2015 was a record-breaking year for ETFs, which attracted more than $350 billion in new assets globally. Institutional investors are primary contributors to the steady growth in ETF demand, and over the last five years Greenwich Associates has conducted studies in the U.S., Europe, Asia, and Canada to identify the key trends behind their increasing ETF adoption.

In this paper we take a long-term view and explore how trends we are seeing today can be expected to impact ETF demand in 2020.

To arrive at projected growth in institutional ETF demand, we relied on survey data from the 2015 Global Exchange-Traded Funds Study to identify five key trends driving global ETF demand. We then built a growth model projecting ETF asset growth over the next five years. Using current asset levels as a starting point, the model examined respondents’ future plans for increasing usage, broadening usage, increasing holding periods, and adopting new products among ETF users and non-users.

By the year 2020, we expect the following five drivers will collectively produce approximately $300B in annual institutional ETF flows:

- The broadening use of ETFs across applications and asset classes will drive $132 billion in new demand in five years’ time.

- The migration toward using ETFs to obtain core exposures and achieve strategic goals will produce $42 billion in annual flows.

- Liquidity needs will fuel demand for ETFs in fixed income, driving $68 billion in new annual flows.

- Institutions using ETFs to replace derivatives positions will produce $28 billion in flows annually.

- Innovative exposures like smart-beta ETFs will attract $25 billion in annual flows.

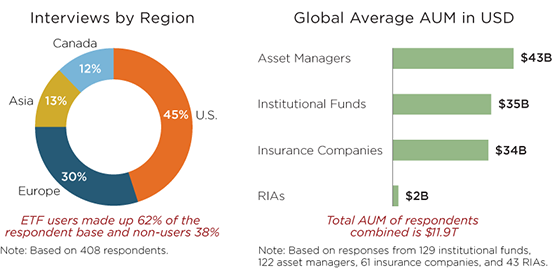

Greenwich Associates interviewed a total of 408 institutional investors globally, of which 253 were exchange-traded fund users and 155 were non-users, in an effort to track and uncover usage trends. The respondent base included 137 institutional funds (corporate pensions, public pensions, foundations and endowments), 141 asset managers (firms managing assets to specific investment strategies/guidelines), 63 insurance companies, 20 investment consultants, and 47 registered investment advisors (RIAs). RIAs are advisors or firms providing investment advice/recommendations that are registered with the U.S. Securities and Exchange Commission.

The Greenwich Associates growth model projects respondent data about assets currently invested in ETFs and future plans for increasing usage, broadening usage, increasing holding periods, and adopting new products among users and non-users. Assumptions about current assets are based on BlackRock’s 2015 Global ETF Landscape report, while assumptions about levels and pace of future adoption are modeled on adoption levels observed through Greenwich Associates ETF research over the past six years.