Institutional allocations to impact investing are growing rapidly and are on track for further expansion in coming years. This growth is occurring despite a lack of consensus about how impact investing should be defined and treated within institutional portfolios.

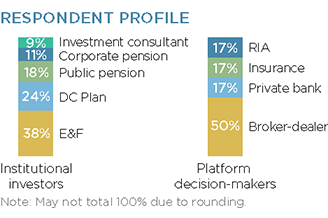

To gain a better understanding of the fast-spreading phenomenon, Greenwich Associates and American Century Investments® interviewed approximately 75 U.S. institutional investors and more than 50 U.S. professional buyers at intermediary platforms about their views of impact investing.

- Institutions participating in the study cite three main benefits of impact investing: 1) the ability to achieve positive social benefit, 2) the ability to align investments with personal or organizational values, and 3) the ability to send a positive message to stakeholders. Institutions are similarly aligned in their expectations of investment performance: Almost all expect a market rate of return, at a minimum.

- Institutional investors report lukewarm satisfaction with current impact investment efforts. Although 70% of respondents say they are at least “satisfied” with current programs, only about a quarter say they are “very satisfied.” Public pension plans and defined contribution (DC) plans give particularly low satisfaction marks to existing impact investing programs. Institutions report tepid satisfaction levels with both the social contributions achieved by their impact investing programs and the investment performance of their impact investment managers.

- Study participants’ preferred method of accessing impact investments is screened commingled funds (funds that screen in or screen out particular investments), followed by investments in screened separate accounts. Institutions also invest directly in socially responsible deals and companies, and with asset managers that financially support a designated cause.

Despite the category’s rapid growth, impact investing in the U.S. remains in its early stages. Impact investing definitions and best practices will take shape and solidify as the category continues to attract new participants and assets.

MethodologyBetween November 2015 and March 2016, Greenwich Associates conducted 74 in-depth telephone interviews with institutional investors and investment consultants and 52 intermediary platform decision-makers to test their knowledge of and receptivity to various approaches to impact investing across the asset management industry.