Table of Contents

German institutional investors are increasingly coming to terms with the fact that they cannot meet investment return targets with their traditional fixed income-dominated portfolios. After waiting for years for interest rates to rise, more institutions are accepting that rates will be "lower for longer" and are moving to adjust their portfolio allocations in response. As investors start diversifying toward products and asset classes with the potential to deliver higher returns, they are hitting a major stumbling block: risk management.

While German institutions have ample experience and expertise in managing relatively straightforward allocations into a limited number of "plain vanilla" asset classes such as European government bonds, investment grade corporate credit and European equities, most lack experience investing in new asset classes ranging from global credit and high-yield debt to infrastructure and emerging market equities.

As institutions wake up to the fact that their internal resources and capabilities fall short of what they need to successfully diversify and globalize their portfolios, they are turning to asset managers for advice and support. Customization and knowledge transfer are becoming increasingly important criteria for institutions selecting managers, who are being asked to provide value-added insight outside the bounds of core, traditional investment mandates and investors’ experience. (Despite German institutions’ increasing appetite for advice, usage rates for investment consultants remain among the world’s lowest.)

A handful of asset managers have seized this opportunity. These firms are working with their institutional clients to integrate specialist asset classes into their portfolios. Institutions also place a high value on the assistance these managers can provide in the areas of risk management and overall portfolio construction.

Greenwich Quality Leaders

To date, only a small number of asset management firms have been able to use these advisory services to truly differentiate their value propositions from the rest of the marketplace. At the top of that list is Allianz Global Investors, whose success in this effort has helped it achieve the title of 2016 Greenwich Quality Leader in German Institutional Investment Management.

From January to April 2016, Greenwich Associates conducted in-depth interviews with 267 professionals at the largest institutional funds in Germany. Study participants were asked to name the asset managers they employ and to rate the quality of those managers in a series of investment and service categories. Greenwich Quality Leaders are firms that receive client ratings topping those of competitors by a statistically significant margin.

Diversifying Portfolios

Many German institutional investors have taken the first small steps toward diversifying their portfolios by adding specialist strategies. Assets in multi-asset strategies now make up 5% of total assets for public pensions and 2% for corporates. Six percent of public and industry pension fund fixed-income assets are now allocated to high yield, up from 3% over the last two years, while insurance assets in international/global bonds have increased from 4% to 10% of total assets in the same period.

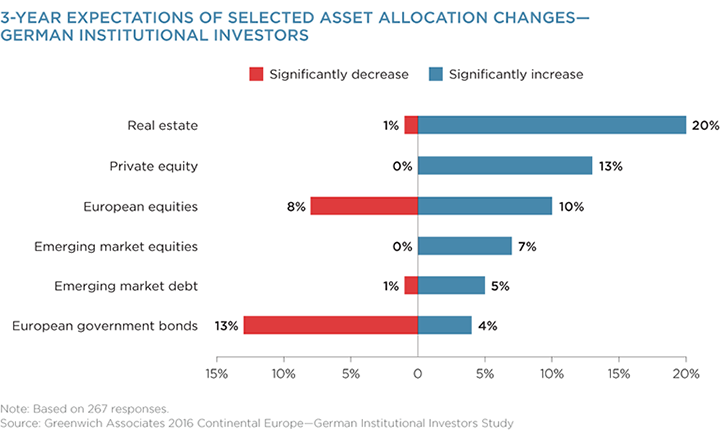

In addition to the changes to date, German institutions of all types are signaling their intention to go farther. Thirteen percent of institutions in the study say they plan to significantly decrease target allocations to European government bonds in the next three years. Meanwhile, 1 in 5 institutions plans to significantly expand allocations to real estate in that time period, and more than 10% each plan to make significant increases to infrastructure, private equity, and high-yield bonds.

Consultants Mark Buckley and Markus Ohlig advise on the investment management market in Continental Europe.

MethodologyBetween January and April 2016, Greenwich Associates conducted in-depth interviews with 267 professionals at the largest institutional funds in Germany. Institutions included corporate pension funds, public pension funds, banks, Sparkassan, foundations, churches, and insurance companies. Interview participants were asked about their investment service providers, their business practices and their future expectations.