Table of Contents

German institutional investors face the same challenges as those affecting their peers throughout Europe—but more extreme. The 2019 Greenwich Quality Leaders℠ in German Institutional Investment Management are succeeding in this tough environment by helping clients make difficult adjustments to investment portfolios and strategies.

The extended period of historically low and even negative interest rates continues to place European institutions under considerable pressure, as they struggle to hit the return targets they need to achieve in order to fund their liabilities. This situation is exacerbated in Germany by institutional portfolios that are dominated by fixed income. Allocations to fixed income average 82% of institutional assets in Germany. That’s the highest in Europe, topping the average 77% in France and 68% in Italy.

For the past decade, low yields on these fixed-income allocations have depressed the overall rates of return on portfolio assets. As a result, almost 60% of the German institutions participating in the 2019 Greenwich Associates study cite rate of return and funding issues as the biggest challenge facing their portfolios this year, dwarfing all other concerns.

German institutions are taking action to address these issues, and the primary step is to increase their investments in alternative asset classes. “We are taking more risk, but only very controlled and very limited,” explains the representative of a German occupational pension fund. “To achieve adequate returns with a moderate risk profile, we have allocated funds to alternative investments and have hired during the past 12 months and are still in the selection process for additional external investment managers.”

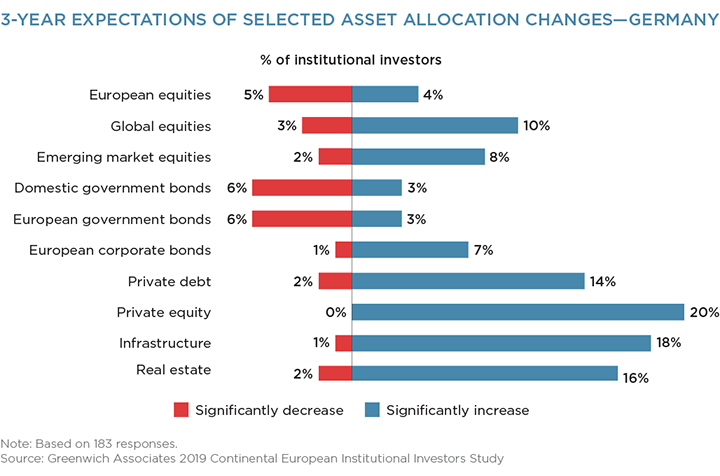

Allocations Shift to Alternatives

Twenty percent of German institutions in the study expect to significantly increase allocations to private equity in the next three years. In a rare occurrence in our global research, not a single institution expressed the intention to reduce these allocations. The story is much the same in infrastructure (18% planning major increases; only 1% planning reductions), real estate (16% increase, 2% decrease) and private debt (14% increase, 2% reduction). On net, institutions are also planning to increase allocations to other asset classes with higher alpha potential, including global equities, emerging market equities and European corporate bonds—albeit at a much slower pace.

Institutions are funding their increased investments in alternatives with assets previously allocated to core European fixed-income and equity strategies. “We are reducing equity engagement and strengthening our real estate engagement; we are looking for performance,” says the representative of a Sparkasse. As a representative of a German corporate pension fund explains, “We are shifting into passive management in order to cut costs for asset management and to counteract the low interest income. We are also increasing investments into alternatives/infrastructure in order to generate income.”

The magnitude of these allocation shifts becomes even more apparent when looking at institutions’ 12-month hiring expectations. An impressive 7.3% of German institutions plan to hire a new manager in alternatives in the next year. That’s nearly four times the share planning to hire a new manager in equities and more than double the share planning to hire in fixed income.

Greenwich Quality Leaders

The 2019 Greenwich Quality Leaders in German Institutional Investment Management demonstrate that there is more than one way to succeed in this challenging marketplace. Two of these firms, Allianz Global Investors and PIMCO, also share the title of 2019 Greenwich Quality Leader across continental Europe. These managers have a diverse product set that can accommodate institutional demand for both liquid, public equities and fixed income, as well as for exposure to illiquid assets like private debt, infrastructure and other alternatives. In addition, both firms offer robust advisory capabilities that can help guide institutions, as they alter their allocation profiles and otherwise work to craft solutions to the challenges they face.

Union Investment also earns the title of Greenwich Quality Leader and is similar to Allianz and PIMCO in that its product slate spans both liquid strategies and alternatives, the latter of which derives from its substantial real estate offering. Rounding out the list, Quoniam Asset Management has leveraged superior capabilities in factor investing to capitalize on growing institutional demand for these strategies and for lower-cost exposures more generally.

German Institutions: ESG Laggards

Despite the strong showing by the German Green Party in the 2019 European Parliament elections and the strong commitment of the German populace to environmental issues, German institutions are lagging the rest of Europe when it comes to environmental, social and governance (ESG) investing.

German institutions are only half as likely as their peers in the Netherlands and the Nordics to consider ESG factors when hiring a new investment manager. The situation is much the same when it comes to tracking the carbon footprint of investment portfolios—a process that has been embraced by 43% of institutions in the Nordics, 32% in France, 23% in the Netherlands, but only 7% in Germany.

There are signs that things are starting to change, however. Spurred in part by proposed EU rules that will force institutional investors to disclose how they integrate ESG factors in their risk and investment decision-making processes, German institutions have begun to move on this issue. Although still trailing far behind their European peers, the share of German institutions factoring ESG credentials into manager hiring increased to 40% in 2019 from just 29% in 2018.

Consultants Mark Buckley and Markus Ohlig advise on the investment management market in Continental Europe.

MethodologyDuring the first quarter of 2019, Greenwich Associates conducted in-depth interviews with 227 key decision-makers at the largest German institutional investors. Institutions included German corporate, public, and industry-wide defined-benefit, defined-contribution and hybrid pension funds, banks, Sparkassen, foundations and churches, insurance and reinsurance companies, sovereign pension reserve funds, and other non-pension institutional investors including official institutions, central banks, monetary authorities, sovereign wealth funds, and supranationals.