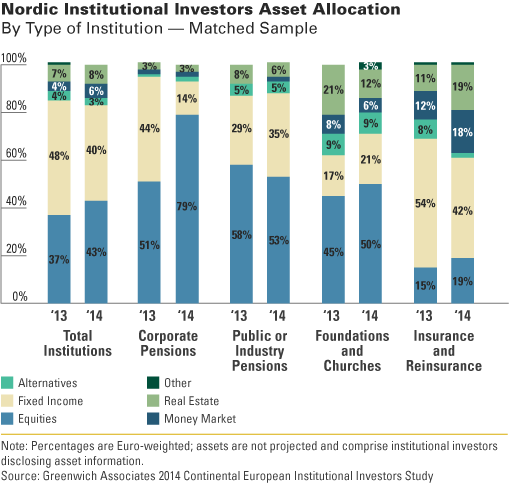

Results from the Continental European Institutional Investors Study revealed that equities now makes up 43% of portfolios versus 37% in year prior. With investors pulling out of fixed income, exposure in equities and real estate were made possible.

Other Findings to Help Support Your Business Strategy:

- Corporate Pensions dramatically increased exposure to equities (13: 51%, 14: 79%), while slashing allocations to fixed income from 44% to 14%. In contrast, other Continental European countries noticeably enacted opposite tactics among fixed income and equities thus far this year.

- Public/industry pension plans only slightly altered their investment strategies among the traditional asset classes; and minor movement also occurred between real estate and money market allocations.

- With regards to real estate, Nordic foundations and churches scaled back their exposure nearly in half, while insurance and reinsurance investors almost doubled.

- Nordics identify asset return expectations as the number one decision-maker for allocation changes. With the exceptions of foundations and churches, funding position is the least decision-maker encouraging allocation shifts.

- When comparing expectations for future asset mix, institutions in Europe expect to significantly increase exposure to infrastructure and real estate, along with European equities and global equities. On the contrary, domestic and government bond assets are expected to significantly decrease.