2015 Greenwich Leaders: U.S. Institutional Investment Management Service

U.K.-based partnership Baillie Gifford and U.S. liability-driven investment (LDI) specialist NISA Investment Advisors are the Greenwich Associates 2015 Quality Leaders in U.S. Institutional Investment Management Service.

Every year, Greenwich Associates interviews over 1,000 U.S. institutional investors about the asset managers they employ. Greenwich asks study participants to rate their managers in a series of investment and service categories, and then uses the results to compile Greenwich Quality Index (GQI) scores for each manager. Firms with Service GQI scores that top those of competitors by a statistically significant margin are named Greenwich Quality Leaders.

NISA Investment Advisors and Baillie Gifford claim the title of Greenwich Quality Leader at a time when client service is taking on an increasingly important role in the investment management industry. A string of challenges including funding shortfalls, an extended period of historically low interest rates and yields, and increasing market complexity have placed institutional investors under significant pressure.

As they contend with these challenges, investors are looking to investment managers for help. “In the not too distant past, managers were expected to do one thing: deliver on the mandate, which for active managers usually meant delivering alpha,” says Greenwich Associates consultant Andrew McCollum. “But today, investors want ideas, advice and solutions that can help them meet their organizational and investment needs.”

Delivering that kind of advisory service requires investment managers to develop a deep understanding of their clients’ situations and needs and to tap into their own expertise and capabilities to provide solutions. That type of client service effort goes far beyond a single relationship manager. Developing true counseling relationships with clients requires consistent input from portfolio managers, product specialists, sales and client relations professionals. “Client service at this level requires a true ‘team of advisors’ approach that represents a major change in thinking and structure for many managers,” says Greenwich Associates consultant Davis Walmsley.

That is not to suggest that relationship managers are losing importance. To the contrary, as client service expectations are raised, the role of the relationship manager (RM) is becoming even more critical. As firms try to meet clients’ new demands for advice and solutions, they are recruiting RMs with new and upgraded skill sets. RMs today must possess both analytical and technical skills. RM hires are increasingly CFA charterholders, and investment managers are targeting experienced professionals from investment consultants and elsewhere in the investment community.

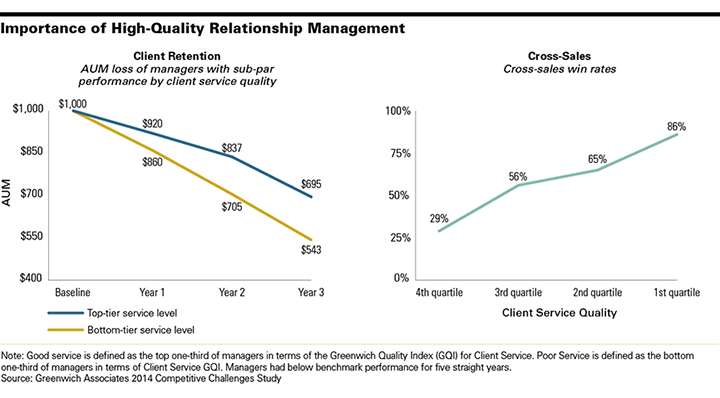

Client Service Quality Has a Direct Impact on Asset Retention and Cross-Sales

The quality of an investment manager’s client service and its performance can have a direct bearing on business outcomes. Research from Greenwich Associates Competitive Challenges shows that during times of sub-par investment performance, asset managers with top-rated client service lose far fewer assets than firms with client service rated in the bottom-tier. In these situations, top-rated firms retain an average 22% more assets than bottom-rated managers.

Highly rated client service functions also give investment managers a huge advantage when it comes to cross sales. Greenwich Associates data shows a strong and consistent correlation between GQI scores and cross-selling win rates. Firms with top quartile GQI scores achieve an average cross-sales win rate of 86%, versus the 29% win rate among firms in the fourth quartile.

“Client service’s influence on critical outcomes in asset retention and cross-selling will only become stronger as investors seek out managers capable of delivering ideas, advice and other forms of value beyond the constraints of traditional investment mandates,” says Andrew McCollum.

----------------------------------------------------

Greenwich Associates consultants Andrew McCollum and Davis Walmsley advise on the investment management market in the United States.

Between July and October 2015, Greenwich Associates conducted 1,341 interviews with senior professionals at corporate and union funds, public funds, endowments and foundations, insurance general accounts, and healthcare organizations with either pension or investment pool assets greater than $250 million.

Study participants were asked to provide quantitative and qualitative evaluations of their investment managers, qualitative assessments of those managers soliciting their business, and detailed information on important market trends.