Table of Contents

Increasingly complex and challenging market conditions are causing U.S. asset owners to seek out higher levels of support from their external partners. In response, U.S. investment consultants are transforming themselves from curators of recommended asset manager lists into centralized sources of expertise, knowledge transfer and market information.

Soaring inflation and rate hikes by the U.S. Federal Reserve upended a run of historically favorable conditions for investors last year. Volatility continued into 2023, culminating in the collapse of several regional banks that threatened to expand into a broader crisis. Throughout this unpredictable period, asset owners have looked to external partners for insights into fast-changing markets and for more-focused support in their investment functions.

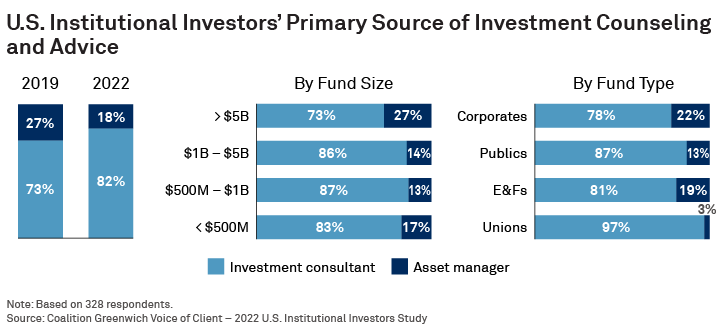

Institutional asset managers have, as a legacy, positioned themselves prominently to provide clients with bespoke guidance beyond the narrow bounds of traditional investment mandates. However, investment consultants remain far and away asset owners’ No. 1 source of advice. That’s especially the case for smaller asset owners (i.e., < $5 billion in AUM), who are less frequently identified as strategic partnership candidates by asset managers.

“Even the largest asset owners whose investment managers are offering bespoke strategic advice are leaning heavily on their consultants during these turbulent market environs,” says Coalition Greenwich Head of Investment Management – North America Todd Glickson. “Because consultants operate at the nexus of a broad network of asset owners and investment managers, they are perfectly positioned to serve as a centralized source of expertise—not just on managers and manager searches, but on tactical and strategic issues faced by asset owners every day.”

Changing Expectations

Asset owners’ need for advice on topics like asset allocation, investment products, portfolio construction, and market events has changed their expectations for their investment consultants. Increasingly, asset owners are looking for consultants who are available for discussion and responsive to requests. To meet those demands, some consultants are having to reassess their client service models in order to deliver timely attention to clients across their portfolios.

With the dramatic shift in market conditions and new challenges like the integration of environmental, social and governance (ESG) strategies, investment consultants will have additional opportunities to expand and deepen their relationships with asset owners. “For asset managers, this means it is increasingly important to invest in consultant relations teams, even as managers commit more resources to build direct relationships with end clients,” says Coalition Greenwich Senior Relationship Manager Susan Gould.

2022 Greenwich Quality Leaders

The 2022 Greenwich Quality Leaders in U.S. Investment Consulting have all distinguished themselves by providing exceptional service to clients in a period of difficult market conditions. The following tables present the complete list of 2022 Greenwich Quality Leaders in U.S. Investment Consulting.

Todd Glickson, Susan Gould, Alasdair Philip, and Joseph Mattesi advise on the investment management market in the United States.

MethodologyBetween February and November 2022, Coalition Greenwich conducted interviews with 727 individuals from 590 of the largest tax-exempt funds in the United States. These U.S.-based institutional investors are corporate, public, union, and endowment and foundation funds, with either pension or investment pool assets greater than $150 million. Study participants were asked to provide quantitative and qualitative evaluations of their asset management and investment consulting providers, including qualitative assessments of those firms soliciting their business and detailed information on important market trends.