Table of Contents

Today, wealth management represents a key growth driver for commercial banks and other financial institutions. However, most of them are falling short of their potential when it comes to winning clients and growing assets. They are failing because:

- Changing the culture of commercial relationship managers from focusing on their next loan to the overall health of the customer is a major obstacle, and

- Many pour money into technology—chasing that ever present desire to have the latest and greatest gadget to attract the emerging wealth segment—instead of recognizing the continued value of relationships.

The key to success lies in the customer’s experiences. Customer-experience management (CEM) strategies represent an important tool for removing these impediments and setting the wealth management business on a path to growth. In this paper, we will show how commercial banks can employ CEM principles and techniques to energize internal referral processes to boost new customer acquisition and expand share of wallet with existing clients.

The Booming Business of Wealth Management

Financial institutions of all types recognize wealth management as an important source of growth. The business is particularly appealing to commercial banks for two reasons:

1) Wealth management provides a consistent and reliable source of fee income. Clients of commercial bank wealth management services typically produce an average of $25,000 – $50,000 per year in largely fee-based revenues, roughly equivalent to a middle-market commercial banking client. Just as importantly, these revenues tend to be “sticky.” Due to the depth and complexity of wealth management relationships, client turnover rates are low. In fact, signing on a commercial banking customer as wealth management client is seen as a surefire way of increasing customer loyalty—or at least creating barriers to exit that will prolong the life of the relationship.

2) Wealth management is booming. The baby-boom generation has accumulated a massive amount of investible assets for retirement and other savings. As they age, boomers are thinking about how to pass on that wealth to their heirs, setting the stage for a generational wealth transfer of historic proportions—one that will provide opportunities for wealth management firms. At the same time, market dislocations in the years following the global financial crisis prevented many middle-market company owners from selling their businesses. This five years of pent-up demand is now materializing, and the resulting M&A transactions are creating significant “wealth events” for business owners and their families. According to a study from Accenture, baby boomers have started to pass along their life savings to their heirs, and this process will continue over the next few decades. When done, some $30 trillion will be transferred from one generation to the next.

Unrealized Potential

Despite these growth trends, many commercial banks are falling well short of their potential in wealth management. It is common in many commercial banks in the U.S. to have a significantly larger base (2x–3x in some cases) of commercial business clients as clients in private banking and wealth management. The overlap between the two is generally very small.

Just one-quarter of middle-market company owners and executives taking part in a mid-2015 Greenwich Associates Market Pulse study maintain their personal investment accounts with their company’s primary business bank. While some of these individuals say they don’t want to keep personal and business accounts with the same bank, over half either have a provider relationship formed prior to their business banking relationship or are simply unaware of the bank’s offerings in wealth—relatively easy sales objections to overcome. In fact, nearly 60% of the other middle-market business owners had never even been solicited for their personal banking and wealth management business by their primary commercial bank.

“The biggest opportunity for banks is simply to ask their commercial clients about their needs—something that has, remarkably, not occurred at a rate one would expect,” says Greenwich Associates consultant Duncan Banfield. “Commercial clients have not been mined broadly, and our research shows that they are very willing to talk to their business banker about their needs.”

Of course, all this unrealized potential represents a massive revenue opportunity for banks that solve the wealth management puzzle.

Use CEM to Energize Internal Referrals

For virtually all commercial banks, the amount of wealth held by middlemarket banking clients vastly exceeds the current AUM of the wealth management business. Those untapped assets represent an opportunity so vast that it should count as an important competitive advantage for commercial banks competing in wealth management. But in general, banks have not been successful in accessing these assets. The main reason: Banks have not been able to generate sufficient levels of referrals from their commercial banking units.

For most banks, the logical first step in trying to generate referrals is establishing an incentive system. The industry has proven time and again that employees do what they are paid to do, and they do not do what they are not paid to do. But even a properly constructed incentive plan is not enough. To be effective, referral programs must include both a compensation structure that incentivizes the proper behavior, as well as a training and education program that informs employees about the goals and benefits of the system and addresses concerns that limit internal referrals.

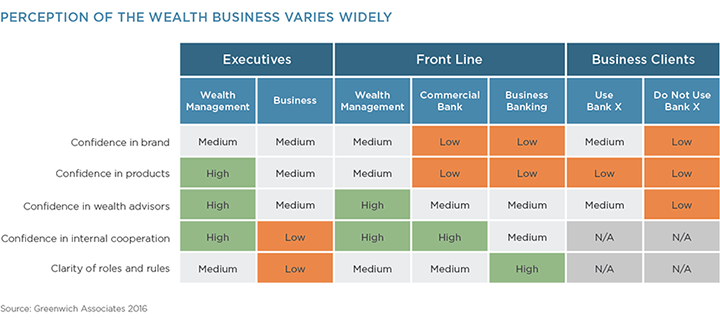

CEM strategies can provide the foundation for these training and education initiatives. Using an internal CEM program targeting senior executives, commercial banking relationship managers, client service professionals, and even back-office personnel, banks can answer the following critical questions:

- How is the wealth management business perceived by bankers and other employees?

- How do internal employees define the wealth management brand, and do these perceptions align with the bank’s external branding?

- What feedback have commercial bankers and other employees heard from clients about the quality of the wealth management service?

- Has the Commercial Relationship Manager referred a commercial banking client to wealth management? If so, how was that experience?

- Do employees understand the role wealth management plays in the bank’s overall business strategy?

- Do commercial banking relationship managers understand how the addition of a wealth management relationship can positively impact customer loyalty and account retention in their own business?

- Are there specific reasons why commercial bankers or other employees have not made a referral?

Recognizing Disincentives

When it comes to referring their clients to wealth management, commercial bankers often have personal disincentives that can outweigh immediate financial benefits. Bankers work hard to develop strong client relationships, and some might see the introduction of a wealth management relationship manager as a threat. Without confidence in the wealth brand, the banker might also see referrals as putting the client relationship itself at risk.

If wealth management’s reputation is not strong or if there are negative anecdotes circulating in the bank, bankers might be reluctant to steer good clients in its direction. The results of internal research will help banks identify the primary factors limiting internal referrals and suggest ways to remove or at least minimize them. Without these insights, banks relying on internal referrals as a key source of growth in wealth management are flying blind.

Even banks that have properly incentivized and educated bankers in referrals risk falling short of performance goals, if they are relying on bankers and other employees to take the initiative and deliver referrals. To institutionalize the referral process, banks should implement a standard review, held at least annually, in which commercial bankers are required to talk to their middle-market clients about their wealth situations and management. These conversations can be introduced naturally to discussions about the business by using the following line of questioning:

- Are there any major life-stage events on the horizon?

- Do you have any plans for an acquisition, sale or merger?

- Are there other family members in the business and how is that going?

- Is there a succession plan for the business?

- Did you know that we offer succession planning, trust and other services that could be helpful in dealing with these issues?

- Do you use a wealth management provider? How many? What do you like or dislike about them?

Answers to these questions can be fed into the bank’s CRM system and used to identify the best prospects for wealth management solicitations or referrals.

Win Share of Wallet with Insights from CEM

A more traditional, external application of CEM can help banks improve their wealth management product offering, strengthen the wealth management brand, and expand share of wallet among their existing wealth management clients.

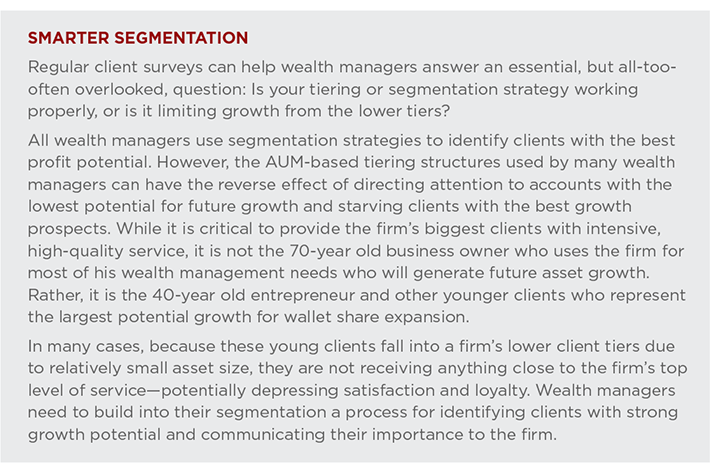

That final goal—building share of wallet—is a core plank of almost any wealth management growth strategy. The typical wealth management client in the $1-5 million asset bracket uses one or two wealth managers. An institutional CEM program that regularly solicits feedback from clients can help banks determine their share of wallet, which competitors hold the remainder and help banks determine the upside potential. Just as importantly, by actively listening to their wealth management clients, banks identify the criteria clients use in selecting advisors, allocating share of wallet and deciding whether to stick with current providers or switch assets to a new advisor.

At a top-line level, banks must identify the drivers of customer loyalty within the existing client base and determine how the firm is delivering in these critical areas. Among the factors that frequently appear on this list are advisor responsiveness, effective communications, ease of doing business, strength and coordination of the coverage team across disciplines including investments, planning, tax, trust/estate and others, and status as a “trusted advisor.”

At a more granular level, systematic analysis of client feedback will reveal how clients perceive the bank’s performance in critical “Moments of Truth” that heavily influence satisfaction and loyalty ratings:

1. Onboarding of the new relationship: In a relationship as complex as wealth management, the onboarding process can take up to six months. Bumps in this process can have a negative impact on client satisfaction and loyalty before the account is even fully up and running.

2. Transition to a new wealth advisor: Industrywide, up to 10% of wealth management clients experience a turnover in their wealth advisor every year. Banks need a seamless transition process to get clients through this high-risk period.

3. Problem resolution: Over the course of a wealth management relationship, occasional snags are inevitable. Problems in these relationships can be complex and difficult to resolve. At the same time, customer expectations are high—many clients expect problems to be taken care of with a single phone call. Banks must have in place an effective process that not only resolves problems, but creates clarity about the resolution process, sets expectations for the client about ongoing communications and expected completion.

4. Annual goals-planning sessions: These meetings are critical to the wealth advisor because they are most appropriate sales platforms that clients do not perceive as sales. Advisors must be able to skillfully initiate conversations about any changes to the client’s business, family and personal situations, and how those developments could impact the client’s wealth and wealth management needs. Banks must institutionalize these critical sessions and train advisors to uncover opportunities to expand share of wallet.

If effectively structured, a wealth management CEM program will show how the bank is performing at these important inflection points and trigger actions that allow the bank to address both one-off problems and systemic weaknesses. Further analysis of client feedback will provide insights into what steps the bank needs to take at a more strategic level to capture greater share of wallet and improve its overall wealth management offering. Banks should be asking:

- What is the wealth management brand equity or point of differentiation?

- What are the behaviors and activities that drive share of wallet?

- Are your playbook behaviors working? Have you codified them and trained around them?

- Do you have the right people in the right jobs (finders vs. minders)?

- Is there effective coordination of coverage among team members?

Conclusion

Improving the performance between the commercial bank and the wealth management businesses will not be easy. For any organization, building a franchise in a complex business like wealth management requires deft planning and coordination. Although banks possess an inherent advantage in the form of a sizable book of commercial clients that can be solicited for wealth management services, they also must contend with cultural and organizational characteristics that can act as impediments to growth. These range from a lack of buy-in among commercial bankers and other bank employees to inconsistencies in product offerings and service quality across wealth management platforms.

Commercial banks looking to grow their wealth management businesses must start with an honest cultural assessment. Many banks have put their faith in growth strategies that rely too heavily on cash incentives to generate referrals from commercial bankers. While an effective incentive plan is essential, it is only a start. Success in a business as complex as wealth management requires the right mix of culture, process and training. Getting it right can be a special challenge for commercial banks, many of which have been created through acquisitions of organizations with disparate cultures, systems and client bases.

Customer experience management strategies can help banks create effective growth strategies by identifying the key drivers of the business, assessing how their organizations are performing, and improving results in winning new business and expanding share of wallet from existing customers.