In volatile markets, client service can be the make-or-break factor for investment management firms when it comes to winning—or losing—customers and assets.

Last year, three firms set themselves apart from the competition by delivering superior service to institutional clients in Canada: BlackRock; Connor, Clark & Lunn; and Phillips, Hager & North. These firms are the 2015 Greenwich Quality Leaders in Canadian Institutional Investment Management Service.

As part of its annual Canadian Institutional Investors Study, Greenwich Associates asks plan sponsors to rate the asset managers they employ on a series of key service-related factors, and then uses the results to compile Greenwich Quality Index (GQI) scores for each manager. Firms with Service GQI scores that top those of competitors by a statistically significant margin are named Greenwich Quality Leaders.

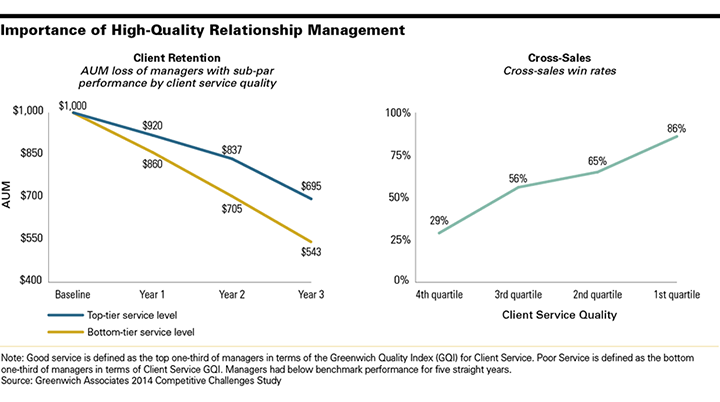

The quality of a firm’s customer service and its performance in metrics like the GQI can have a direct bearing on business outcomes. Research from Greenwich Associates Competitive Challenges shows that during times of sub-par investment performance, asset managers with top-rated customer service lose far fewer assets than firms with customer service rated in the bottom-tier.

In these situations, top-rated firms retain an average 22% more assets than bottom-rated managers, which translates into meaningful revenue saved.

Highly rated customer service functions also give investment managers a huge advantage when it comes to cross sales. Greenwich Associates data shows a strong and consistent correlation between GQI scores and cross-selling win rates.

Firms with top quartile GQI scores achieve an average cross-sales win rate of 86%, versus the 29% win rate among firms in the fourth quartile.

“Solutions” Focus Increases Emphasis on Customer Service

Changes in global financial markets and institutional investing are making the client service function even more important for asset managers. Facing funding pressures and a long-term, low-yield market environment, institutional investors are seeking partners that can help them find solutions to their problems. This change in client expectations is raising the bar for asset managers, who now need to convey their understanding of clients’ unique situations and offer ideas and products that meet the clients’ needs.

Accomplishing those goals has required many asset management firms to upgrade client service capabilities, including the type and quality of their client service professionals—especially relationship managers.

“Institutional investors are looking for asset managers to provide thoughtful insights and customized advice through white papers and presentation materials as well as during formal reviews and informal conversations,” says Greenwich Associates consultant Davis Walmsley. “The three Greenwich Quality Leaders for 2015 have demonstrated an ability to deliver value to clients beyond investment performance.”

Between July and October 2015, Greenwich Associates conducted 235 interviews with senior professionals at corporate funds, public funds and provincial funds, and endowments and foundations with assets greater than $100 million.

Study participants were asked to provide quantitative and qualitative evaluations of their investment managers, qualita¬tive assessments of those managers soliciting their business, and detailed information on important market trends.