European pension funds are adopting ETFs into their investment portfolios for both strategic purposes, like obtaining core investment exposures, and tactical tasks.

Leading the move into ETF investing are public and industry pension funds, almost 30% of which are now using the funds.

International diversification of investment portfolios is emerging as a primary driver of ETF adoption, and ETF use among European pensions is highest in international equity and fixed income.

Greenwich Associates projects meaningful growth for ETFs among pensions in terms of both number of users and allocations.

In the near-term, this growth will be driven by significant increases in ETF allocations in equity portfolios by current ETF users.

Over a longer period, the relaxation of internal investment guidelines that now limit or even prohibit pension-fund ETF investment will allow for continued growth.

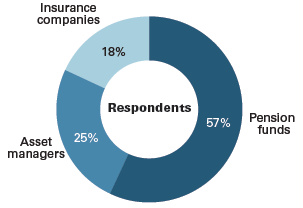

MethodologyGreenwich Associates interviewed a total of 120 European-based institutional investors, 83 of which were exchange-traded fund users and 37 were non-users, in an effort to track usage behaviors and examine perceptions associated with exchangetraded funds. The respondent base consisted of 68 pension funds (corporate and public funds, and other institutional investors), 30 asset managers (firms managing assets to specific investment strategies/guidelines) and 22 insurance companies.

© 2014 Greenwich Associates, LLC. Javelin Strategy & Research is a division of Greenwich Associates. All rights reserved. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, Greenwich ACCESS™, Greenwich AIM™ and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.