greenwich Quality Leaders℠ in Overall German Institutional Investment Management Quality, Allianz Global Investors and PIMCO, are well positioned to benefit from these shifts. These managers—which also took home the title of 2018 Greenwich Quality Leaders for Continental Europe as a whole—combine proficiency in specialty asset classes with world-class investment and client-service platforms, allowing them to help institutional investors form and implement these important changes to their strategies and portfolios.

Over the next three years, the German institutions participating in the Greenwich Associates 2018 Continental European Institutional Investors Study expect to decrease (on net) allocations to every fixed-income category in their portfolios, except emerging markets debt. Twelve percent of the institutions are planning significant reductions to European government bond allocations (versus only 3% planning growth). Seven percent are planning to make major cuts to domestic government bonds (versus only 1% planning increases). Even in emerging markets debt—which is seen by many institutions around the world as one of the few areas of fixed income that can provide real opportunities for investment alpha—net expectations for allocations among German institutions have dropped from +12% to just +3%.

Many of these freed-up funds will flow into real assets. For example, 22% of institutions plan to significantly boost allocations to real estate (with 3% planning reductions), and 15% are planning major increases to infrastructure (versus 2% reductions). Demand will also be strong for both private equity and private debt.

Implementing these shifts is fueling a spike in the amount of assets German institutions outsource to external managers. As recently as 2016, German corporate pension funds outsourced only 30% of portfolio assets. In 2018, that share hit 72%. Although the trend is less dramatic among other institution types, the movement is all in the same direction.

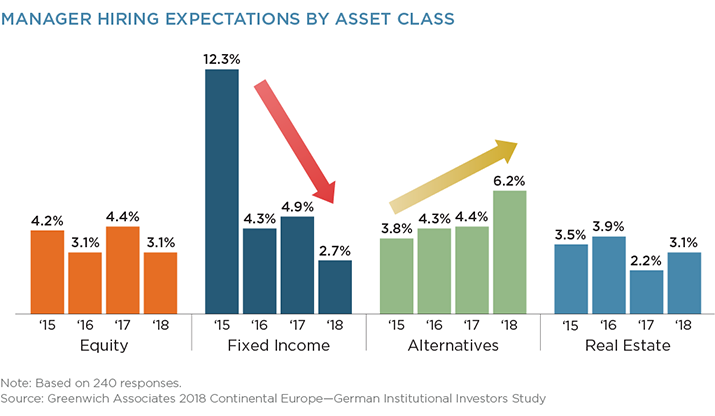

The growth in externally managed assets is obviously good news for the investment management industry. However, the shift won’t benefit all managers. To the contrary, demand for core fixed-income managers is collapsing. The share of institutions with plans to hire a fixed-income manager in the next 12 months has plunged from 12% in 2015 to less than 3% today. Meanwhile, in alternatives, hiring expectations have surged over that period, while jumping sharply in the past 12 months in real estate.

German Institutions Lagging in SRI

When it comes to the role of socially responsible investing (SRI) in the institutional market, Germany is becoming something of an outlier in Europe. The share of German institutions including SRI as an important consideration in their manager selection process stands at 32%. That share is among the smallest in Europe. Switzerland is the only European country with a smaller share, at 24%. By contrast, 97% of investors in the Netherlands and Finland include SRI as a key criterion when selecting a manager, as do approximately 64% of institutions in Sweden and 53% of institutions in the U.K. and France.

“As a population, Germans are right in step with other Europeans in terms of their commitment and even passion for environmental and social issues,” says Greenwich Associates Managing Director Markus Ohlig. “But at the moment, it seems there is some disconnect between those cultural attitudes and the governance of large institutions.”

Quant Strategies Proliferating

Across Europe, institutional investors are adding quantitative strategies to their portfolios. Based on “factors” like value and momentum, which are academically proven to generate excess returns that can be harvested over time, quantitative strategies are being implemented primarily alongside purely passive strategies in asset classes deemed too efficient to provide opportunities for consistent outperformance by fundamental active managers. For example, about a quarter of European institutions are using quantitative strategies in European equities, while roughly 1 in 5 are applying them in global equities. Among German institutions, 10% are employing a quantitative approach in domestic equities.

Consultants Mark Buckley and Markus Ohlig advise on the investment management market in Continental Europe.

MethodologyDuring the first quarter of 2018, Greenwich Associates conducted in-depth interviews with 240 key decision-makers at the largest German institutional investors. Institutions included German corporate, public, and industry-wide defined-benefit, defined-contribution and hybrid pension funds, banks, Sparkassen, foundations and churches, insurance and reinsurance companies, sovereign pension reserve funds, and other non-pension institutional investors including official institutions, central banks, monetary authorities, sovereign wealth funds, and supranationals.